The new half-million dollar regions

Media Release

13 December 2016

The new half-million dollar regions

Six regions in the New Zealand property for sale market now have an average asking price over $500,000, according to the latest Trade Me Property Price Index.

Head of Trade Me Property Nigel Jeffries said this time last year Auckland was the only region that had an average asking price above this level. “The Bay of Plenty was the first region to join Auckland, nudging the bar in December last year while Nelson debuted in September. Then in the last month alone, Waikato, Wellington and Northland have also joined the club.”

He said Auckland’s average asking price crossed that threshold six years ago. “Auckland became a half-million dollar region back in late 2010, and last month cracked $900,000 in average asking price for the first time, as it continues its inexorable rise towards the million dollar mark."

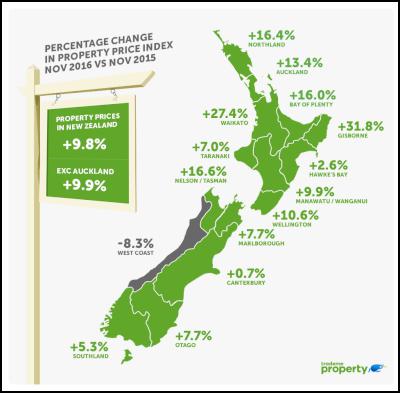

In November, the average asking price across New Zealand rose to $624,850, up 1.1 per cent since October and up 9.8 per cent since November 2015.

The rise in average asking price in the City of Sails is outpacing the national figure, breaking through to another record high in November to $911,800, a 1.6 per cent lift on October and up 13.4 per cent over the past 12 months.

Waikato becomes a powerhouse region

The average asking price in the Waikato region has shot up by over $100,000 in 12 months, up 27.4 per cent from $393,400 to $501,100.

“A graph looking back at the last five years resembles the proverbial hockey stick. This spectacular appreciation of property stands in stark contrast to the period between 2008 and 2014 where average asking prices were unchanged at around $360,000. It wasn’t until 2015 that the hill became a lot steeper,” Mr Jeffries said.

The $100,000 lift in average asking price in the Waikato over the past 12 months matches the monetary rise in Auckland, but represents a 13.4 per cent increase in the City of Sails.

Around the grounds

All but one of the 15 regions stepped up a notch in November, with just the West Coast showing a dip in average asking price, down 8.3 per cent. Twelve regions lifted over 5 per cent in the past year and seven regions saw double-digit inflation.

“Gisborne had the single biggest rise in average asking price in November, but this is partly due to the mix of recent listings in the area. We’d be cautious about reading too much into this just yet,” Mr Jeffries said.

In the larger regions, the biggest increases were seen in the Waikato (+27.4 per cent), followed by Nelson/Tasman with a 16.6 per cent lift over the past 12 months to $535,550. Hard on its heels was Northland with a 16.4 per cent rise in the past year to $505,600.

The Wellington market broke through the half-million dollar mark in November, up 10.6 per cent in the past 12 months to a record average asking price of $508,850.

Christchurch market quiet on the home front

While Auckland and Wellington powered ahead in November, the property for sale market in Christchurch remained subdued, Mr Jeffries said.

“The average asking price in Canterbury has risen less than 1 per cent in the past year, up just $3,400 to $473,900. It’s worth noting that large homes saw a healthy lift of 10 per cent, topping $800,000 for the first time, however the middle market of three- and four-bedroom homes barely moved.”

Table 1: Average asking price by

property size & region, November 2016 vs November

2015

| All Properties | Large houses

5+ bedroom | Medium

houses 3-4 bedroom | Small

houses 1-2 bedroom | |

| New Zealand | $624,850 + 9.8% | $1,148,950 + 16.3% | $620,800 + 8.9% | $402,900 + 7.4% |

| New

Zealand excluding Auckland | $471,650 + 9.9% | $782,250 + 13.4% | $486,100 + 9.7% | $321,750 + 10.5% |

| Auckland | $911,800 + 13.4% | $1,441,850 + 16.2% | $922,400 + 12.8% | $667,450 + 9.9% |

| Wellington | $508,850 + 10.6% | $816,950 + 10.9% | $529,050 + 10.9% | $371,850 + 15.2% |

| Christchurch | $473,900 + 0.7% | $802,450 + 10.4% | $498,700 + 0.4% | $340,750 + 2.1% |

Auckland apartment market loses momentum

Mr Jeffries said the Auckland apartment market is stagnating following a strong period of growth over the previous year.

“A year ago the average asking price of an Auckland city apartment blasted past $600,000, having soared up more than $150,000 in nine months. Over the past year it’s been quite a different story, with prices shunting sideways to hover around $575,000.

“In the past month the average asking price

has been stuck in the mud as the pipeline of new inventory

remains very strong – more than 500 new apartment listings

hit the Auckland market in the last month.”

Table 2: Average asking price by property type & region, November 2016 vs November 2015

| All Urban Properties | Apartments | Townhouse | Units | |

| New Zealand | $528,650 + 3.3% | $560,150 No Change | $595,950 + 7.2% | $439,600 + 5.1% |

| New

Zealand excluding Auckland | $392,200 + 9.0% | $508,100 + 16.6% | $434,800 + 6.4% | $312,050 + 11.2% |

| Auckland | $654,000 + 5.3% | $578,950 - 3.8% | $847,450 + 11.6% | $617,400 + 10.5% |

| Wellington | $409,350 + 11.1% | $464,450 + 13.3% | $454,600 + 11.1% | $311,550 + 8.8% |

| Christchurch | $391,800 - 0.2% | $416,650 + 3.9% | $448,000 - 0.1% | $320,900 + 3.2% |

-ends-

MORE INFORMATION

· About the Trade Me Property Price Index:

· The Trade Me Property Price Index measures trends in the expectations of selling prices for residential property listings added to Trade Me Property by real estate agents and private sellers over the past three months.

· It provides buyers, sellers and realtors with insights into ‘for sale’ price trends by property type and property size.

· The Index is produced from data on properties listed on Trade Me Property in the three months leading up to the last day of each period. Each period’s value is a truncated mean of the complete three months’ worth of listings. This is to better reflect trends in property prices rather than month-to-month fluctuations in housing stock.

· The Index uses an “80% truncated mean” of the expected sale price to calculate the average asking price. This excludes the upper and lower 10% of listings by price, and averages the expected sale prices of the remaining properties.

· It provides an insight into ‘for sale’ price trends by type and size of property. Other reports aggregate property price data across these various properties.

Vegetables New Zealand: Asparagus Season In Full Flight: Get It While You Still Can

Vegetables New Zealand: Asparagus Season In Full Flight: Get It While You Still Can  Bill Bennett: Download Weekly - How would NZ telecoms cope with another cyclone

Bill Bennett: Download Weekly - How would NZ telecoms cope with another cyclone NZ On Air: Firm Audience Favourites Lead NZ On Air Non-Fiction Funding

NZ On Air: Firm Audience Favourites Lead NZ On Air Non-Fiction Funding Insurance and Financial Services Ombudsman: Woman Gets $40k More After Disputing Insurer’s Decision

Insurance and Financial Services Ombudsman: Woman Gets $40k More After Disputing Insurer’s Decision BNZ: A Quarter Of Older NZers Fear Going Online Due To Scam Concerns

BNZ: A Quarter Of Older NZers Fear Going Online Due To Scam Concerns University of Auckland: Scientists Develop Tool To Monitor Coastal Erosion In Fine Detail

University of Auckland: Scientists Develop Tool To Monitor Coastal Erosion In Fine Detail