HiFX Weekly FX Technical Report

NZD/USD

Last

Price: 0.7163

Daily: /Mkt accumulating below nearby

0.7175 resistance

Weekly: Underlying

bullish view maintained above

0.6950

Support 1: 0.7095/05

Support2:

0.7025/35

Resistance1: 0.7175/85

Resistance2:

0.7250/60

With recent NZD erosion again unfolding in an (ABC) corrective manner prices look to have stabilised ahead of key support at 0.6950. Additional preparation may well prove necessary before new cyclical peaks are attainable again but a breach of even 0.7175/85 local resistance will further encourage this developing positive (near term) view and target 0.7250 if not 0.7325 areas next. Fresh dips now have some buying interest around 0.7100 then 0.7025 and only a breach of tertiary 0.6945/55 demand would argue an important top seen already.

NZD/AUD

Last

Price: 0.9579

Daily: NZD prices still effectively

pivoting 0.9500 at present

Weekly: Latter stages of

intermediate triangular formation

Support 1: 0.9495/05

Support2:

0.9390/00

Resistance1: 0.9600/10

Resistance2:

0.9690/00

Although recent NZD price action here looks accumulative the market is still effectively pivoting 0.9500 or so in broad terms with an extension beyond 0.9800 probably required before underlying technicals improve. Thus far re-emergent weakness continues to uncover good/regular layers of support and technical studies indicate buying interest now exists at 0.9500 initially then again in the 0.9400 area. However some selling pressure is also apparent around 0.9600 and 0.9700 as well with attention remaining focused elsewhere for the most part.

NZD/EUR

Last

Price: 0.6653

Daily: /Uptrend slowing as prices

respect local resistance

Weekly: Broad NZD ascending

pattern intact above 0.6375

Support 1:

0.6590/00

Support2: 0.6515/25

Resistance1:

0.6775/85

Resistance2: 0.6845/55

A broad ascending sequence remains intact here and despite some loss of upside impetus over recent weeks no structural damage has yet been done. Studies suggest NZD prices would need to accelerate beyond 0.6850 secondary resistance to regain bullish momentum -targeting at least 0.6925 and probably 0.7000+ levels thereafter. However demand at 0.6600 then and 0.6525 areas equally limits negative scope with an extension beneath distant/key 0.6325 support considered necessary before an important (multi-month) top is confirmed instead.

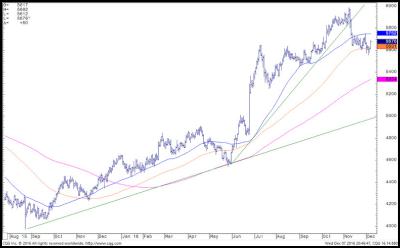

NZD/JPY

Last

Price: 81.49

Daily: Positive tone with NZD prices

focusing on 83.25 next

Weekly: Accumulative pattern

targeting 85.00+ eventually

Support 1:

80.15/25

Support2: 78.40/50

Resistance1:

83.25/35

Resistance2: 84.90/00

Marginally overbought daily readings notwithstanding recent gains look part of a broader recovery sequence and re-emergent weakness will now thus be considered corrective only. Some selling pressure is again likely to emerge around prior/notable 83.25 area highs but dips back from here have good support extending toward 78.50 and local demand is visible beginning around 80.25. While the extent of available accumulation limits upside scope as well for the moment an eventual extension to and above 85.00 looks increasingly feasible.

NZD/GBP

Last

Price: 0.5676

Daily: /NZD values

re-accumulating ahead of 0.5500 level

Weekly:

/Maturing correction from prior 0.5985 cyclical

highs

Support 1: 0.5570/80

Support2:

0.5490/00

Resistance1: 0.5745/55

Resistance2:

0.5820/30

As elsewhere underlying NZD technicals remain favourable and despite recent erosion further gains are thus anticipated going forwards. Some support is being met ahead of the 0.5500 level and although resistance also exists around 0.5750 an upside breach will argue an interim low already posted. Once seen potential exists back toward 0.5825 then 0.5900 as well in coming sessions with broader evidence suggesting 0.6000+ targets eventually. Expect fresh erosion to uncover demand beginning at 0.5575 and only below 0.5490/00 as well frustrates.

Alcohol Healthwatch: Licensing Decision Lauded For Prohibiting Buy Now Pay Later Schemes In Bottle Stores

Alcohol Healthwatch: Licensing Decision Lauded For Prohibiting Buy Now Pay Later Schemes In Bottle Stores Motor Industry Association: Vehicle Registrations Up 5.6% In December, But Year-To-Date Sales Reflect Market Challenges

Motor Industry Association: Vehicle Registrations Up 5.6% In December, But Year-To-Date Sales Reflect Market Challenges BNZ: Depression-era Bequest Still Helping 88 Years Later

BNZ: Depression-era Bequest Still Helping 88 Years Later Hugh Grant: How Can Telehealth And Home Healthcare Solutions Be Helpful?

Hugh Grant: How Can Telehealth And Home Healthcare Solutions Be Helpful? New Zealand Merino Company: The New Zealand Merino Company Will Investigate PETA Claims

New Zealand Merino Company: The New Zealand Merino Company Will Investigate PETA Claims New Zealand Certified Builders: Building A Granny Flat? Four Things You Should Know

New Zealand Certified Builders: Building A Granny Flat? Four Things You Should Know