NZ farmers look to 2017 with optimism

Media Release December 5, 2016

New Zealand farmers look to 2017 with optimism, with overall confidence levels staying high

Results at a Glance

• Overall farmer confidence in the broader agricultural economy has dipped from last quarter – but remains at high levels

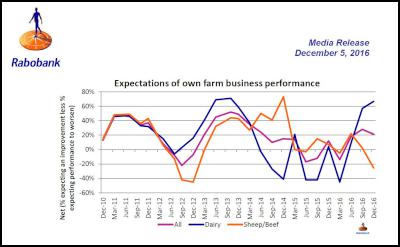

• Farmers’ expectations for their own business performance are strong but slightly back on the previous survey

• Sheep and beef farmer expectations for their own farm businesses dropped sharply with close to half now expecting own farm business performance to worsen

• Dairy farmer expectations for their own businesses lifted for the third successive quarter with more than two thirds surveyed expecting their farm business performance to improve in the next 12 months

• Farmer investment intentions were at their highest level since late 2014, with more than a quarter of survey participants expecting to increase their farm business investment in the coming year

Confidence levels among New Zealand’s farmers remain high but have tempered slightly, the latest quarterly Rabobank Rural Confidence Survey has found.

After surging considerably in the previous quarter – off the back of improved dairy farmer outlook – the latest survey, completed in early November, recorded a small decline in sentiment among farmers.

The overall net confidence reading fell to +25 per cent, down from +35 per cent last quarter, but remained at net positive levels for the third consecutive quarter.

The survey found the number of farmers expecting the rural economy to improve in the next 12 months had fallen to 39 percent per cent (down from 48 per cent in the previous quarter), while the number expecting it to worsen rose to 14 per cent (up from 13 per cent). A total of 42 per cent were expecting similar conditions (down from 37 per cent).

Rabobank New Zealand general manager for Country Banking, Hayley Moynihan said the positive outlook for the dairy and horticulture sectors had kept overall confidence in the agricultural economy high.

“The prospects for the dairy and horticultural sectors are good for 2017 and, while overall confidence has come back slightly from last quarter, it’s still significantly higher than the levels recorded throughout 2015 and early 2016,” she said.

Ms Moynihan said the primary driver of the fall in overall confidence was reduced optimism in the prospects for the sheep and beef sector.

“Sheep and beef farmers are likely to experience a tough season. Lamb prices have reached the seasonal peak, with the lucrative UK and EU Christmas trade now finished, and returns have been around 10 per cent lower than last year. While on the beef side, global prices are under pressure – and the beef schedule is likely to weaken in 2017,” she said.

“The high New Zealand dollar, particularly in relation to the British pound, is also making life difficult for sheep and beef farmers – which is unfortunate considering the improving market demand in other overseas markets – and the pessimism surrounding this sector appears to be the biggest contributor to the lower expectations for the performance of the broader agricultural economy.”

Farmers’ expectations for their own businesses in the next 12 months also came back slightly from the previous survey, but remain strong. Overall 42 per cent of farmers expected the performance of their own farm business to improve over this period, 34 per cent expected it to remain the same and 21 per cent for it to worsen. This resulted in a fall in the net reading for this measure to +21 per cent, down from +28 per cent in the previous quarter.

Ms Moynihan said a closer look at the survey results by industry highlighted the vastly different expectations in farm performance amongst farmers in New Zealand’s two largest agri sectors.

The survey found sheep and beef farmers were significantly less positive about their own businesses than last quarter registering a net reading of –25 percent this survey, from +two per cent previously. Conversely, the reading for dairy farmers rose to +67 per cent from +57 per cent last quarter.

“Given the current challenges facing the sector, it’s not surprising we’ve seen a substantial drop in sheep and beef farmer expectations. On the other hand, dairy farmer expectations for their own business have lifted for the third consecutive quarter,” she said.

The survey found 70 per cent of dairy farmers have expectations for their own business performance to improve through 2017 and just three per cent consider their farm business performance may worsen next year. This is the highest reading of individual business optimism among dairy farmers since 2013 when commodity prices reached USD 5,000 / tonne.

“This further improvement in dairy farmer confidence followed significant commodity price hikes in Global Dairy Trade Events since the last survey and Fonterra recently raising their forecast farm gate milk price for the 2016/17 season to $6.00 kg/ ms,” Ms Moynihan said.

“While dairy farmers are really positive about the coming year, the survey did also highlight that they remain wary of price volatility. 39 per cent of dairy farmers surveyed noted the risk of falling commodity price to the general agricultural economy, while almost one third are watching for weakness in overseas markets.”

Horticulturalists’ expectations for the performance of their own businesses dropped to a net reading of +19 per cent back from +26 per cent last quarter.

“This is the second consecutive fall in horticulturalists’ expectations for their own businesses, however, it continues a run of net positive results dating back to the September 2015 survey,” Ms Moynihan said.

“Growing conditions have been good for a number of horticultural industries and this –combined with on-going strong demand for horticultural produce in export markets, especially for kiwifruit and pip fruit - will account for the continuing high confidence levels among this sector.”

Investment intentions amongst farmers rose to a net reading of +17 per cent from +11 per cent last quarter, the highest reading since late 2014. A total of 28 per cent of respondents expected to increase investment (24 per cent last quarter), 61 per cent expected investment to remain the same (compared with 63 per cent) and 10 per cent (from 13 per cent) expected investment to decrease.

Horticulturalists had the strongest investment intentions with net +33 per cent looking to increase investment, followed by dairy farmers at net +22 per cent and sheep and beef farmers at net +7 per cent.

“With dairy farmers’ confidence levels in their own business performance so high we might have expected even stronger investment intentions among this group, however, with an average of $2.60 kg/ ms of debt having been accrued by dairy farmers across the industry during the downturn, repayment of a portion of this debt is likely to be a focus for many,” Ms Moynihan said.

Conducted since 2003, the Rabobank Rural Confidence Survey is administered by independent research agency TNS, interviewing a panel of approximately 450 farmers each quarter.

Financial Markets Authority: Individual Pleads Guilty To Insider Trading Charges

Financial Markets Authority: Individual Pleads Guilty To Insider Trading Charges Great Journeys New Zealand: Travel Down Memory Lane With The Return Of The Southerner

Great Journeys New Zealand: Travel Down Memory Lane With The Return Of The Southerner WorkSafe NZ: Overhead Power Lines Spark Safety Call

WorkSafe NZ: Overhead Power Lines Spark Safety Call Transpower: Transpower Seeks Feedback On Electricity Investment Short-list For Upper South Island

Transpower: Transpower Seeks Feedback On Electricity Investment Short-list For Upper South Island Commerce Commission: “Cheating The System” – Sentencing In Country’s First Criminal Cartel Case

Commerce Commission: “Cheating The System” – Sentencing In Country’s First Criminal Cartel Case Kiwi Economics: The Government’s Books Are Hard To Balance. Lower Productivity, Lower Tax, Higher Spend

Kiwi Economics: The Government’s Books Are Hard To Balance. Lower Productivity, Lower Tax, Higher Spend