Embargoed Media Release

ASB Housing Confidence

Survey

EMBARGOED until 0500 Wednesday, November 9, 2016

Are the good times over?

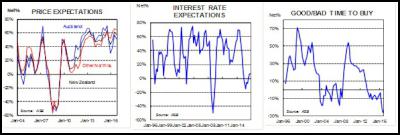

• Buyer sentiment drops to a 20-year low

• Expectations for house prices to rise moderate, but remain high; fewer people expect interest rates to fall

• Latest LVR restrictions appear to be having a greater impact on investors outside of Auckland

Buyer sentiment has tumbled to a historical low in the ASB Housing Confidence Survey.

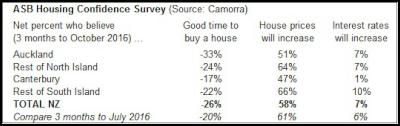

The October quarter report finds a net 26 per cent of people think it’s a bad time to buy a house, compared to a net 20 per cent three months earlier.

It is the weakest sentiment since the survey started in 1996.

While buyer sentiment remains lowest in Auckland (-33%), other regions registered the sharpest falls this quarter.

Excluding Aucklanders, 10 per cent of New Zealanders say it’s a good time to buy a house (compared to 13% last quarter) and 35 per cent (33%) say it is a bad time to buy.

ASB chief economist Nick Tuffley says ongoing expectations of house price increases, and higher debt servicing costs, appear to have been subduing buyer sentiment this year.

But the latest loan-to-value ratio (LVR) restrictions, introduced in October, appear to have pushed sentiment lower, particularly outside Auckland.

“The fact that the 40 per cent investor deposit requirement is having a proportionately larger impact on investors outside of Auckland could explain why sentiment dropped more in other regions this quarter,” Mr Tuffley says.

On the other hand, if the new restrictions slow market activity and house price growth over time, potential first home buyers might begin to look more favourably on the housing market, Mr Tuffley says.

“However, first home buyers may remain cautious given recent house price appreciation, and they are also likely to be wary of perceived changes in borrowing costs. All up, high house prices and a higher deposit threshold for investors are likely to weigh on sentiment this year.”

Tempered house price expectations

Most respondents are still expecting house prices to rise. However, net house price expectations have dropped from recent highs. On balance, a net 58 per cent expect higher prices (61%).

The South Island, excluding Canterbury, was the only region where net expectations of house price increases lifted to a net 66 per cent (56%).

People see interest rates as largely steady

Few respondents expect interest rates to fall.

On balance, respondents expect interest rates to either remain steady or increase.

“This is likely to be because the previous two OCR cuts were associated with little downward movement in mortgage rates,” Mr Tuffley says.

“We continue to expect the RBNZ to cut the OCR by 25bp on Thursday (November 10), but due to funding issues, we don’t expect floating mortgage rates to move to the same extent. Term mortgage rates have started to creep up.”

Results at a glance

Click for big version.

Click for big version.

Note: The ASB Housing Confidence Survey is constructed from data received from 2730 individual respondents.

The full housing confidence report for the three months to October 2016 is attached and will be available online atwww.asb.co.nz tomorrow.

ENDS

Skoltech: Scientists Reinvent Physical Laws Governing Formation Of Snowflakes, Raindrops, And Saturn’s Rings

Skoltech: Scientists Reinvent Physical Laws Governing Formation Of Snowflakes, Raindrops, And Saturn’s Rings Trademe: Trash To Treasure - Kiwi Make The Most Of Unwanted Christmas Gifts

Trademe: Trash To Treasure - Kiwi Make The Most Of Unwanted Christmas Gifts  Financial Markets Authority: FMA Seeks Clarity From High Court On Use Of Eligible Investor Certificates In Wholesale Investment Sector

Financial Markets Authority: FMA Seeks Clarity From High Court On Use Of Eligible Investor Certificates In Wholesale Investment Sector Scion: Scion’s Novel Internship Model Connects Talent With Industry

Scion: Scion’s Novel Internship Model Connects Talent With Industry Financial Markets Authority: Westpac Admits To Misleading Representations That Resulted In $6.35m In Overcharges

Financial Markets Authority: Westpac Admits To Misleading Representations That Resulted In $6.35m In Overcharges Bill Bennett: Download Weekly - Review Of 2024

Bill Bennett: Download Weekly - Review Of 2024