Improved dairy sector expectations, farmer confidence surges

Media Release September 20, 2016

Improved dairy sector expectations see New Zealand farmer confidence surge higher

Results at a Glance

· Overall confidence in the agricultural economy has improved considerably from the previous quarter

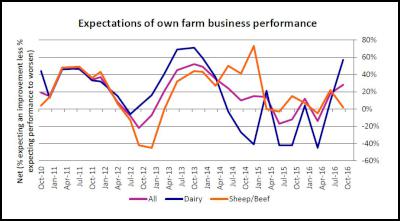

· Farmers’ expectations for their own business performance also improved, driven by sizeable improvement in expectations among dairy farmers

· While overall confidence was up among all sectors, sheep and beef farmers registered small decline in expectations of their own business performance

· Horticulturalists’ business performance expectations also fell, but remain at elevated levels

· Farm business investment intentions remained stable.

New Zealand farmer confidence in the agricultural economy has risen for the second consecutive quarter and is now at its highest level since 2013, the latest Rabobank Rural Confidence Survey has shown.

Almost half of all farmers surveyed were expecting the rural economy to improve in the coming 12 months resulting in overall net confidence shooting up to a reading of +35 per cent from +three per cent last survey.

The survey – completed earlier in the month – found the number of farmers expecting the rural economy to improve had risen to 48 per cent (up from 25 per cent last quarter), 37 per cent were expecting it to remain the same (down from 52 per cent), while only 13 per cent were expecting the agricultural economy to worsen (down from 22 per cent).

Farmers across all sectors were more optimistic about the prospects for the agricultural economy as a whole with dairy farmers showing the biggest increase in optimism. Of dairy farmers surveyed, over two-thirds (67 per cent) expected conditions to improve, the highest result registered on this measure since October 2007.

Rabobank New Zealand general manager for Country Banking, Hayley Moynihan said the jump in confidence recorded in the latest survey was largely attributable to farmers’ expectations that commodity prices – particularly for dairy products – have begun to ascend from the bottom and will continue to rise over the next 12 months.

“Since the last survey, in July, three consecutive increases in Global Dairy Trade (GDT) results have lifted commodity prices by 25 per cent and given those involved in the dairy sector a much-needed boost. The big jump in the overall confidence reading is also a reflection of how low confidence in the agricultural economy has been over the past two years contributing to confidence reaching near-decade lows in several survey results during this period.” Media Release September 20, 2016

The improved outlook for the rural economy as a whole was also reflected in farmers’ expectations for their own business performance over the next 12 months. Overall 44 per cent of the country’s farmers expected their business to improve over this period, with 16 per cent expecting business performance to worsen. This resulted in a jump in the net reading for this measure to +28 per cent (+18 per cent previously). Dairy farmers were the primary driver of this increase, recording a net positive reading of +57 per cent (up from +nine per cent previously).

“On top of dairy farmers vastly improved expectations for their own businesses, the survey also signalled a potential lift in milk supply for the coming season with 31 per cent of dairy farmers expecting their production to increase and only 15 per cent expecting it to fall in the 16/17 season,” Ms Moynihan said.

In contrast to the increasing optimism amongst dairy farmers, the expectations of sheep and beef farmers for their own business performance in the coming 12 months dipped.

“The net reading for sheep and beef farmers on this measure fell to +two per cent, back from the +22 per cent recorded last quarter,” Ms Moynihan said.

“This result was not wholly unexpected as, despite lamb prices rising in both the North and South Islands, and farmgate beef prices remaining steady, the high New Zealand dollar is currently providing a challenging trading environment for the sheep and beef sector.”

Horticulturalists expectations for their own business performance also fell, but remain at elevated levels.

“A net reading of +26 per cent was recorded by horticulturalists this survey from +47 per cent previously,” Ms Moynihan said. “This result is well back on last quarter, but the confidence amongst horticulturalists in their own business is still relatively high as it has been for a number of consecutive quarters.”

“Export gains in the horticulture sector have been the standout performer for the New Zealand economy in recent years, and expectations are again high for strong returns this coming season, particularly for pip fruit and gold Kiwifruit.”

Ms Moynihan said horticulturalists continued to have the strongest investment intentions amongst all farmers.

“The survey showed 42 per cent of horticulturalists are expecting their farm investment to increase in the coming 12 months with only 11 per cent expecting farm investment to decrease,” she said, “and this result reflects the optimism horticulturists have about the returns they will receive for their product this season.”

Investment intentions for dairy and sheep and beef farmers were relatively unchanged from the last survey.

“The number of dairy farmers expecting investment to increase lifted to 19 per cent (from 13 per cent last quarter), while investment intentions fell amongst sheep and beef farmers to Media Release September 20, 2016

21 per cent (from 28 per cent),” Ms Moynihan said. “However, the majority of both dairy farmers (67 per cent) and sheep and beef farmers (66 per cent) are expecting farm investment in the coming year to remain at the same level as the previous 12 months,” she said.

Conducted since 2003, the Rabobank Rural Confidence Survey is administered by independent research agency TNS, interviewing a panel of approximately 450 farmers each quarter.

Rabobank New Zealand is a part of the international Rabobank Group, the world's leading specialist in food and agribusiness banking. Rabobank has more than 115 years' experience providing customised banking and finance solutions to businesses involved in all aspects of food and agribusiness. Rabobank is structured as a cooperative and operates in 40 countries, servicing the needs of approximately 8.8 million clients worldwide through a network of more than 1000 offices and branches. Rabobank New Zealand is one of New Zealand's leading rural lenders and a significant provider of business and corporate banking and financial services to country's food and agribusiness sector. The bank has 33 branches throughout New Zealand. Rabobank also operates RaboDirect, New Zealand’s first internet-only bank specialising in savings and deposits.

Hugh Grant: How To Reduce Network Bottlenecks

Hugh Grant: How To Reduce Network Bottlenecks Dominion Road Business Association: Auckland Transport's 'Bus To The Mall' Campaign: A Misuse Of Public Funds And A Blow To Local Businesses

Dominion Road Business Association: Auckland Transport's 'Bus To The Mall' Campaign: A Misuse Of Public Funds And A Blow To Local Businesses Parrot Analytics: A Very Parrot Analytics Christmas, 2024 Edition

Parrot Analytics: A Very Parrot Analytics Christmas, 2024 Edition Financial Markets Authority: Individual Pleads Guilty To Insider Trading Charges

Financial Markets Authority: Individual Pleads Guilty To Insider Trading Charges Great Journeys New Zealand: Travel Down Memory Lane With The Return Of The Southerner

Great Journeys New Zealand: Travel Down Memory Lane With The Return Of The Southerner WorkSafe NZ: Overhead Power Lines Spark Safety Call

WorkSafe NZ: Overhead Power Lines Spark Safety Call