NZ commercial real estate returns highest since the GFC

New Zealand commercial real estate returns highest since the GFC

The Property Council New Zealand/IPD New Zealand Quarterly Property Index Q1 2016 results have been released.

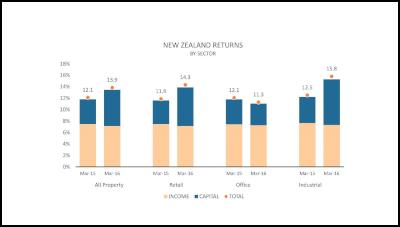

The results, announced at a Property Council event in Auckland yesterday, show a total annualised return of 13.9% for the year-ending March 2016. This is above the 12.5% to December 2015 and the ten-year average return of 9.9%.

The total annualised return for retail sector increased to 14.3%, office to 11.3% and industrial to a whopping 15.8%.

Capital rates are firming across the board, with an average of 7.1% for office, 6.8% for retail and 6.9% for industrial.

The all property return for New Zealand is at its highest level since the Global Financial Crisis, indicative of commercial property market’s strong performance.

Retail and industrial returns strengthening

Highest performance since the GFC

Property Council chief executive Connal Townsend says the returns demonstrate a booming commercial property market.

“The results show a high level of confidence in this sector, and for the last several years, the Index has been delivering strong returns steadily. The commercial property industry has a critical role to play as a contributor to regional and national economies and should be supported.

“The sector builds cities and towns by creating civic centres, educational institutions, commercial hubs and social amenities. It is crucial to the growth of regional New Zealand and meeting the needs of our high growth areas.”

PROPERTY COUNCIL NEW ZEALAND/IPD NEWS ZEALAND PROPERTY INDEX

The PCNZ/IPD New Zealand Property Index provides a broad measure of investment returns for the property market in New Zealand. The index database is comprised of property assets from 20 participating funds with a combined asset value of $14.1 billion, representing 563 investments. Participants represent listed property vehicles, unlisted wholesale property funds, unlisted retail property funds, property syndicates, private investors and the public sector. The index details total return, income return, and capital growth for office, retail and industrial on a quarterly basis.

ENDS

NZAS: New Zealand Association Of Scientists Awards Celebrate The Achievements Of Scientists And Our Science System

NZAS: New Zealand Association Of Scientists Awards Celebrate The Achievements Of Scientists And Our Science System Stats NZ: Retail Spending Flat In The September 2024 Quarter

Stats NZ: Retail Spending Flat In The September 2024 Quarter Antarctica New Zealand: International Team Launch Second Attempt To Drill Deep For Antarctic Climate Clues

Antarctica New Zealand: International Team Launch Second Attempt To Drill Deep For Antarctic Climate Clues Vegetables New Zealand: Asparagus Season In Full Flight: Get It While You Still Can

Vegetables New Zealand: Asparagus Season In Full Flight: Get It While You Still Can  Bill Bennett: Download Weekly - How would NZ telecoms cope with another cyclone

Bill Bennett: Download Weekly - How would NZ telecoms cope with another cyclone NZ On Air: Firm Audience Favourites Lead NZ On Air Non-Fiction Funding

NZ On Air: Firm Audience Favourites Lead NZ On Air Non-Fiction Funding