Chronic lack of supply fuels regional growth in house prices

11 May 2016

Chronic lack of supply fuels regional growth in house prices and sales volumes

Sales volumes hit new levels and median house prices reached new record highs across more regions of New Zealand than ever before, according to the latest figures released today by REINZ, source of the most recent, complete and accurate real estate data in New Zealand.

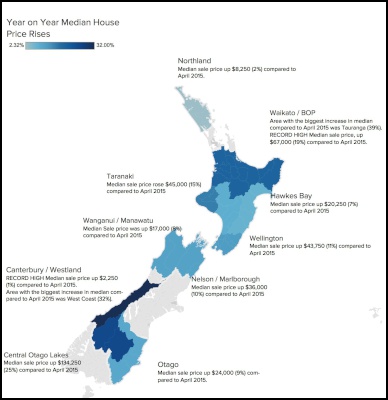

Record median prices were reached in Waikato/Bay of Plenty, Taranaki, Canterbury/Westland and Otago. This shows the growing ‘Halo Effect’ of rising prices around New Zealand is strengthening in the regions where it is already present, and moving on to new regions, driven by a chronic lack of supply.

On a seasonally adjusted basis* the number of dwellings sold in April 2016 rose by 12.8% compared to March, indicating that the normally-expected drop in sales between March and April was far smaller than usual. And compared to April 2015, all regions recorded increases in sales volume.

At the same time, the availability of properties for sale has fallen by over one third over the past 12 months, with a number of regions seeing declines of more than half. Days to sell, another measure of demand has also fallen by more than 20% over the past 12 months in nine of the twelve regions.

The national median price was $490,000 for April, an increase of $35,000 (7.7%) on April 2015, and down 1.0% compared to March. Excluding the impact of the Auckland region, the national median price rose $29,000 to $382,000 compared to April 2015.

Real Estate Institute of New Zealand (REINZ) Chief Executive Colleen Milne says, “The April data confirms the continued strength of the real estate market right across New Zealand, driven by a chronic lack of supply.

“Anecdotal evidence suggests that investors outside of Auckland are increasingly looking to real estate investments to improve their yields compared to bank deposits. First home buyers are also taking advantage of low mortgage rates, putting pressure on the number of properties available for sale. The strength of the seasonally adjusted level of sales demonstrates that the underlying demand for real estate across New Zealand remains strong, with every region recording an increase on a seasonally adjusted basis.

“We are reading the Reserve Bank’s Financial Stability Report today with interest, and have issued a separate statement regarding it, as the report underpins what our data has described as the Halo Effect for a while now.”

Sales Volumes

There

were 8,568 unconditional residential sales in April, an

18.4% increase on April 2015 and a 10.1% decline on March.

On a seasonally adjusted basis, the number of sales rose

12.8% from March to April. The strong increase in

seasonally adjusted sales reflects a smaller decline in

sales between March and April than is normally the case.

Over the past 10 years the average decline between March and

April has been 16.6%.

Sales volumes excluding Auckland, were up 28.8% on April 2015 and up 29.4% on a seasonally adjusted basis. All regions, apart from Northland, Auckland and Taranaki are showing in excess of 20% annual sales growth. Auckland saw the number of sales increase by 1.7% compared to April 2015, the first annual increase in Auckland’s sales volume since October 2015.

Compared to April 2015, all regions recorded increases in sales volume, with Hawke’s Bay recording the largest increase of 50%, followed by Southland with 49% and Otago with 35%.

Prices

The

national median house price rose $35,000 (+7.7%) to $490,000

from April 2015 to April 2016. Compared to March the

national median house price fell by $5,000 (-1.0%).

Excluding the Auckland region, the national median price

rose $29,000 (+8.2%) compared to April 2015. On a

seasonally adjusted basis, the national median house price

rose 7.7% compared to April 2015.

Waikato/Bay of Plenty, Taranaki, Canterbury/Westland and Otago all reached new record median prices in April. Central Otago Lakes recorded the largest percentage increase in median price compared to April 2015, at 25.2%, followed by Waikato/Bay of Plenty at 19.1% and Taranaki at 15.1%. In comparison, Auckland recorded the fourth largest increase in the median price at 12.8%. Taranaki recorded the largest percentage increase in median price compared to March, with an 8.7% increase, followed by Hawke’s Bay with a 4.8% increase and Manawatu/Wanganui with a 2.6% increase.

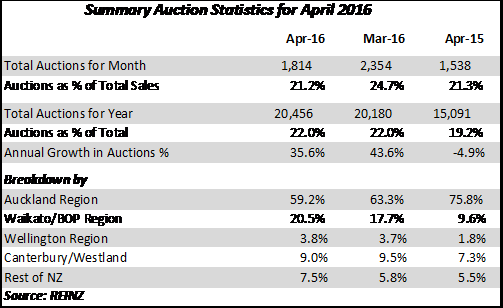

Auctions

There were 1,814

dwellings sold by auction nationally in April, representing

21.2% of all sales and an increase of 276 (+18%) on the

number for April 2015. The 20,456 sales by auction in the 12

months to April 2016 represented 22.0% of all dwelling

sales, compared to 19.2% (15,091 sales) for the year ending

April 2015.

Transactions in Auckland represented 59% of national auction sales, a significant drop from the 76% of national auction sales in April 2015. In contrast the number of auction sales in Waikato/Bay of Plenty has more than doubled from 9.6% of national auction sales in April 2015 to 20.5% in April 2016.

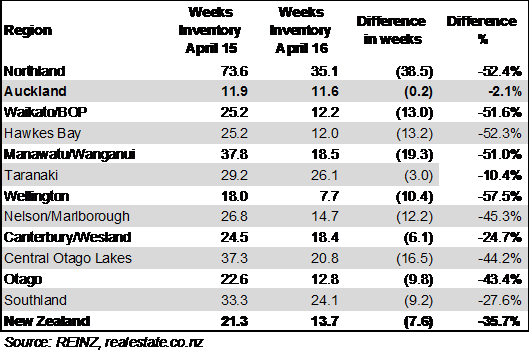

Inventory and

Days to Sell

Data from REINZ and

realestate.co.nz shows that the level of properties

available for sale across all regions in New Zealand has

fallen between April 2015 and April 2016. In absolute

terms, Wellington has the fewest level of properties for

sale with just 7.7 weeks of supply, followed by Auckland

with 11.6 weeks and Hawke’s Bay with 12.0 weeks. Compared

to April 2015 the number of properties available for sale

has declined by 35.7% across New Zealand with Wellington

experiencing the biggest decline of 57.5% followed by

Northland with a 52.4% decline and Hawke’s Bay with a

52.3% decline.

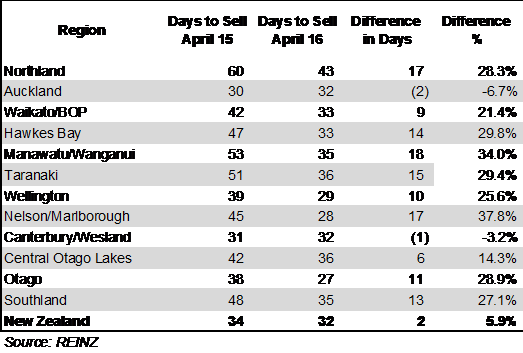

In terms of days to sell, while the number of days to sell has only improved by two days (5.9%) this masks some significant changes at the regional level. Between April 2015 and April 2016, in absolute terms the improvement in the number of days to sell has been greatest in Manawatu/Wanganui (+18 days), followed by Northland and Nelson/Marlborough (+17 days) and Taranaki (+15 days).

Further Data

Across New Zealand the total value of

residential sales, including sections, was $5.487 billion in

April, compared to $4.237 billion in April 2015 and $6.187

billion in March. For the 12 months ended April 2016 the

total value of residential sales was $56.457 billion. The

breakdown of the value of properties sold in April 2016

compared to April 2015 is:

| April 2016 | April 2015 | |||

| $1 million plus | 1,085 | 12.7% | 779 | 10.8% |

| $600,000 to $999,999 | 2,202 | 25.7% | 1,605 | 22.2% |

| $400,000 to $599,999 | 2,036 | 23.8% | 1,860 | 25.7% |

| Under $400,000 | 3,245 | 37.9% | 2,990 | 41.3% |

| All Properties Sold | 8,568 | 100.0% | 7,234 | 100.0% |

http://img.scoop.co.nz/media/pdfs/1605/REINZ_Residential_Regional_Commentary___April_2016.pdf

For

more real estate information and market trends data, visit

www.reinz.co.nz. For New Zealand's most

comprehensive range of listings for residential, lifestyle,

rural, commercial, investment and rental properties, visit

www.realestate.co.nz - REINZ's official

property directory website.

Editor’s

Note:

The monthly REINZ residential sales

reports remain the most recent, complete and accurate

statistics on house prices and sales in New Zealand. They

are based on actual sales reported by real estate agents.

These sales are taken as of the date that a transaction

becomes unconditional, up to 5:00pm on the last business day

of the month. Other surveys of the residential property

market are based on information from Territorial Authorities

regarding settlement and the receipt of documents by the

relevant Territorial Authority from a solicitor. As such,

this information involves a lag of four to six weeks before

the sale is recorded.

*Seasonal adjustment is a

statistical technique that attempts to measure and remove

the influences of predictable seasonal patterns to reveal

how the market changes over

time.

ENDS

NZAS: New Zealand Association Of Scientists Awards Celebrate The Achievements Of Scientists And Our Science System

NZAS: New Zealand Association Of Scientists Awards Celebrate The Achievements Of Scientists And Our Science System Stats NZ: Retail Spending Flat In The September 2024 Quarter

Stats NZ: Retail Spending Flat In The September 2024 Quarter Antarctica New Zealand: International Team Launch Second Attempt To Drill Deep For Antarctic Climate Clues

Antarctica New Zealand: International Team Launch Second Attempt To Drill Deep For Antarctic Climate Clues Vegetables New Zealand: Asparagus Season In Full Flight: Get It While You Still Can

Vegetables New Zealand: Asparagus Season In Full Flight: Get It While You Still Can  Bill Bennett: Download Weekly - How would NZ telecoms cope with another cyclone

Bill Bennett: Download Weekly - How would NZ telecoms cope with another cyclone NZ On Air: Firm Audience Favourites Lead NZ On Air Non-Fiction Funding

NZ On Air: Firm Audience Favourites Lead NZ On Air Non-Fiction Funding