Home values continue to rise in many parts of New Zealand

STRICTLY EMBARGOED UNTIL 12 NOON, WEDNESDAY 6 APRIL 2016

Home values continue to rise in many parts of New Zealand

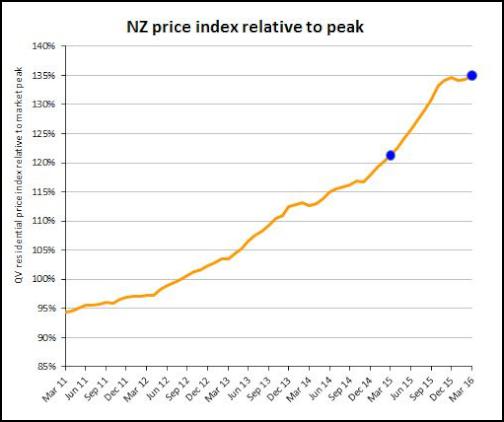

The latest monthly QV House Price Index shows that nationwide residential property values for March have increased 11.4% over the past year. Values rose slightly by 0.2% over the past three months and are now 35% above the previous market peak of late 2007. When adjusted for inflation the nationwide annual increase drops slightly to 11.3% and values are now 15.4% above the 2007 peak. The average value nationwide is now $559,492.

The Auckland market has increased 16.9% year on year, but has decreased by 0.2% over the past three months. Values there are now 70.4% higher than the previous peak of 2007. When adjusted for inflation values are 16.8% over the past year and are 45.5% above the 2007 peak. The average value in the Auckland region is now $931,061.

The full set of QV House Price Index statistics for all New Zealand for March can be downloaded by clicking this link: QV House Price Index (HPI) for March 2016.Click here to view new QV HPI Quarter 1 video which can be downloaded for use on your website.

QV National Spokesperson Andrea Rush said, “Home values have risen in most parts of New Zealand in the first quarter of 2016 with the exception of the Auckland region where values have been on a slight downward trend over the past three months.”

“However, over the past few weeks activity and demand has begun to pick up again across the Super City and values have actually risen again over the past month by 0.6%, so it appears the downward trend may be coming to an end.”

“The strong upward trend in the Hamilton and Wellington housing markets is continuing unabated. While in comparison the Christchurch market remains relatively flat, rising only slightly. The Dunedin values continued to rise at a steady pace.”

“The latest CoreLogic buyer classification data shows 44.0% of sales in Auckland were to multiple property owners, 21% were to first home buyers and 24.0% were to those moving from one home to another.”

“Around the rest of the country multiple property owners accounted for 37.0% of sales; while 20.0% of sales were to first home buyers and 26.0% were to movers.”

“While CoreLogic statistics also show listings levels remain low in many parts of the country with the exception of Taranaki and Canterbury.”

Auckland

While the overall figure for the Auckland Region was now 0.2% in the first quarter of the year, not all parts of the super city saw values drop.

Home values were down in the former Auckland City council central suburbs decreasing by 0.3% over the past three months. However, they increased by 14.5% in the year since March 2015 and the average value in this area is now $1,093,035.

Waitakere City home values also dropped 1.1% over the past three months but rose 18.1% since March last. The average value there is now $739,411. Values on the North Shore values were also down 1.1% in the three months to the end of March but rose 15.1% year on year. The average value there is now $1,077,459.

Manukau City bucked the downward trend it’s seen over the past couple of months and values started rising again by 0.5% in the first three months of the year and they were up a total of 20.9% year on year. The average value there is now just shy of $800,000 and is sitting at $799,700.

Meanwhile home values in the outer fringe areas of the super city continued to see steady value rises as they have done throughout the year. Papakura District increased the most, up 1.9% over the past three months and 27.4% year on year. While Rodney and Franklin continue to play catch up on more central areas; Rodney home values rose 1.8% over the past three months and 17.4% year on year, but values there are now 41.5% higher than the previous peak of 2007, which is well below the Auckland Regional average of 70.4%. Similarly, Franklin values were up 1.7% over the past three months and 19.2% year on year but are 49.1% higher than 2007 levels, much lower than the regional average.

QV Homevalue Registered Valuer, James Wilson said, ““The ‘wait and see’ approach which entered the market after new rules to curb investor activity is now subsiding and investors are beginning to re-enter the market.”

“Agents are reporting a shortage of listings and that well-presented, quality homes are selling well with strong prices being achieved. Properties which provide multiple consented income units are increasingly popular among both investors and owner occupiers.”

“Buyers appear willing to secure properties on an unconditional basis without always completing adequate ‘due diligence’. This market behaviour is considered highly risky and can leave purchasers exposed if something is wrong with the property.

“The outlying Auckland localities continue to remain popular amongst investors and owner occupiers alike.”

“However, investors are now placing greater emphasis on the long term rental returns over capital gains which indicates a shift away from a speculation based investment model and a return to traditional models governed by longer term investment returns.”

“The diminishing level of rental returns also continues to drive investors outside of Auckland in order to achieve desired returns and achieve lower deposit requirements.”

Hamilton

Home values across Hamilton City increased by 3.7% over the past three months and 23.3% year on year. The average value in the city now is $460,725. Values in the Waikato District also continued to accelerate, rising 7.0% over the past three months and 25.6% year on year. While home values are starting to take off in the Hauraki District (up 5.2%); and Matamata-Piako District (up 6.1%) since the beginning of the January.

QV Homevalue Hamilton Valuer, Stephen Hare said, “Hamilton City property market is still strong and home values are continuing on a steady upward trend and there’s a noticeable lack of homes listed for sale on the market.”

“Values growth has slowed in the new housing areas of Flagstaff and Rototuna as homes here are already at a relatively high price level and we are now seeing the value growth in the lower price bracket suburbs such as Fairfield, Claudelands, Dinsdale, Hillcrest/Silverdale and Melville.”

“In the regions, Paeroa is attracting interest from property investors but most sales are to buyers relocating from Auckland in search of a more affordable home.”

“There are a number of investors selling their investment properties in the town to first home buyers and this is creating a double edged sword as local tenants are finding themselves out of a home. This trend is creating a shortage of rental accommodation and is also pushing up rents in the Hauraki District town.”

“The property market throughout the Waipa District also remains strong especially in Cambridge and Leamington. The lack of listings is also a noticeable trend in these towns particularly in Leamington demand is strongest for properties in the $400,000-$600,000 price bracket.”

Tauranga

Home values in Tauranga City continue to accelerate rising 5.5% over the past three months alone and 22.6% year on year. The average value in the city is now $571,872.

Western Bay of Plenty home values also continued to see strong increases up 7.1% since the beginning of January and 18.7% year on year. The average value in the district is now $497,748.

QV homevalue Tauranga Registered Valuer David Hume said, “The Tauranga Market shows no signs of letting up with a large number of out of town buyers.”

“Agents are reporting that in many instances sale prices are continuing to exceed both their and vendors expectations.”

“There is a lot of activity in Omokoroa at present with a new twelve-lot subdivision at Kayelene Place recently selling out in two weeks at an average sales price of $295,000 for sections ranging from 750 – 900 square metres.”

Wellington

The QV House Price Index for the entire Wellington region shows home values rose 3.1% over the past three months and 7.5% year on year. The average value across the wider region there is now $491,236.

Home values in Wellington City area increased by 4.2% over the past three months and 8.9% year on year. The average value there is now $593,060. Lower Hutt home values rose 1.8% over the past three months; while Upper Hutt was up 0.6%; Porirua also rose 2.6% while the Kapiti Coast was up 3.1% over the same period.

QV homevalue Wellington Registered Valuer Pieter Geill said, “The housing market across the Wellington region remains hot with continued strong activity, high buyer demand and value growth.”

“There is still not enough stock to meet demand from buyers and the number of homes listed for sale remains at only about 50% of what it was three years ago.”

“People are lining up to attend some open homes and buyers are finding that their offers need to be unconditional to be successful and it’s been reported that it’s often not the highest offer that wins, but the cleanest offer (with the least conditions) that vendors are accepting.”

“In the Hutt Valley and Tawa, properties up to $600,000 are selling well. Investors remain active but they are no longer making cheeky offers as they need to make serious market related offers to ensure they are successful.”

“Developers are actively looking for sub-dividable land in the Hutt Valley, but there is not much land available. Blocks of flats are selling very well. There are still Auckland investors present but most of the bigger sales this month have been local.”

“Offers are being made and accepted very quickly and there is a growing frustration from buyers who are missing out and putting their highest bid forward to try and avoid missing out.”

Christchurch

Home values in Christchurch City rose by 0.8% over the past three months and 2.9% year on year. The average value in the city is now $485,700.

QV homevalue Christchurch, Registered Valuer Damian Kennedy said, “The market has generally had little growth with exception of entry level suburbs, such as Linwood, Aranui, Wainoni and New Brighton as well as in other suburbs with high numbers of new builds. This growth appears to be a bit of catch up in the more affordable suburbs which have seen less value growth than suburbs that boomed after the major earthquakes.”

“In areas which sustained severe earthquake damage new builds have also stimulated market growth because new homes generally sell for a higher value than the previously older homes in that suburb. The more recent earthquakes did cause some damage to some areas only on a section by section basis. As it is not suburb wide damage it does not appear to have impacted on market activity as a whole.”

“Favourable market conditions such as KiwiSaver incentives, looser LVR restrictions and low interest rates continue to see first home buyers remaining active in the market.”

Dunedin

Home values in Dunedin are continuing to show strong and steady increases rising by 2.0% over the past three months and 8.1% year on year. The average value in the city is now $315,185.

QVhomevalue Dunedin Registered Valuer, Duncan Jack said, “Value levels continue on a steady upward trend and sales activity levels continue to be extremely buoyant with sale numbers only appearing to be restricted by the number properties listed for sale on the market.”

“Listing levels appear to be fairly static however buyer demand is very strong, with most buyers having strong intentions to purchase which is resulting in multiple offers scenarios remaining commonplace in the market.”

All sectors of the residential market are being affected by the increase in demand especially in the $200,000 to $300,000 price range but also the mid to upper ranges experiencing strong competition from buyers.”

“An increasing number of higher value properties appear to be coming onto the market for sale which suggests increased confidence in this sector of the housing market.”

“Anecdotal evidence suggests there continues to be good demand from out of town investors attracted by high yields as well as by those moving to Dunedin who appear to be attracted by the value for money and lifestyle which Dunedin provides.”

Hawkes Bay

Napier home values are starting to accelerate rising 4.3% over the past three months and 9.1% year on year and average value there is now $358,732. While, Hastings increased by 2.6% over the past three months and 9.6% year on year. The average value there is now $331,149.

QV homevalue Hawkes Bay, Registered Valuer Bevan Pickett said, “The Hawke’s Bay market remains strong with properties selling quickly and there is a clear lack of homes listed for sale.”

“The lack of stock and high buyer demand means multiple offers continue to be common place and some properties barely make it to the market before being sold.”

“Local buyers have been forced into action by the presence of out of town buyers in the market who include investors and those relocating to live in the Hawkes Bay.”

“The low to mid-price-bracket is particularly active with out of town investors and they are giving strong competition to first home buyers, meaning those who were previously discerning in their decision-making need to loosen their criteria in order to secure a home.”

“Auctions and tenders are becoming more popular as the strength of sale tends towards the vendor and it becomes increasingly difficult to cap an asking price on a home given that values are rising quickly.”

Nelson

Nelson home values are now rising quickly up 4.3% over the past three months. Values rose 8.9% year on year and the average value in the city is now $446,860. While home values in the Tasman District rose 1.1% over the past three months and 5.1% year on year.

QV Nelson Registered Valuer Craig Russell said, ““We have seen a continuation of a proactive market with properties selling in a short time frame with asking prices typically being achieved or exceeded.”

“It has been a strong start to the year in the region with the recent interest rate cuts and strong migration fuelling house prices.”

“There have been plenty of section sales occurring in recent months, which is partly due to a lack of listings of existing homes. Construction companies are expecting to be busy with new house builds as a result of the increased activity in section sales.”

“Investors remain active given the current low interest rates and relatively high yields compared to the main centres around the country.”

“A number of agents have switched to no price marketing which is another indication of a strong market given purchasers can be forced into a bidding war.”

Other Provincial centres

Many provincial centres are experiencing the fastest rate of home value growth since before the previous peak of 2007 including Whangarei, Napier, Rotorua, Taupo, Carterton in the Wairarapa, as well as the Central Otago and Queenstown Lakes Districts according to QV National Spokesperson, Andrea Rush.

“Regional areas within commuting distance to Auckland, Tauranga and Hamilton also continued to show significant value rises including towns located in the Waikato, Waipa, Hauraki, Western Bay of Plenty and Kaipara Districts.”

“The only areas to see a drop in home values over the first quarter of the year in the North Island apart from parts of Auckland were Otorohanga, Wairoa, South Taranaki and in the South Island, the West Coast districts of Buller and Westland as well as Ashburton and the Christchurch Hills suburbs.”

Vegetables New Zealand: Asparagus Season In Full Flight: Get It While You Still Can

Vegetables New Zealand: Asparagus Season In Full Flight: Get It While You Still Can  Bill Bennett: Download Weekly - How would NZ telecoms cope with another cyclone

Bill Bennett: Download Weekly - How would NZ telecoms cope with another cyclone NZ On Air: Firm Audience Favourites Lead NZ On Air Non-Fiction Funding

NZ On Air: Firm Audience Favourites Lead NZ On Air Non-Fiction Funding Insurance and Financial Services Ombudsman: Woman Gets $40k More After Disputing Insurer’s Decision

Insurance and Financial Services Ombudsman: Woman Gets $40k More After Disputing Insurer’s Decision BNZ: A Quarter Of Older NZers Fear Going Online Due To Scam Concerns

BNZ: A Quarter Of Older NZers Fear Going Online Due To Scam Concerns University of Auckland: Scientists Develop Tool To Monitor Coastal Erosion In Fine Detail

University of Auckland: Scientists Develop Tool To Monitor Coastal Erosion In Fine Detail