Auckland home values drop while other centres rise

Auckland home values drop while other centres

rise

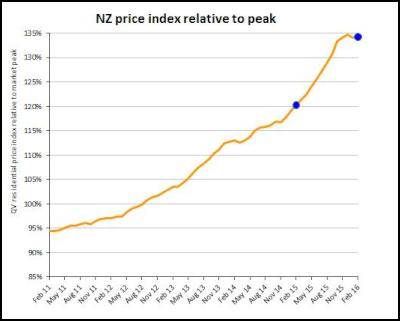

The latest monthly QV House Price Index shows that nationwide residential property values for February have increased 11.6% over the past year. Values rose slightly by 0.1% over the past three months and are now 34.3% above the previous market peak of late 2007. When adjusted for inflation the nationwide annual increase drops slightly to 11.5% and values are now 14.7% above the 2007 peak. The average value nationwide is now $556,306.

The Auckland market has increased 17.8% year on year, but has decreased by 0.7% over the past three months. Values there are now 69.4% higher than the previous peak of 2007. When adjusted for inflation values are 17.7% over the past year and are 44.7% above the 2007 peak. The average value in the Auckland region is now $925,656.

QV National Spokesperson Andrea Rush said, “Home values in the main centres are increasing with the exception of Auckland where many areas have seen values decrease over the past three months.”

“There continues to be strong growth in home values in Whangarei, Tauranga, Hamilton, Napier, Wellington and Queenstown. Values in Christchurch and Dunedin are also rising at a more moderate pace.”

“Regional areas within commuting distance to Auckland are also still benefiting from buyers looking for more affordable housing or rental property and values are up more than 5.0% in the Kaipara, Waikato and Hauraki Districts over the past three months.

“The only places which have seen values decrease over the past three months outside of Auckland are Stratford in the North Island and Ashburton, Waimate and the West Coast districts of Buller and Grey in the South Island.”

“Listings levels remain low in most parts of the country despite more properties coming onto the market during February.”

“The drop in values in the Auckland region is a continuation of the softening in the market seen late last year when measures to curb investors were introduced. However over the past couple of weeks, activity levels have started to pick up across the super city, so it’s possible the drop in values may be short lived.”

Auckland

Over the past three months home values in the former Auckland City Council suburbs, also North Shore, Manukau and Waitakere have decreased while the outer fringe areas of Papakura, Franklin and Rodney have continued to rise.

Auckland City suburbs decreased by 0.6% over the past three months but rose 16.0% year on year. The average value there is now $1,088,811. Waitakere City home values dropped the most, down 2.2% over the past three months but rose 18.4% year on year. The average value there is now $731,065. Values in Manukau also were down by 0.9% over the past three months but were up by 21.1% year on year and the average value there is now $789,940. North Shore values dropped 1.1% over the past three months but rose 16.4% year on year. The average value there is now $1,076,158.

Meanwhile values in the Rodney District rose 2.9% over the past three months and 17.5% year on year as these suburbs played catch up on value rises in other suburbs closer in to the city centre. The average value there is now $825,031. Similarly, the Papakura District continued to rise up 1.4% over the past three months and 27.2% year on year. The average value there is $604,103. Franklin values were also up 1.8% over the past three months and 19.9% year on year. The average value there is now $585,815.

QV Homevalue Registered Valuer, James Wilson said, “Whilst activity levels remain low compared to the first nine months of 2015, the ‘wait and see’ approach that began late last year appears to be subsiding among investors and many now appear willing to re-enter the market.”

“Auction campaigns are still producing lower clearance rates than that of mid to late 2015, however post auction negotiations are proving successful in increasing numbers, attendance is also up and clearance rates are rising.”

“The apartment market continues to strengthen, in particular modern, recently completed complexes or ‘off plan’ apartment purchases. Construction of new townhouses on brownfield sites is becoming increasingly popular as homeowners seek to stay in the same locality. This is achieved through either sub division of a parent site or the demolition of the existing dwelling on a site.

“Proximity to public transit networks is becoming an increasingly popular variable in a purchase decision.”

Hamilton

Home values across Hamilton City continued to rise quickly up 4.6% over the past three months and 22.0% year on year. The average value in the city now is $455,966. Values in the Waikato District continued to accelerate rising a whopping 8.4% over the past three months and 22.8% year on year, while the Hauraki District was up 6.1% since December.

QV Homevalue Hamilton Valuer, Stephen Hare said, “The market continues to see strong activity particularly investors and first home buyers and while growth rates in the market are not as high as they were market is continuing to rise as demand continues to outstrip supply.”

“There is a shortage of rental stock available particularly with students returning for university and newcomers to the city starting new jobs. In the Eastern suburbs of Hamilton, which is close to the University and a popular area for student accommodation, it is particularly difficult to find rental properties.”

“There also continues to be strong demand from out-of-town investors for rental properties in other Waikato areas which is leading to value rises continuing in the Waikato District towns of Ngaruawahia, Te Kauwhata and Huntly East and West.”

“Tuakau and Pokeno values are also continuing to rise driven by demand from Aucklanders who are looking for more affordable properties in close enough proximity to commute.”

Tauranga

Home values in Tauranga City rose a massive 7.4% over the past three months and they are now 22.3% higher than they were in February last year. The average value in the city is now $565,547.

Western Bay of Plenty home values also continued to accelerate rising 6.9% over the past three months and 13.4% year on year. The average value in the district is now $484,340.

QV homevalue Tauranga Registered Valuer David Hume said, “The Bay of Plenty market continues to show no signs of slowing, with demand for properties far outstripping supply.”

“The way the top end of the market is continuing to strengthen, characterised by the building activity along Marine Parade at present and reported levels of enquiry from agents active along this strip.”

“Well located Mount Maunganui properties are setting new benchmarks. The recent sale of a renovated three-bedroom 1950’s Bungalow on a 309 square metre section for $905,000 at auction earlier this month is a good example of this.”

“Previously less desirable areas of Mount Maunganui are also undergoing a real period of gentrification with a number of properties along Maunganui Road south of Golf Road being renovated in the past 12 months.

“Given the similarities to the peak of the 2006 – 2007 property market and a reported levelling off in the Auckland, everyone is now starting to ask the question: ‘How long can this period of rapid house price increases be sustained?’”

Wellington

The QV House Price Index for the Wellington region as a whole rose 3.5% over the past three months and 6.1% year on year. The average value across the wider region there is now $485,424.

Home values in Wellington City area increased by 4.7% over the past three months, 7.0% year on year and the average value there is now $584,306.

Lower Hutt home values rose 1.9% over the past three months; while Upper Hutt was up 1.2%; Porirua also rose 3.2% while the Kapiti Coast was up 1.5% over the same period.

QV homevalue Wellington Registered Valuer Kerry Buckeridge said, “There continues to be strong activity and high prices being achieved across the full range of property types and price bands in the Wellington market.”

“Properties that are priced sensibly and marketed well, including private sales, are commonly receiving multiple offers from buyers.”

“A key factor is the shortage of housing stock which is resulting in demand continuing to outstrip supply in the Wellington and Hutt Valley markets.

“Out-of-town investors remain active in the market and there are reports of first home buyers missing out on properties due to increasing multiple offer situations which is resulting in an increasing number of first home buyers shifting their focus to the more affordable end of the apartment market.”

“Just as there is a noticeable lack of listings and rising prices in the home sales market we are also seeing a shortage of rental properties in the Wellington Area with close to 25.0% fewer listed than this time last year. As a consequence, most landlords are putting rents up when renewing tenancies or re-letting properties.”

Christchurch

Home values in Christchurch City rose by 0.9% over the past three months and 2.5% year on year. The average value in the city is now $485,014.

QV homevalue Christchurch, Registered Valuer Darryl Taggart said, “The market appears very active and while this is so far not translating into value growth in the statistics it’s possible this will start to show over the next month or two.”

“There is nothing to suggest the latest earthquakes have had any effect on property values and it’s likely the housing market is now so in tune with earthquake related issues that it won’t have much of an impact apart from on homes where new damage has occurred.”

“Well located properties in good condition are still selling well and demand continues to meet supply in the market.”

“There continues to be an air of optimism in the market as we mark five years since the big February quake as the city enters a new phase of regeneration.”

Dunedin

Home values in Dunedin are continuing to show steady increases up by 1.5% over the past three months and 6.5 % year on year. The average value in the city is now $311,088.

QVhomevalue Dunedin Registered Valuer, Duncan Jack said, “Agents are continuing to report multiple offer scenarios and short listing periods resulting from strong buyer competition.”

“The number of properties listed for sale also remains on the low side of normal for this time of the year but listings do seem to have picked up during February.”

“Home value levels continue to rise steadily in Dunedin – albeit slightly slower when compared to some of the other urban centres around New Zealand.”

Hawkes Bay

Napier home values increased by 4.1% over the past three months and 7.1% year on year and average value there is now $352,995. While, Hastings increased by 2.7% over the past three months and 8.7%year on year. The average value there is now $326,092.

QV homevalue Hawkes Bay, Registered Valuer Bevan Pickett said, “The market strength seen in recent times is continuing with significantly increased activity in all sectors of the market and a shortage homes listed on the market for sale.”

“Any good listings are being snapped up and stock that has been sitting on the market for a while is now selling at good value levels.”

“Investors continue to be present in the market although there are ‘slim pickings’ in terms of suitable listings for them and this is leading to high competition amongst buyers with multiple offer situations increasingly common.”

“This high demand and lack of supply is leading to upward pressure on home values and some areas are now seeing significant value growth.”

Nelson

Nelson home values continued to increase up 3.7% over the past three months and 7.7% year on year. The average value in the city is now $439,741. While home values in the Tasman District were also up slightly by 0.2% over the past three months and 3.0% year on year.

QV Nelson Registered Valuer Craig Russell said, “The Nelson market continues to see significant value growth and the market sentiment seems to be that values will continue to rise over the short term given interest rates are low and there is a lack of listings.”

“Listings numbers have picked up over the past month as more properties have come onto the market for sale but they are still well down on this time last year.”

“A number of agents have switched to no price marketing such as selling by auction or by negotiation, this indicates both that house prices are rising quickly and of a strong market where purchasers may being forced into a bidding war which can put upward pressure on prices.”

“Previously properties up to $450,000 have been in the greatest demand; we are now seeing an increase in this with properties up to $550,000 now in hot demand.”

“There is strong demand within the subdivisions for vacant land; this is particularly strong within Stoke and Richmond which has seen an increase in asking prices in recent months.”

Provincial centres

Most provincial centres in New

Zealand have seen residential property values rise over the

past three months. In the North Island, Carterton rose 7.9%

over the past three months; Whangarei District was up 4.9%

over the same period. In the South Island, Queenstown Lakes

District rose 6.1% over the past three months; and nearby

Central Otago District was up 4.5% over the same period.

The full set of QV House Price Index statistics for all New Zealand for February can be downloaded by clicking this link: QV House Price Index for February 2016

Commerce Commission: Systemic Breaches Of Consumer Law Lead To $1.5million Fine For Kiwibank

Commerce Commission: Systemic Breaches Of Consumer Law Lead To $1.5million Fine For Kiwibank SolarZero: SolarZero Limited (in Liquidation) - Important Business Update

SolarZero: SolarZero Limited (in Liquidation) - Important Business Update Science Media Centre: Cyclone Gabrielle's Impacts On NZ's Ecosystems - Expert Reaction

Science Media Centre: Cyclone Gabrielle's Impacts On NZ's Ecosystems - Expert Reaction RNZ: Parts Of Power System Could Be Out For 36 Hours In Event Of Extreme Solar Storm

RNZ: Parts Of Power System Could Be Out For 36 Hours In Event Of Extreme Solar Storm NZAS: New Zealand Association Of Scientists Awards Celebrate The Achievements Of Scientists And Our Science System

NZAS: New Zealand Association Of Scientists Awards Celebrate The Achievements Of Scientists And Our Science System Stats NZ: Retail Spending Flat In The September 2024 Quarter

Stats NZ: Retail Spending Flat In The September 2024 Quarter