Dairy challenges take NZ rural confidence to near-decade low

Dairy challenges take New Zealand rural confidence to

near-decade low

New Zealand farmer confidence has fallen to its lowest levels in nearly a decade, as dairy farmers across the country struggle with the challenges arising from the slump in global markets, the latest quarterly Rabobank Rural Confidence Survey has shown.

While a recovery in global dairy prices is on the horizon, it is not expected to flow through into domestic farmgate milk prices before the 2016/17 production season.

The survey – completed earlier this month – found confidence in the agricultural economy had fallen significantly this quarter to a negative net reading of -45 per cent, down from 13 per cent in the March quarter.

With farmer sentiment at its lowest level since early 2006, more than half of those surveyed (56 per cent) expect conditions in the rural economy to worsen, up considerably from 23 per cent with that view previously. While those expecting similar conditions to last year stood at 32 per cent (down from 40 per cent) and just 11 per cent anticipate an improvement – compared with 36 per cent last quarter.

Rabobank New Zealand CEO Ben Russell said that while dairy farmers are likely to receive a better farmgate milk price than last season, it was still pegged to be below the full production cost for many farmers.

Mr Russell said dairy farmers were taking steps to reduce their costs in the current operating environment.

“In response to current pricing signals, we are seeing dairy farmers cut back their rates of supplementary feed and some lower their stocking rates by culling lower performing cows, and maximising feed available to a higher quality, but smaller, herd,” he said.

Mr Russell said subdued sentiment in the dairy sector not only had significant flow-on effects to other agricultural sectors and service providers – highlighting the impact of reduced expenditure on grazing and feed inputs by dairy farmers – but also to the wider New Zealand economy.

“In recent months we have seen the weakness in dairy prices contribute to sluggish growth in the New Zealand economy, weighing on the dollar and increasing expectations of further interest rate cuts,” he said.

At a farm level, 58 per cent of dairy farmers expect a poorer farm business performance over the coming 12 months (up from 23 per cent), while just 16 per cent expect it to improve – compared with 44 per cent with that view previously.

Lower commodity prices were the key driver of lower rural sentiment this quarter, with 78 per cent of surveyed farmers expecting conditions in the agricultural economy to worsen on the back of prices – up from 43 per cent last quarter.

Farmers also raised concerns around the state of overseas markets and rising input costs, cited by 16 and 14 per cent of respondents, respectively.

The impact of drought pared back as a negative driver of sentiment, raised by just four per cent of respondents, compared with 25 per cent last quarter.

“Good rain in April helped alleviate the dry conditions that gripped parts of the country though February and March, notwithstanding that parts of the South Island – particularly North Canterbury – are still facing drought conditions,” Mr Russell said.

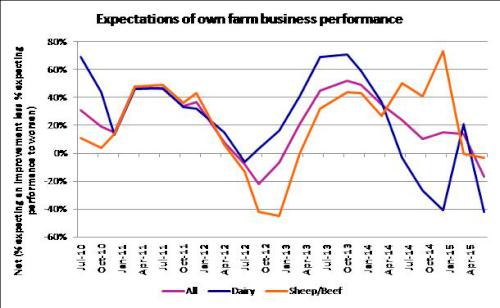

The hangover from a dry summer, coupled with disappointing farmgate returns, flowed into the neutral outlook held by sheep and beef producers. Similar to last quarter, half of drystock farmers (52 per cent) expect a similar farm business performance to last year while they were almost equally spilt as to whether conditions would improve or deteriorate – at 22 and 25 per cent, respectively.

In aggregate, New Zealand farmers revised down their expectations for their own farm business performance to a net negative reading of -17 per cent, from 14 per cent last quarter.

This flowed into investment intentions, with the majority of respondents (60 per cent) expecting to maintain their investment, but a smaller proportion expecting to increase it. Overall, 16 per cent are expecting to increase investment (down from 28 per cent) while 23 per cent are looking to cut expenditure this year (up from 12 per cent).

Mr Russell said the investment appetite amongst dairy farmers had waned, with only eight per cent holding expansionary intentions over the coming 12 months.

“This is reflective of the market that dairy farmers are operating in despite the longer-term fundamentals remaining positive,” he said.

Conducted since 2003, the Rabobank Rural Confidence Survey is administered by independent research agency TNS, interviewing a panel of approximately 450 farmers each quarter.

ends

Bill Bennett: Download Weekly - Review Of 2024

Bill Bennett: Download Weekly - Review Of 2024 Bill Bennett: One NZ scores worldwide first as Starlink direct-to-mobile launches

Bill Bennett: One NZ scores worldwide first as Starlink direct-to-mobile launches Hugh Grant: How To Reduce Network Bottlenecks

Hugh Grant: How To Reduce Network Bottlenecks Dominion Road Business Association: Auckland Transport's 'Bus To The Mall' Campaign: A Misuse Of Public Funds And A Blow To Local Businesses

Dominion Road Business Association: Auckland Transport's 'Bus To The Mall' Campaign: A Misuse Of Public Funds And A Blow To Local Businesses Parrot Analytics: A Very Parrot Analytics Christmas, 2024 Edition

Parrot Analytics: A Very Parrot Analytics Christmas, 2024 Edition Financial Markets Authority: Individual Pleads Guilty To Insider Trading Charges

Financial Markets Authority: Individual Pleads Guilty To Insider Trading Charges