JP Morgan Cornering Silver Bullion Market?

JP Morgan Cornering Silver Bullion Market?

- Why is JP Morgan accumulating the

biggest stockpile of physical silver in history?

-

Legendary silver analyst Butler believes JP Morgan in a

position to corner silver market

- JP Morgan may be

holding as much as 350 million ounces of physical

silver

- JP Morgan realises the value of owning physical

silver bullion today

- Silver at $16 today - Set to soar

to over $50 again

JPMorgan Chase, the largest U.S. bank, one the largest providers of financial services in the world and one of the most powerful banks in the world has accumulated one of the largest stockpiles of silver, the world has ever seen.

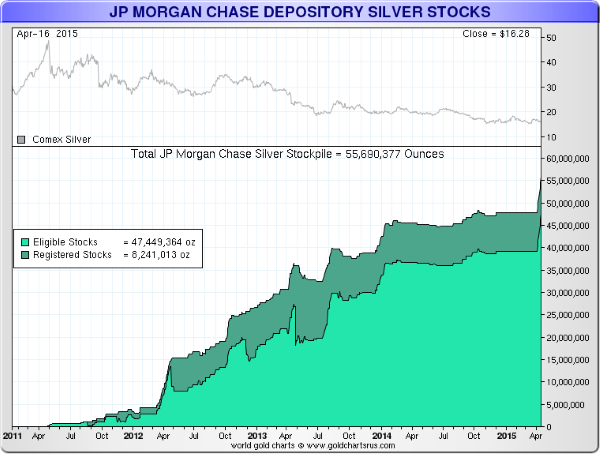

The total JP Morgan silver stockpile has increased dramatically in the last four years. In 2011, JP Morgan has little or no physical silver. By 2012, they had acquired 5 million ounces of silver bullion.

Incredibly in the last 3 years, their COMEX silver stockpile has increased tenfold and is now over 55 million ounces.

Silver in USD – 10 Years (Thomson Reuters)

JP Morgan

Cornering Silver Bullion Market?

- Why

is JP Morgan accumulating the biggest stockpile of physical

silver in history?

- Legendary silver analyst Butler

believes JP Morgan in a position to corner silver

market

- JP Morgan may be holding as much as 350 million

ounces of physical silver

- JP Morgan realises the value

of owning physical silver bullion today

- Silver at $16

today - Set to soar to over $50 again

JPMorgan Chase, the largest U.S. bank, one the largest providers of financial services in the world and one of the most powerful banks in the world has accumulated one of the largest stockpiles of silver, the world has ever seen.

The total JP Morgan silver stockpile has increased dramatically in the last four years. In 2011, JP Morgan has little or no physical silver. By 2012, they had acquired 5 million ounces of silver bullion.

Incredibly in the last 3 years, their COMEX silver stockpile has increased tenfold and is now over 55 million ounces.

Silver in USD – 10 Years (Thomson Reuters)

It would seem like a good opportunity to take a similar position to an institution which is very well connected and very well informed due to its relationship with and influence over the U.S. government, the U.S. Treasury and the U.S. Federal Reserve.

The smart and connected money, JP Morgan, however, seems to realise the value of owning physical silver bullion today.

JP Morgan’s silver accumulation suggests another economic crisis looms large and that silver is set to soar … again.

Silver is currently trading at just over $16 per ounce. GoldCore continue to believe that silver will surpass its non inflation adjusted high $50 per ounce in the coming years.

Indeed, we believe that silver will surpass its inflation adjusted high or real record high of over $150 per ounce in the next 5 to 7 years.

http://www.goldcore.com/us/#section-0

ENDS

Kiwi Economics: It’s Mayhem In Markets As Downside Risks Dominate Following Trump’s Tariffs

Kiwi Economics: It’s Mayhem In Markets As Downside Risks Dominate Following Trump’s Tariffs Mindful Money: Consumer Demand For Ethical Investing Remains Strong Despite International Headwinds

Mindful Money: Consumer Demand For Ethical Investing Remains Strong Despite International Headwinds Greenpeace: Taranaki - Greenpeace Activists Stop Unloading Of Palm Kernel Sourced From Indonesian Rainforests

Greenpeace: Taranaki - Greenpeace Activists Stop Unloading Of Palm Kernel Sourced From Indonesian Rainforests Seafood New Zealand: Seafood Situation Saved By A Sausage - New Plymouth Locals Innovate, Using Crayfish Bait

Seafood New Zealand: Seafood Situation Saved By A Sausage - New Plymouth Locals Innovate, Using Crayfish Bait Takeovers Panel: Takeovers Panel Convenes Meeting To Inquire Into The Acquisition Of Shares In NZME Limited

Takeovers Panel: Takeovers Panel Convenes Meeting To Inquire Into The Acquisition Of Shares In NZME Limited WorkSafe NZ: Conveyor Belt Death-Trap Was A Danger In Plain Sight

WorkSafe NZ: Conveyor Belt Death-Trap Was A Danger In Plain Sight