Rent rises steaming ahead of inflation

Rent rises steaming ahead of inflation

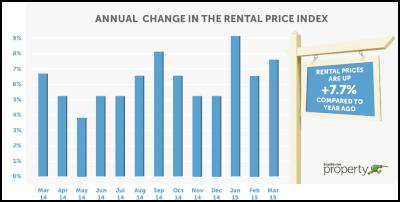

Rents across New Zealand continue to steam ahead of inflation with the median asking rent in March 2015 up 7.7 per cent compared with March 2014. By comparison, inflation across the wider economy is at a 16-year low and up just 0.1 per cent year-on-year.

In March, the median rent being asked for by landlords bounced up to a record high of $420 per week, up from $390 per week a year ago.

According to Trade Me Property’s Rental Price Index, median rents were up 6.5 per cent year-on-year in February and up 9.1 per cent year-on-year in January.

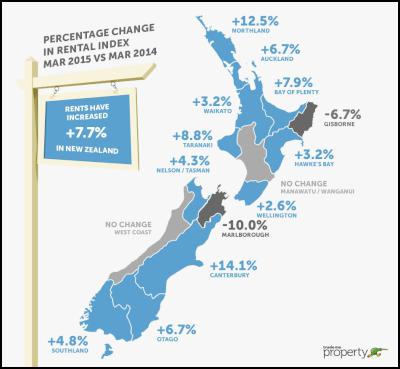

Head of Trade Me Property Nigel Jeffries said the rental market was not a great one for tenants, with increases in 11 out of 15 regions across the country. “There is continued pressure on asking rents, with Auckland tenants being asked to pay almost 7 per cent more than a year ago, with the median rent at a new high of $480 per week,” he said. “Weekly rents in the city have broken through new records in 22 out of the past 24 months and have continued to tick up from when they were $440 per week back in March 2013.”

Mr Jeffries said that although 7.7 per cent was “not even close to the super-hot pace of house prices”, it was well ahead of general inflation. He said the rental market was seeing “the economic reality of limited supply and fierce demand” in most regions.

Across the country over the past five years, the median weekly rent has risen by 23.5 per cent from $340 to $420. The majority of this increase was in the past 18 months, with rents up 13.5 per cent from $370 per week in September 2013 to $420 per week in March 2015.

Ups and downs in the regions

Of the 15 regions, two stood still, two dropped and the remainder increased by between 2 and 14 per cent. The strongest growth was in Canterbury, where median rents were up 14.1 per cent over the past year, jumping from $450 per week last month to $485 per week in March.

Canterbury is top of the table as the most expensive region for renting a property, despite the number of listings having soared by more than 50 per cent on a year ago.

Mr Jeffries said it was a familiar refrain but the region was heavily influenced by the Christchurch market, growing strongly on the back of the post-quake rebuild.

Northland also saw double-digit growth, up 12.5 per cent year-on-year.

The West Coast has had a tough run and has been the laggard after many consecutive months of rental falls. In March this levelled off and was unchanged. Median asking rents in Gisborne fell for the third consecutive month, down 6.7 per cent year-on-year.

Asking rents in Marlborough tumbled 10.0 per cent since March 2014, reversing a steady rise in rents over 2015.

Auckland and Christchurch driving the increases in rents

The market for 3 and 4 bedroom properties represent the largest segment of the rental market accounting for over 4 out of 10 properties for rent, they also represent the most dynamic segment of the market rising 9.3 per cent in the past year from $430 to $470 a week.

Mr Jeffries said this strength in this segment of the market was most pronounced in Auckland and Christchurch. “These properties are the touch point of the market and are commanding the largest rent increases, a medium sized property has risen by $50 a week in Auckland over the past year to a new record high of $550. Christchurch 3 and 4 bedroom properties which in the month of March made up nearly half of all properties rented, saw rents rise over the past year by $70 to top Auckland’s rent at $560 a week representing a 14.3 per cent rise”

Mr Jeffries said the Christchurch rental market

had begun to show signs of easing, however the March figures

“certainly indicate that the market is active with strong

transaction activity driven by increased supply matched to

strong demand with landlords leveraging some significant

increases in rents”.

Table 1: Median weekly rent by property size & region

| New Zealand | Auckland | Wellington | Christchurch | |

| Large

houses 5+ bedrooms | $680 + 4.6% | $733 + 4.6% | $750 + 8.7% | $750 No Change |

| Medium houses 3-4 bedrooms | $470 + 9.3% | $550 + 10.0% | $480 No Change | $560 + 14.3% |

| Small houses 1-2 bedrooms | $320 + 3.2% | $390 + 2.6% | $340 + 6.3% | $375 + 1.4% |

| All property types | $420 + 7.7% | $480 + 6.7% | $400 + 2.6% | $495 + 10.0% |

Multi-dwelling

property lags the general market

The heat in the rental market is primarily only burning in relation to traditional properties with apartments, townhouses and units all experiencing much lower annual increases. Asking rents for units in March were unchanged at $310 per week and well down on the $330 per week peak in January this year.

The asking rent inflation in the Auckland apartment market eased in March, despite hitting a new high of $440. It was up just $20 per week year-on-year.

The Christchurch market for both apartments and townhouses spiked in March, up 18.6 per cent and 11.1 per cent respectively. Mr Jeffries said both sectors had seen “a significant increase” in new inventory as new developments reached the market and drove median asking rents up.

Table 2: Median weekly rent by property type & region

| New Zealand | Auckland | Wellington | Christchurch | |

| Apartments | $400 + 1.3% | $440 + 4.8% | $400 - 2.4% | $439 + 18.6% |

| Townhouses | $460 + 2.2% | $532 + 1.4% | $400 - 2.4% | $500 + 11.1% |

| Units | $310 No Change | $370 + 2.8% | $300 No Change | $350 + 2.9% |

| All property types | $420 + 7.7% | $480 + 6.7% | $400 + 2.6% | $495 + 10.0% |

ENDS

Vegetables New Zealand: Asparagus Season In Full Flight: Get It While You Still Can

Vegetables New Zealand: Asparagus Season In Full Flight: Get It While You Still Can  Bill Bennett: Download Weekly - How would NZ telecoms cope with another cyclone

Bill Bennett: Download Weekly - How would NZ telecoms cope with another cyclone NZ On Air: Firm Audience Favourites Lead NZ On Air Non-Fiction Funding

NZ On Air: Firm Audience Favourites Lead NZ On Air Non-Fiction Funding Insurance and Financial Services Ombudsman: Woman Gets $40k More After Disputing Insurer’s Decision

Insurance and Financial Services Ombudsman: Woman Gets $40k More After Disputing Insurer’s Decision BNZ: A Quarter Of Older NZers Fear Going Online Due To Scam Concerns

BNZ: A Quarter Of Older NZers Fear Going Online Due To Scam Concerns University of Auckland: Scientists Develop Tool To Monitor Coastal Erosion In Fine Detail

University of Auckland: Scientists Develop Tool To Monitor Coastal Erosion In Fine Detail