Wage inflation acceleration suggests skill shortages emerging

• ASB Cantometer Index remained

steady in March.

• Labour market beginning to

tighten.

• Capacity constraints could limit

growth but will also fuel wage inflation in Canterbury over

2015.

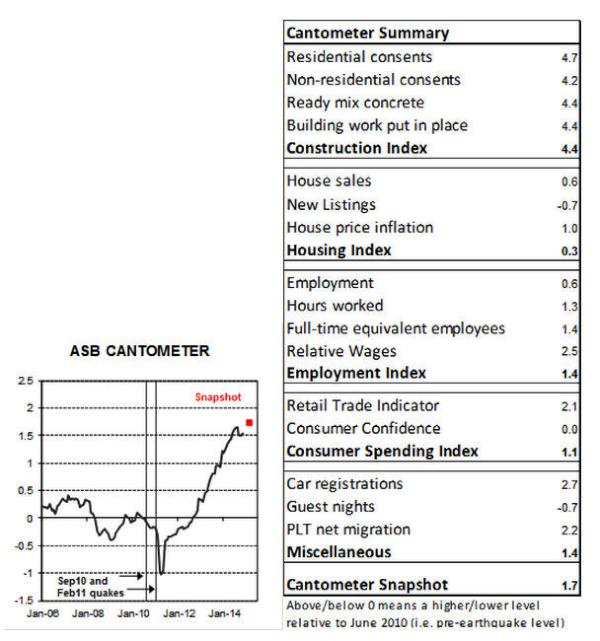

The Cantometer Index remained at 1.7 in March, where it has been since the start of 2015, reflecting the increase in activity from late last year.

“Following a relentless climb over the past two years, the Cantometer is starting to show signs of stabilising,” says ASB Chief Economist Nick Tuffley. “Construction has lifted rapidly to a phenomenally high level in a short period of time. While we expect construction activity will continue to remain at historically high levels for some time, the rate of growth is likely to be more modest compared to recent years.”

While the increase of growth is beginning to slow down, wage inflation pressures appear to be lifting with Canterbury wage growth stronger than in the rest of the economy.

“Wage inflation growth is likely a reflection of an increase in skill shortages. Construction activity in Auckland has been similar to the levels experienced in Canterbury with both regions competing for skilled workers,” says Mr Tuffley.

“Strong wage inflation, combined with slowing job and population growth, suggest firms are once again starting to struggle to recruit after two years of aggressive growth.”

This slowdown in growth largely indicates that capacity constraints are starting to bite.

“Consequently, we may see a pickup in wage and construction cost inflation in the Canterbury region over 2015,” concludes Mr Tuffley.

About the

Cantometer

The Cantometer is designed to

summarise activity in Canterbury. The study takes a range of

publicly available regional economic data, which are

standardised and aggregated into a summary measure. The

index has been rebased to zero in June 2010 (the end of the

quarter immediately preceding the first earthquake) such

that a positive number represents activity being above

pre-earthquake levels.

Along with the aggregate Cantometer index, there are five sub categories: Construction, Housing, Employment, Consumer spending and Miscellaneous*. These sub-indices will provide some insight into which sectors are driving the rebuild activity at a given point in time.

For most activity data we have used the level of activity. However, when incorporating wages and house prices into the index, levels are less informative. Instead the index uses prices relative to the rest of the country.

An increase in relative prices is a signal for resources to be reallocated to the Canterbury region.

The historical Cantometer series represented on the charts is a simple average of the complete set of data for each month.

*The miscellaneous category includes car registrations, guest nights and permanent and long-term net migration. A common factor driving these areas will be population growth, and we expect all these indicators to increase as the rebuild gathers momentum.

If you would like to receive ASB updates and reports by email: https://reports.asb.co.nz/register/index.html

ENDS

This edition of the ASB Cantometer Index is embargoed until 5am on Tuesday 31 March 2015. The full report is attached and will be available online.

Vegetables New Zealand: Asparagus Season In Full Flight: Get It While You Still Can

Vegetables New Zealand: Asparagus Season In Full Flight: Get It While You Still Can  Bill Bennett: Download Weekly - How would NZ telecoms cope with another cyclone

Bill Bennett: Download Weekly - How would NZ telecoms cope with another cyclone NZ On Air: Firm Audience Favourites Lead NZ On Air Non-Fiction Funding

NZ On Air: Firm Audience Favourites Lead NZ On Air Non-Fiction Funding Insurance and Financial Services Ombudsman: Woman Gets $40k More After Disputing Insurer’s Decision

Insurance and Financial Services Ombudsman: Woman Gets $40k More After Disputing Insurer’s Decision BNZ: A Quarter Of Older NZers Fear Going Online Due To Scam Concerns

BNZ: A Quarter Of Older NZers Fear Going Online Due To Scam Concerns University of Auckland: Scientists Develop Tool To Monitor Coastal Erosion In Fine Detail

University of Auckland: Scientists Develop Tool To Monitor Coastal Erosion In Fine Detail