Solid Performance in December Rural Property Market

News Release 22 January

2015

Solid Performance in December Rural Property Market

Summary

Data released today by the Real Estate Institute of NZ (“REINZ”) shows there were 68 fewer farm sales (-12.3%) for the three months ended December 2014 than for the three months ended December 2013. Overall, there were 486 farm sales in the three months to end of December 2014, compared to 374 farm sales for the three months ended November 2014 (+30.0%) and 554 farm sales for the three months to the end of December 2013. 1,849 farms were sold in the year to December 2014, 5.9% more than were sold in the year to December 2013.

The median price per hectare for all farms sold in the three months to December 2014 was $28,781 compared to $24,163 recorded for three months ended December 2013 (+19.1%). The median price per hectare fell 3.5% compared to November.

The REINZ All Farm Price Index fell 0.9% in the three months to December compared to the three months to November, moving from 3,278.1 to 3,249.8. Compared to December 2013 the REINZ All Farm Price Index fell by 0.2%. The REINZ All Farm Price Index adjusts for differences in farm size, location and farming type, unlike the median price per hectare, which does not adjust for these factors.

Five regions recorded increases in sales volume for the three months ended December 2014 compared to the three months ended December 2013. Nelson recorded the largest increase in sales (+15 sales), followed by Auckland (+8 sales). Compared to the three months ended November 2014, 11 regions recorded an increase in sales.

“Sales activity during the 3 month period ending December 2014 reflects the resilience of the rural market with volumes and prices indicating a strong degree of confidence amongst the ranks of vendors, purchasers and financiers in the medium to longer term future of the pastoral industry”, says REINZ Rural Spokesman Brian Peacocke.

“Taking into account the reduction in the dairy payout for the current season, of particular note has been the strength of the dairy market in the Waikato region.”

Highlights Include:

• Strong

first farm buyer activity in Northland;

• A very strong

run of dairy farm sales in the Waikato where confidence in

the industry has resulted in record prices paid for specific

quality properties in very good locations;

• An active

market for dairy and dairy support units in the Rotorua /

Taupo district;

• Reasonable activity and solid prices

for sheep and beef properties in Hawkes Bay –

predominantly local purchasers;

• A fully firm market

in the Manawatu / Wanganui region with good sales volumes

for finishing and grazing units, albeit mainly smaller

properties involved;

• Reports of a surprisingly

strong market in Canterbury, particularly in the grazing

category of properties;

• Sluggish conditions in Otago

with low levels of listings; and

• A good steady

market across the board with values holding well in

Southland.

Grazing properties accounted for the largest number of sales with 45.1% share of all sales over the three months to December 2014, Horticulture properties accounted for 11.1%, Finishing properties accounted for 13.4% and Dairy properties accounted for 19.5% of all sales. These four property types accounted for 89.1% of all sales during the three months ended December 2014.

Dairy

Farms

For the three months ended December

2014 the median sales price per hectare for dairy farms was

$41,227 (95 properties), compared to $36,825 for the three

months ended November 2014 (55 properties), and $38,267 (121

properties) for the three months ended December 2013. The

median dairy farm size for the three months ended December

2014 was 113 hectares.

Included in sales for the month of November were 49 dairy farms at a median sale value of $43,884 per hectare. The median farm size was 114 hectares with a range of 17 hectares in Taranaki to 455 hectares in Waikato. The median production per hectare across all dairy farms sold in December 2014 was 987 kgs of milk solids.

The REINZ Dairy Farm Price Index fell by 3.2% in the three months to December compared to the three months to November, from 2,229.4 to 2,157.6. Compared to December 2013, the REINZ Dairy Farm Price Index rose by 11.0%. The REINZ Dairy Farm Price Index adjusts for differences in farm size and location compared to the median price per hectare, which does not adjust for these factors.

Finishing Farms

For

the three months ended December 2014 the median sale price

per hectare for finishing farms was $24,043 (65 properties),

compared to $26,545 for the three months ended November 2014

(57 properties), and $21,289 (111 properties) for the three

months ended December 2013. The median finishing farm size

for the three months ended December 2014 was 51

hectares.

Grazing Farms

For

the three months ended December 2014 the median sales price

per hectare for grazing farms was $16,167 (219 properties)

compared to $14,811 for the three months ended November 2014

(155 properties), and $16,308 (237 properties) for the three

months ended December 2013. The median grazing farm size

for the three months ended December 2014 was 64

hectares.

Horticulture

Farms

For the three months ended December

2014 the median sales price per hectare for horticulture

farms was $202,308 (54 properties) compared to $186,615 (61

properties) for the three months ended November 2014, and

$141,134 (36 properties) for the three months ended December

2013. The median horticulture farm size for the three

months ended December 2014 was six

hectares.

Lifestyle

Properties

The lifestyle property market saw

a 4.9% lift (+82 sales) in sales volume in the three months

to December 2014 compared to December 2013. 1,769 sales

were recorded in the three months to December 2014 compared

to 1,687 sales in the three months to December 2013. 137

more sales were recorded compared to the three months to

November 2014 (+8.4%). For the 12 months to December 2014

there were 6,419 unconditional sales of lifestyle

properties, a decrease of 2.6% (-172 sales) over the 12

months to December 2013.

Eight regions recorded an increase in sales compared to December 2013 while five recorded decreases in sales. Compared to November 2014, eight regions recorded an increase in sales with three regions recording decreases.

The national median price for lifestyle blocks rose by $5,000 (+1.0%) from $520,000 for the three months to December 2013 to $525,000 for the three months to December 2014. The median price for lifestyle blocks in Auckland rose by $140,500 (+17.2%) from $817,500 for the three months to December 2013 to $958,000 for the three months to December 2014, a new record median price for the region. Over the same time period, the median price fell by 3.82% in Waikato to $490,500, and by 2.52% in Canterbury to $580,000. Compared to November 2014, the national median sales price rose by $10,000.

The median number of days to sell for lifestyle properties improved by 12 days, from 72 days for the three months to the end of November to 60 days for the three months to the end of December. Compared to the three months ended December 2013 the median number of days to sell eased by one day from 59 days to 60 days. Taranaki recorded the shortest number of days to sell in December 2014 at 36 days, followed by Gisborne at 41 days and Southland at 44 days. West Coast recorded the longest number of days to sell at 259 days, followed by Northland at 99 days, with Nelson at 97 days.

Commenting on the lifestyle property market Brian Peacocke said, “Continuing low inflation, reductions both in fuel prices and interest rates are beneficial factors influencing the lifestyle market.”

Highlights

Include:

• Very strong activity within all categories

and record sales for December in the lifestyle areas on the

southern fringe of Auckland City;

• A buoyant market in

the Waikato with purchasers from the north having a distinct

influence;

• Good healthy activity in the Bay of Plenty

where northern purchasers are also making their presence

felt;

• A slower to steady market in the lower North

Island;

• healthy sales activity in the Nelson /

Marlborough region;

• Good levels of confidence being

displayed in Canterbury with sales activity reflecting that

confidence;

• Steady to medium activity in the Otago /

Southland regions;

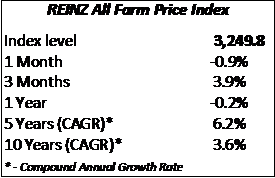

REINZ All Farm Price Index

– Additional Data

The table below sets out

the returns for the REINZ All Farm Price Index for the three

months ending December 2014.

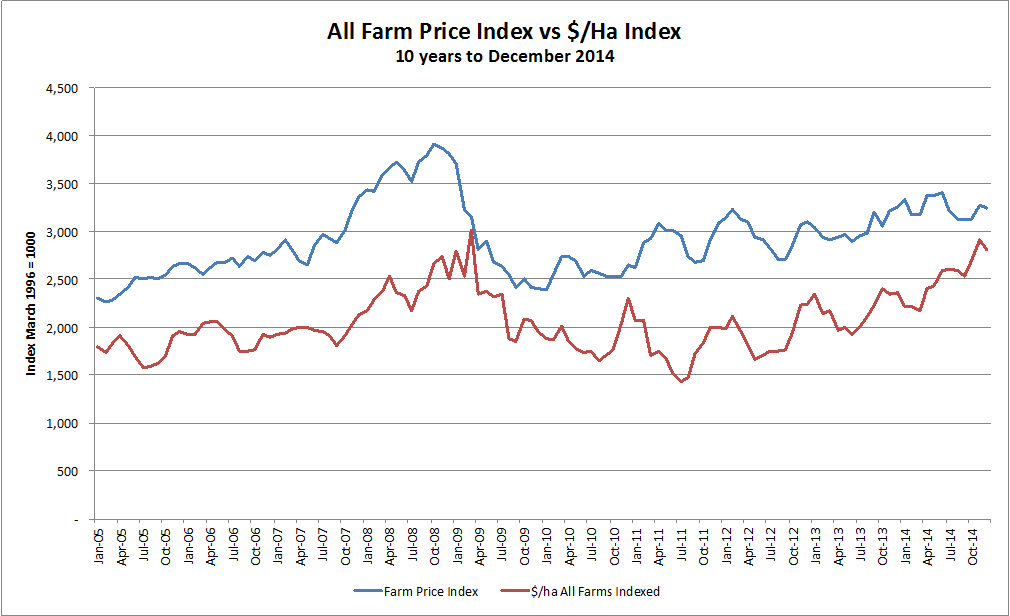

The

graph below shows the trends in the REINZ All Farm Price

Index compared to an index of movements in the $/hectare

measure of farm prices.

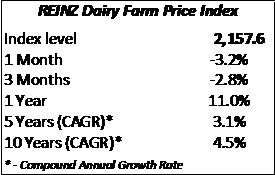

REINZ Dairy Farm Price Index

– Additional Data

The table below sets out

the returns for the REINZ Dairy Farm Price Index for the

three months ending December 2014.

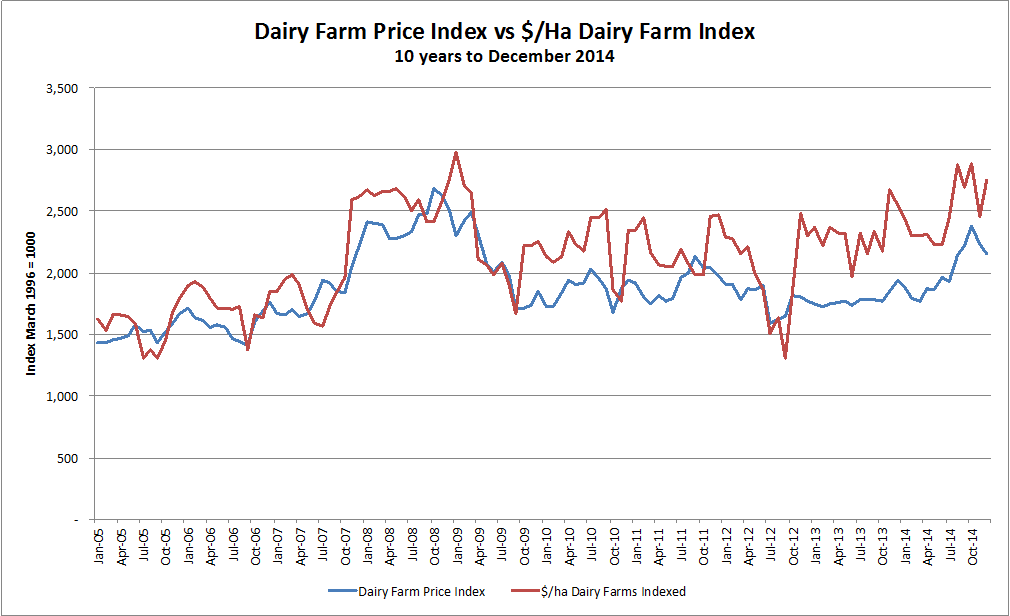

The

graph below shows the trends in the REINZ Dairy Farm Price

Index compared to an index of movements in the $/hectare

measure of farm prices.

----- ENDS -----

REINZ_Rural_Market_Report__December_2014.pdf

Real

Estate Institute of New Zealand

For more real

estate information and market trends data, visit

www.reinz.co.nz. For New Zealand's most comprehensive range

of listings for residential, lifestyle, rural, commercial,

investment and rental properties, visit

www.realestate.co.nz - REINZ's official

property directory website.

Editors

Note:

The information provided by REINZ

in relation to the rural real estate market covers the most

recently completed three month period; thus references to

September refer to the period from 1 October 2014 to 30

December 2014.

The REINZ Farm Price Indices have

been developed in conjunction with the Reserve Bank of New

Zealand. It adjusts sale prices for property specific

factors such as location, size and farm type which can

affect the median $/hectare calculations and provides a more

accurate measure of farm price movements. The REINZ Farm

Price Indices has been calculated with a base of 1,000 for

the three months ended March 1996. The REINZ Farm Price

Indices is best utilised in assessing percentage changes

over various time periods rather than trying to apply

changes in the REINZ Farm Price Index to specific property

transactions.

Hugh Grant: Retail Crime Is Out Of Control – Why Business Owners Can’t Wait For Government Action

Hugh Grant: Retail Crime Is Out Of Control – Why Business Owners Can’t Wait For Government Action SkyCity Auckland: Sky Tower Glows For International Women’s Day

SkyCity Auckland: Sky Tower Glows For International Women’s Day E tū: Deep Concerns About Undue Influence At NZME

E tū: Deep Concerns About Undue Influence At NZME Air New Zealand: Air New Zealand Chief Executive Greg Foran To Step Down In October 2025

Air New Zealand: Air New Zealand Chief Executive Greg Foran To Step Down In October 2025 Stats NZ: Building Activity Down 4.4 Percent In December 2024 Quarter

Stats NZ: Building Activity Down 4.4 Percent In December 2024 Quarter NIWA: Underwater Canyon Seafloor Study Reveals Landslide And Tsunami Risk

NIWA: Underwater Canyon Seafloor Study Reveals Landslide And Tsunami Risk