Residential Real Estate Market Ends 2014 with Sales Surge

News Release 15 January 2015

Residential Real Estate Market Ends 2014 with Sales Surge

Summary

• 7,064

dwellings sold in December 2014, up 24.2% on December 2013;

strongest December sales since 2006 and the second strongest

December on record

• National median price of

$450,000, up $23,000 on December 2013 and down $5,750 on

November 2013

• Auckland median price reached a

new record of $678,000

• Annual increase over

2014 in the national median price of 5.4%, compared with

9.8% over the 2013 year

• 74,537 dwellings were

sold in 2014, down 7% on the number sold in 2013. The

number of dwellings sold in 2014 represents only 4.2% of all

private dwellings in New Zealand

• 1,439

dwellings sold by auction in December, representing just

over 1 in 5 dwellings sold by auction

REINZ, the most up to date source of real estate data in New Zealand, announced today that there were 7,064 dwelling sales in the month of December, up 24.2% on December 2013 and down 4.7% compared to November. The national median price was $450,000 for the month of December, an increase of $23,000 or 5.4% compared to December 2013, and a decline of $5,750 or 1.3% from November.

Real Estate Institute of New Zealand (REINZ) Chief Executive Helen O’Sullivan says, “The data for December shows very strong sales growth compared to 12 months ago and a much higher level of sales that we would normally expect for the final month of the year. The effect has been seen right across the country, with a number of regions seeing further increases in sales in December after a strong November. The normal December slow down hasn’t really happened in 2014.”

“Apart from Auckland, median prices across the country have moderated somewhat. For the year ended December, Auckland’s median price rose by 13%, but the national median rose by only 5.4%. Even Canterbury, which has seen strong price growth during 2014 has seen its rate of price increase pull back to under 2% for the 12 months to December 2014.”

“The real estate market remains split between Auckland, with strong demand and price growth, and the rest of the country. While a number of regions are experiencing listing shortages the situation in Auckland is acute, with less than three months supply available and demand continuing to be robust. Vendors are simply not coming forward in large enough numbers to meet the demand, despite the strong price rises seen in Auckland over the past three years.”

Sales

Volumes

REINZ data shows there were 7,064

unconditional residential sales in December 2014, a 24.2%

increase on sales recorded for December 2013, and a fall of

4.7% from November. Typically, sales in December are

noticeably lower than November due to the school holidays

and Chirstmas break. On a seasonally adjusted basis the

number of sales was up 4.6.% on November, indicating that

sales for December were a lot stronger than would normally

be expected for this time of year.

Four regions recorded an increase in sales volume compared to November with Hawkes Bay recording the largest percentage increase of 7.2%, followed by Nelson/Marlborough with 6.8% and Northland with 4.2%. All regions recorded an increase in sales volume compared to December 2013 with Manawatu/Wanganui recording the largest increase of 39.7%, followed by Waikato/Bay of Plenty with an increase of 34.8% and Wellington with an increase of 32.5%.

Prices

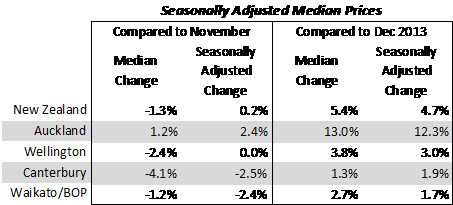

The

national median house price declined $5,750 (-1.3%) to

$450,000 compared to November. Compared to December 2013

the national median house price increased by $23,000

(+5.4%), with six regions recording an increase. On a

seasonally adjusted basis the national median house price

rose 0.2% compared with November and 4.7% compared to

December 2013.

Taking total volumes and prices into account, Auckland accounted for 98% of the increase in the median price between December 2014 and December 2013, with the remainder of the country accounting for just 2% of the increase in the median price.

Auckland recorded the largest percentage increase in median price compared to December 2013, with a 13.0% increase, followed by Wellington with a 3.8% increase and Waikato/Bay of Plenty with a 2.7% increase. Compared to November, Auckland recorded the largest percentage increase in median price, up 1.2%, followed by Taranaki with a 0.6% increase.

The REINZ Stratified Housing Price Index, which adjusts for some of the variations in the mix that can impact on the median price, is 6.0% higher than December 2013, at 4,076.6. The Auckland Index has risen 13.5% compared to December 2013, with the Christchurch Index up 3.7% and the Wellington Index up 1.6%.

Days To Sell

Dwellings took a median of 32 days to sell

in December, the same number as in December 2013, and two

fewer than November. Four regions saw an improvement in the

number of days to sell compared to December 2013 with

Manawatu/Wanganui recording an improvement of four days,

Taranaki an improvement of three days, and Auckland and

Waikato/Bay of Plenty an improvement of one day each.

For the month of December, Auckland, Canterbury/Westland and Otago recorded the shortest days to sell at 29 days, followed by Wellington at 35 days. Northland recorded the longest number of days to sell at 59 days, followed by Central Otago Lakes at 53 days and Hawkes Bay at 48 days. Over the past 10 years the median days to sell for the month of November has averaged 34 days across New Zealand.

Auctions

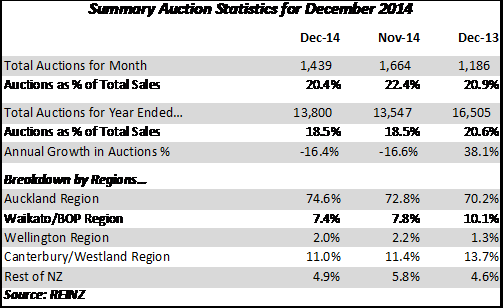

Nationally

there were 1,439 dwellings sold by auction in December

representing 20.4% of all sales, and an increase of 253 on

the number of dwellings sold by auction in December 2013.

For the 12 months to December 2014 the percentage of homes

sold by auction was 18.5% or 13,800, compared to 16,505

(20.6%) for the year ending December 2013.

Transactions in Auckland again dominated the auction market in December, representing 74.6% of the national total of auction sales. 39.3% of all dwelling sales in Auckland were by auction in December 2014, compared to 37.9% of all dwelling sales in Auckland in December 2013. Sales by auction in Waikato/Bay Of Plenty accounted for 7.4% of the national total, Canterbury/Westland accounted for 11.0% of the national total, and all other regions combined accounted for the remaining 7.0% of auction sales in December 2014.

Further Data

Across New Zealand the total value of

residential sales, including sections was $4.025 billion in

December, compared to $4.254 billion in November, and $3.068

billion in December 2013. For the 12 months ended December

2014 the total value of residential sales was $40.378

billion. The breakdown of the value of properties sold in

December 2014 compared to December 2013 is:

| December 2014 | December 2013 | |||

| $1 million plus | 629 | 8.9% | 409 | 7.2% |

| $600,000 to $999,999 | 1,577 | 22.3% | 1,136 | 20.0% |

| $400,000 to $599,999 | 1,902 | 26.9% | 1,589 | 27.9% |

| Under $400,000 | 2,956 | 41.8% | 2,554 | 44.0% |

| All Properties Sold | 7,064 | 100.0% | 5,688 | 100.0% |

The number of sales under $400,000 rose by 402 (+15.7%) in December 2014 compared to December 2013, compared to an increase of 1,376 sales (+24.2%) for all price brackets between the two periods. Up to this point in 2014 the data has shown a significant drop in sales volume for sales under $400,000. However, with the LVR restrictions now more than 12 months old, the comparative data from last year incorporates the impact of the LVR restictions. This month’s data suggests that there may be some improvement in activity in this market segment.

REINZ

Stratified Median Housing Price Index

The

REINZ Housing Price Index fell 1.0% compared with November

to sit at 4,076.6. Auckland rose 0.3%, Christchurch fell

4.6%, and Wellington fell 2.3%. For the month of December,

the Auckland index hit a new record high. For the 12 months

to December the Auckland Index rose 13.5%, the Christchurch

Index rose 3.7% and the Wellington Index rose 1.6%. The

National Index increased 6.0% compared to December last

year.

* CAGR is

Compound Annual Growth Rate

* The Christchurch

data needs to be treated with some caution due to

compositional changes in the suburb mix caused by the

earthquakes in the city

----- ENDS

-----

1. Deciles: For analysis, REINZ breaks real estate

sales into 10 prices bands to comapare trends in prices and

sales volumes across the market.

REINZ_Regional_Data__December_2014.pdf

For

more real estate information and market trends data, visit

www.reinz.co.nz. For New Zealand's most

comprehensive range of listings for residential, lifestyle,

rural, commercial, investment and rental properties, visit

www.realestate.co.nz - REINZ's official

property directory website.

Editor’s

Note:

The monthly REINZ residential sales

reports remain the most contemporary and up-to-date

statistics on house prices and sales in New Zealand. They

are based on actual sales reported by real estate agents.

These sales are taken as of the date that a transaction

becomes unconditional and includes sales as of 5:00pm on the

last business day of the month. Other surveys of the

residential property market are based on information from

Territorial Authorities regarding settlement and the receipt

of documents by the relevant Territorial Authority from a

solicitor. As such, this information involves a lag of four

to six weeks before the sale is recorded by the Territorial

Authority.

The REINZ Monthly Housing Price Index

is calculated using a technique known as stratification,

which provides an averaging of sales prices for common

groups of houses. This approach is considered a more robust

analysis of actual house price trends and was developed in

conjunction with the Reserve Bank.

The REINZ

Monthly Housing Price Index is based on a value of 1000 in

January 1992, the first month for which electronic

information is available. Changes in the index represent

movements in housing prices, where the mix of sales between

the groups is held constant and are more likely to reflect

genuine property price

movements.

Spirits New Zealand: A Year Of Two Halves For The NZ Spirits Industry

Spirits New Zealand: A Year Of Two Halves For The NZ Spirits Industry MoneyHub: Comprehensive Guide To New Zealand Wage And Salary Distributions

MoneyHub: Comprehensive Guide To New Zealand Wage And Salary Distributions Blackland PR: New Zealand’s Sinking Feeling - 2024’s Toughest PR Challenges Revealed

Blackland PR: New Zealand’s Sinking Feeling - 2024’s Toughest PR Challenges Revealed Zhenbo Wang, The Conversation: From New Commercial Moon Landers To Asteroid Investigations, Expect A Slate Of Exciting Space Missions In 2025

Zhenbo Wang, The Conversation: From New Commercial Moon Landers To Asteroid Investigations, Expect A Slate Of Exciting Space Missions In 2025 Worldline: Boxing Day Spending Up On Last Year, But Pre-Christmas Spending Is Slightly Down

Worldline: Boxing Day Spending Up On Last Year, But Pre-Christmas Spending Is Slightly Down Skoltech: Scientists Reinvent Physical Laws Governing Formation Of Snowflakes, Raindrops, And Saturn’s Rings

Skoltech: Scientists Reinvent Physical Laws Governing Formation Of Snowflakes, Raindrops, And Saturn’s Rings