Selling price expectation eases to close out the year

Selling price expectation eases to close out the year

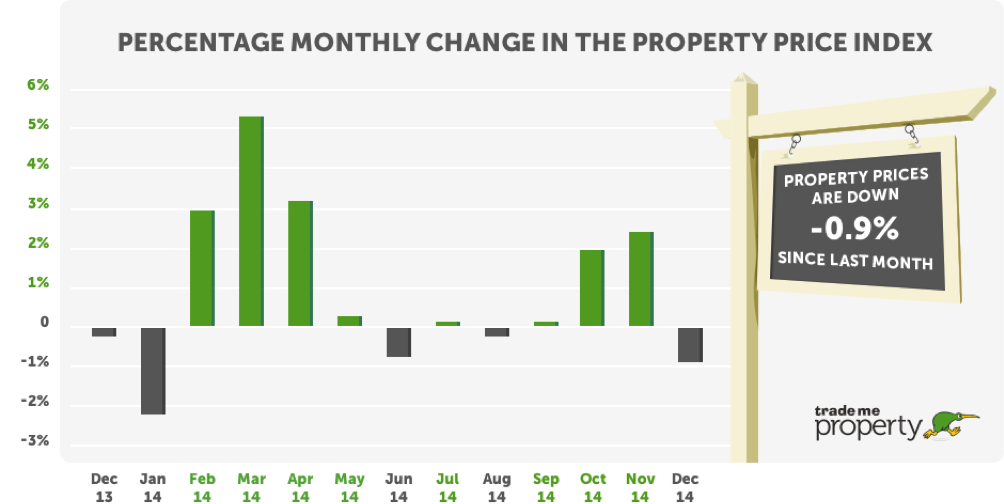

New Zealand property price growth paused in December, falling just under 1 per cent after reaching a record high in November. According to Trade Me Property, the average asking price across all property types for the three months to December was $504,300, above the psychological barrier of $500,000 and up more than $57,000 since December last year.

Head of Trade Me Property Nigel Jeffries said the pause in the recent surge in asking prices was expected. “December is traditionally one of the quietest months of the year so this slowdown is more about there being fewer new listings, rather than an underlying weakness in price expectation by sellers.”

The Property Price Index measures trends in the expectations of selling prices for residential property listings added to Trade Me Property by real estate agents and private sellers over the previous three months. It provides buyers, sellers and realtors with insights into ‘for sale’ price trends by property type and property size.

Mr Jeffries said the easing in the headline level of expected selling price masked strong underlying growth over the medium and long term. “In December we saw average asking prices across New Zealand increase by almost 13 per cent year-on-year, and over the past five years the expected property prices have risen more than 26 per cent.”

Ups and downs in the regions

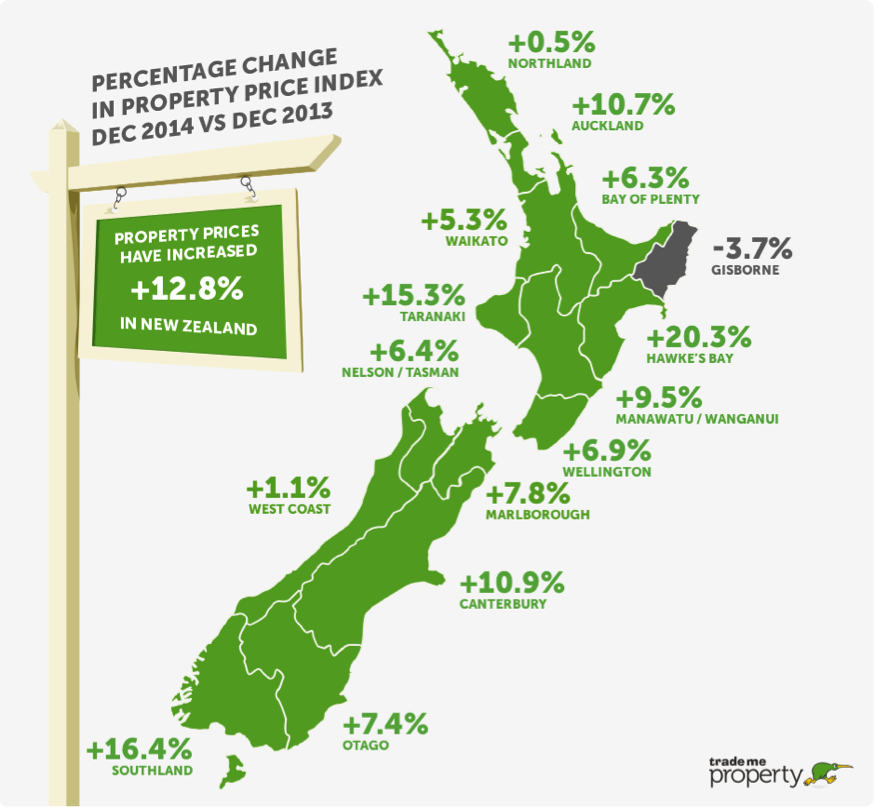

All regions except West Coast, Northland and Gisborne posted year-on-year increases of more than 5 per cent, and Gisborne was the only region that reported a year-on-year fall in price expectation.

The major metro areas of Auckland and Christchurch saw double-digit percentage growth through the year, and many other provincial areas of the country witnessed significant rises including Hawke’s Bay, Taranaki, Southland, Waikato, Bay of Plenty, Otago and Marlborough.

Mr Jeffries said the spread of increases indicated that the polarisation of the property markets to just Auckland and Canterbury may be weakening as “seller optimism” encompassed more of the country.

In Wellington, the 6.9 per cent growth in sales price expectation over the year was rapid compared to more modest 0.9 per cent growth in the 2013 year. In comparison, Auckland was up 11.2 per cent in the year ended December 2013 but closed out 2014 with a 10.7 per cent annual rise. Canterbury was also similar in 2013 and 2014: up 9.2 per cent in 2013 and up 10.9 per cent in 2014.

Price expectation for smaller properties continues to grow

Mr Jeffries said the trend in price expectation for smaller properties comprising 1 or 2 bedrooms continued to grow. “In December 2013 the annual growth in asking price was barely 2 per cent, but this has accelerated through 2014 to end with annual growth of over 16 per cent. There is growing interest from investors, as well as first time buyers.”

In the Auckland market, the selling price expectation of small homes hit a new high in eight of the past 12 months, rising from $465,750 in January 2014 to $531,850 in December 2014.

The trend for medium and large homes has cooled by comparison: homes with 5 or more bedrooms have fallen from an annual rate of 11 per cent in 2013 to 7.6 per cent this year.

Table 1 Houses: Expected sales price

by house size & region (Dec 2014 vs Dec

2013)New

Zealand Auckland Wellington Christchurch Large

houses

5+ bedrooms$863,300

+

7.6%$1,033,600

+ 4.8%$711,800

+

3.0% $652,050

- 13.3%Medium

houses

3-4 bedrooms$509,250

+

11.9%$703,350

+ 8.0%$446,400

+

6.9%$473,050

+ 4.7%Small

houses

1-2 bedrooms$332,900

+

16.3% $531,850

+ 15.7%$327,300

+

10.3% $339,700

+ 7.9%All

property types $504,300

+

12.8%$691,350

+ 10.7%$446,050

+

7.0%$449,350

+

6.6%

Apartment market continues to record new highs

Mr Jeffries said the apartment market continued to grow with new record highs in selling price expectation. “Across the country, average asking prices for apartments in December rose to $431,900, up from $375,900 in December 2013. In Auckland, things were very hot - this rise in price represented a 22 per cent increase taking it to new high of $436,900. This clearly reflects a continuing strong demand for apartments in our largest city.”

Across the other types of property, the appeal of units continues to show strength especially in the Christchurch market with an expected sale price which topped $300,000 for only the second time as this market segment continues to reflect strong demand matched to a continuing shortage of supply.

Table 2

Apartments/townhouses/units: Expected sales price by type

& region (Dec 2014 vs Dec 2013)New

Zealand Auckland Wellington Christchurch Apartments $431,900

+

14.9%$436,900

+ 22.3%$403,000

+

1.1%$466,400

+

13.6%Townhouses $472,000

+

7.7%$645,350

+ 6.2%$387,400

+

3.6%$420,500

+

4.8%Units $345,450

+

14.0%$450,850

+

8.8% $252,800

+

0.3% $301,300

+ 16.8%All

property types $504,300

+

12.8%$691,350

+ 10.7%$446,050

+

7.0%$449,350

+

6.6%

-ends-

Bill Bennett: Download Weekly - Review Of 2024

Bill Bennett: Download Weekly - Review Of 2024 Bill Bennett: One NZ scores worldwide first as Starlink direct-to-mobile launches

Bill Bennett: One NZ scores worldwide first as Starlink direct-to-mobile launches Hugh Grant: How To Reduce Network Bottlenecks

Hugh Grant: How To Reduce Network Bottlenecks Dominion Road Business Association: Auckland Transport's 'Bus To The Mall' Campaign: A Misuse Of Public Funds And A Blow To Local Businesses

Dominion Road Business Association: Auckland Transport's 'Bus To The Mall' Campaign: A Misuse Of Public Funds And A Blow To Local Businesses Parrot Analytics: A Very Parrot Analytics Christmas, 2024 Edition

Parrot Analytics: A Very Parrot Analytics Christmas, 2024 Edition Financial Markets Authority: Individual Pleads Guilty To Insider Trading Charges

Financial Markets Authority: Individual Pleads Guilty To Insider Trading Charges