SMEs Put Recession Well Behind Them

Embargoed: 5 November 2014,

3pm

SMEs Put Recession Well Behind

Them

Five-year report highlights

remarkable turnaround

New Zealand’s SMEs are now showing the highest growth in more than half a decade, capping a remarkable turnaround in the last five years, according to a new report.

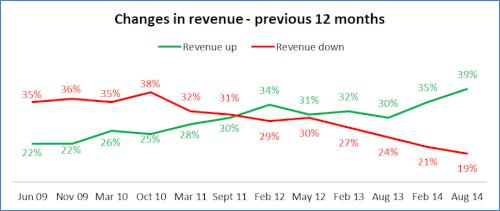

The Five Year MYOB Business Monitor Report, which canvases the biannual national survey of over 1000 small and medium sized business operators over the five years from July 2009, illustrates how far businesses have come since the Global Financial Crisis. In the latest Business Monitor survey, released in September, almost twice as many businesses report revenue growth as losses – more than reversing the trend seen in mid 2009.

MYOB CEO Tim Reed says local SME operators have drawn a line under the post-recession period, especially in the last two years.

“New Zealand’s SME sector has been on a steady climb back to growth since 2009,” says Mr Reed. “Thanks to the hard work of businesses across the country, that growth is now stable and widespread – with few businesses now experiencing losses or expecting them in the coming year.”

Stark contrast to Australia

Mr Reed says despite the country performing well in the post GFC period, Australia’s small business sector has not enjoyed the same level of performance as New Zealand companies have seen.

“New Zealand’s SMEs have really shown how it’s done, in terms of building growth and making the most of their resources in often challenging circumstances,” Mr Reed said.

“In contrast, growth in the SME sector in Australia has remained relatively static, with the number of businesses reporting growth peaking at just over a quarter in 2010/2011, before falling to its current level of just 21%.”

The proportion of small businesses in Australia reporting falling revenue reached 41% in May 2012, before reducing to 31% in the latest Business Monitor, the lowest level in 5 years.

Pressures reduced – except for

interest rates

Other than the rising cost of fuel, which has remained constant over the five years of the report, key pressures for SMEs have been generally declining since June 2009. The number of businesses reporting cashflow pressures has fallen from 24% in 2009 to 19% in 2014, profitability pressure has reduced from 21% to 17% and pressure from competition is down from 19% to 17%.

The notable exception has been interest rates, which have been seen as an increasing risk to business as rate rises begin to bite. In June 2009, just 14% of businesses saw interest rates as a pressure, while 21% factor them as such in the latest 2014 Business Monitor.

Employment, pay investment remains steady

Much of the recovery in the SME sector has come without significant growth in either wages or employment, as investment intentions in both areas have remained static over the last five years.

“In fact, slightly fewer businesses are intending to hire more full time or part time employees in the next year than were in 2009,” says Tim Reed.

“The number of businesses overall that are employing has steadily decreased over the last five years. However, with low unemployment and stable growth, it is likely that we will see an increase in both wage rates and new hiring intentions for the SME sector in the near future.”

Government finally in

positive territory

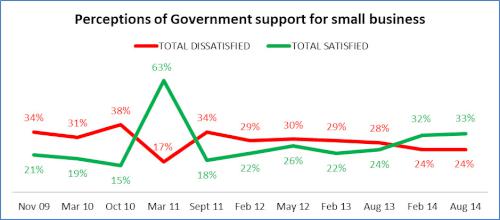

The five-year survey also examined the levels of satisfaction SME operators have with the support of the Government. Other than the period immediately after the Canterbury earthquakes, when support for the Government spiked, 2014 is the first year satisfaction with National’s performance has outweighed dissatisfaction.

Technology playing a major role

The last five years have seen an unprecedented change in the use of technology by SMEs, according to the report.

In particular, the proportion of businesses with an online presence – either a website, social media site, or both – has grown from 27% in 2010 to 43% in 2014. The growth of social media for business has been particularly marked, with 25% of local businesses now operating a social media site and 42% using the platform for business. Over half of all local businesses (52%) now accept online payments and 39% use tablets in the workplace.

“It’s hard not to see a connection between the adoption of internet services and products and at least some of the growth New Zealand businesses have enjoyed over the last five years,” says Tim Reed. “We know from the survey that businesses with an online presence not only enjoy better customer relationships and convert more inquiries, they are typically up to 30% more likely to earn more.”

“New Zealanders love technology, and it is great to see over the last five years, more and more business owners have begun exploring the opportunities that a whole raft of technology tools can bring to their business.”

Overall, says Mr Reed, New Zealand’s SME community can be justifiably proud of everything they have achieved in the last five years.

“I don’t think anybody would characterise the post GFC period as an easy time. And even with the significant economic benefits of the Christchurch rebuild, the Auckland housing boom and record commodity prices, a lot of the macro economic factors won’t have had an immediate or direct effect on many SMEs,” says Tim Reed.

“What I believe we are looking at here is the result of many years of hard work, prudent management and intense commitment on the part of local small business owners to create a major turn around in their part of the local economy.”

For MYOB product information, research results, business tips, discussions, client service and more visit the MYOB website, or its blog, LinkedIn, Twitter, Facebook, Instagram and YouTube sites.

-ends-

About

MYOB

Established in 1991, MYOB is New

Zealand’s leading accounting software provider. It makes

life easier for approx. 1.2 million businesses across New

Zealand and Australia, by simplifying accounting, payroll,

tax, practice management, CRM, websites, job costing,

inventory, mobile payments and more. MYOB also provides

ongoing support via many client service channels including a

network of over 40,000 accountants, bookkeepers and other

consultants. It is committed to ongoing innovation,

particularly in cloud computing solutions, and now spends

NZ$35+ million annually on research and development. For

more information, visit myob.co.nz.

About the MYOB

Business Monitor

The MYOB Business Monitor is a

national survey of 1,000+ New Zealand small and medium

business owners and managers, from sole traders to mid-sized

companies, representing the major industry sectors. It has

run since 2009, commissioned to independent market research

firm Colmar Brunton. This most recent survey ran in

July/August 2014. The Monitor researches business

performance and attitudes in areas such as profitability,

cash flow, pipeline, technology usage and the government.

The weighting of respondents by both geographical location

and sector is based on overall market proportions as

established by Statistics New Zealand and is drawn from an

independent survey group, which includes both MYOB clients

and

non-clients.

Financial Markets Authority: FMA Seeks Clarity From High Court On Use Of Eligible Investor Certificates In Wholesale Investment Sector

Financial Markets Authority: FMA Seeks Clarity From High Court On Use Of Eligible Investor Certificates In Wholesale Investment Sector Scion: Scion’s Novel Internship Model Connects Talent With Industry

Scion: Scion’s Novel Internship Model Connects Talent With Industry Financial Markets Authority: Westpac Admits To Misleading Representations That Resulted In $6.35m In Overcharges

Financial Markets Authority: Westpac Admits To Misleading Representations That Resulted In $6.35m In Overcharges Bill Bennett: Download Weekly - Review Of 2024

Bill Bennett: Download Weekly - Review Of 2024 Bill Bennett: One NZ scores worldwide first as Starlink direct-to-mobile launches

Bill Bennett: One NZ scores worldwide first as Starlink direct-to-mobile launches Hugh Grant: How To Reduce Network Bottlenecks

Hugh Grant: How To Reduce Network Bottlenecks