Modest property price rise in September

Media Release

2 October

2014

Modest property price rise in September

New Zealand property prices

remained subdued for the fifth consecutive month in

September, according to the inaugural Trade Me Property

Price Index out today. The average asking price for

properties for sale rose just 0.1 per cent

month-on-month.

The new Index measures trends in asking prices for residential property listings added to Trade Me Property by real estate agents and private sellers over the previous three months. It provides buyers, sellers and realtors with an insight into ‘for sale’ price trends by both type of property (e.g. apartments, townhouses, houses) and by house size.

Head of Trade Me Property Nigel Jeffries said the September figure was “a far cry” from the strong rises experienced earlier in 2014. “For example, we saw the change in asking price up more than 5 per cent in March, and there were 3 per cent month-on-month lifts in both February and April. It’s a sign that the market is in a sustained period of quiet time.”

According to Trade Me Property’s data, the average asking price across all property types was $487,650 in September 2014, a year-on-year increase of 13.3 per cent. Mr Jeffries said average asking prices peaked in March 2014 at $491,050.

Mr Jeffries said that looking at the long-term data provided further evidence of the market cooling. “We looked back to September 2009 and compared this with September 2014 and we’ve seen asking prices rise by 26 per cent over that period. A good chunk of that rise has been over the past two years, but in recent months we’ve seen that pace of increase all but stutter to a halt.”

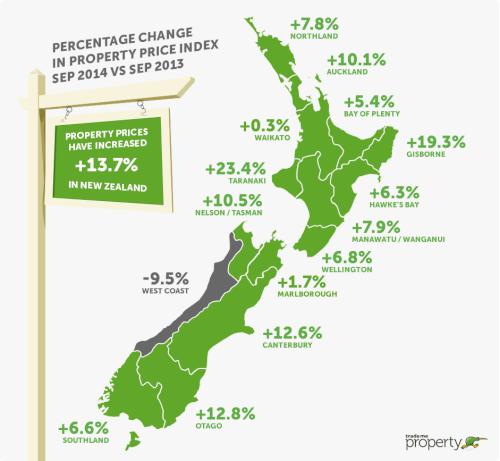

Ups and downs in the regions

Six regions saw a double-digit increase in average asking prices over the past year. “Taranaki led the pack with a 23 per cent increase, followed by Gisborne which was up 19 per cent,” Mr Jeffries said. “However it’s important to remember that both of these regions are relatively small and tend to bounce around a bit.”

The much-reported pressure of demand from buyers in Auckland and Canterbury continues to drive growth in the average asking prices in these two major metropolitan areas, up 10.1 per cent and 12.6 per cent respectively. Otago saw a 12.8 per cent increase in average asking prices year-on-year, and Nelson/Tasman was up 10.5 per cent.

At the other end of the spectrum, West Coast was the weakest (down 9.5 per cent year-on-year), followed by Waikato (up 0.2 per cent) and Marlborough (1.7 per cent).

Smaller houses are experiencing the largest increase in price

Mr Jeffries said the Index’s plateau over the past few months was underpinned by a relative slowdown in asking prices for larger houses.

“We’ve seen average asking prices for small and medium-sized houses increase by more than 15 per cent across the country compared to a year ago, while homes with five or more bedrooms were only up 9 per cent.

“The trend is most noticeable in Wellington where larger houses showed a year-on-year decline of 5 per cent, despite the overall market in the capital ticking up nearly 7 per cent.”

Table 1: Asking prices for houses & YoY

changes (Sept 2014 vs Sept 2013)

| National | Auckland | Wellington | Christchurch | |

| All property types | $487,600 | $647,800 | $426,150 | $434,500 |

| (up 13.7%) | (up 10.1%) | (up 6.8%) | (up 12.0%) | |

| Large houses | $845,500 | $992,000 | $660,550 | $746,400 |

| (5+ bedrooms) | (up 8.7%) | (up 8.2%) | (down 5.2%) | (up 12.5%) |

| Medium houses | $495,300 | $668,550 | $440,700 | $469,950 |

| (3-4 bedrooms) | (up 13.5%) | (up 8.3%) | (up 4.4%) | (up 11.9%) |

| Small houses | $318,400 | $494,850 | $314,400 | $301,350 |

| (1-2 bedrooms) | (up 15.1%) | (up 11.7%) | (up 10.6%) | (up 8.0%) |

Compact living options

driving city price growth

Mr Jeffries said asking price growth in Auckland was being pushed along by non-traditional forms of housing. “Both townhouses and units have seen asking price growth outstrip traditional residential houses, reflecting the strong demand for affordable higher-density living options in the Super City.”

The apartment market, dominated by Auckland, saw a slower paced increase in asking prices. “Wellington saw explosive growth in the asking prices for apartments, up 26 per cent. The catalyst for this is the recent surge of higher priced central city apartments coming onto the market.”

Table 2: Asking prices for

apartments/townhouses/units & YoY changes (Sept 2014 vs Sept

2013)

| National | Auckland | Wellington | Christchurch | |

| All property types | $487,600 | $647,800 | $426,150 | $434,500 |

| (up 13.7%) | (up 10.1%) | (up 6.8%) | (up 12.0%) | |

| Apartments | $397,950 | $389,400 | $467,200 | $339,000 |

| (up 8.9%) | (up 9.1%) | (up 26.6%) | (up 0.2%) | |

| Townhouses | $475,800 | $645,150 | $379,100 | $392,350 |

| (up 11.0%) | (up 13.6%) | (up 3.5%) | (up 6.0%) | |

| Units | $342,000 | $439,650 | $250,600 | $285,550 |

| (up 13.5%) | (up 13.8%) | (down 0.5%) | (up 8.8%) |

-ends-

About

the Trade Me Property Price Index:

o The Index

is a new piece of analysis launched today, focused on

expected sale price. Listings are from private advertisers

and real estate agents.

o The Index is produced from data

on properties listed on Trade Me Property in the three

months leading up to the last day of each period. Each

period’s value is a truncated mean of three months’

worth of listings. This is to better reflect trends in

property prices rather than month-to-month fluctuations in

housing stock.

o The Index uses an “80% truncated

mean” of the expected sale price. This excludes the upper

and lower 10% of listings by price, and averages the

expected sale prices of the remaining properties.

o It

is the first report to provide an insight into ‘for

sale’ price trends by type and size of property. Other

reports tend to aggregate the property price data across

these various properties.

Office of the Privacy Commissioner: New Research Shows Business Leaders Fear Being On The Hook For Others’ Privacy Breaches

Office of the Privacy Commissioner: New Research Shows Business Leaders Fear Being On The Hook For Others’ Privacy Breaches E Tū: E Tū Members Send Open Letter To James Grenon And NZME Board

E Tū: E Tū Members Send Open Letter To James Grenon And NZME Board Commerce Commission: Commission Calls For Comments On Copper Access Deregulation

Commerce Commission: Commission Calls For Comments On Copper Access Deregulation New Zealand Association of Scientists: NZAS Supports Saving Biotechnology Capacity In Callaghan; Asks What Now For Applied Technology Group

New Zealand Association of Scientists: NZAS Supports Saving Biotechnology Capacity In Callaghan; Asks What Now For Applied Technology Group Stats NZ: Business Employment Data - December 2024 Quarter

Stats NZ: Business Employment Data - December 2024 Quarter Transpower: System Operator Launches Review Of Electricity Risk Forecasting Framework

Transpower: System Operator Launches Review Of Electricity Risk Forecasting Framework