Media release

ASB Cantometer Index

EMBARGOED until 5am Friday 26 September

Businesses displaying more confidence as Cantometer hits new high

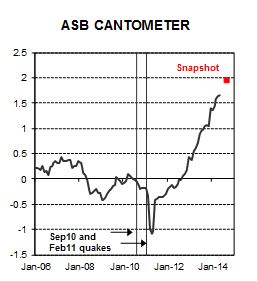

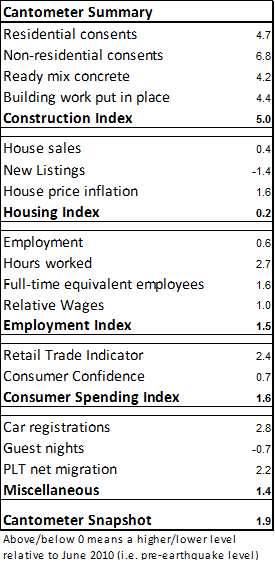

• The ASB Cantometer rose to fresh high of 1.9 in September.

• Businesses demonstrating confidence in major construction projects.

• Tourism recovery slow but steady.

The Cantometer index rose to a fresh high of 1.9 in September, compared to the previous high of 1.8 in August.

“Construction activity continues to stand out with continued gains across both residential and non-residential construction,” says ASB Chief Economist Nick Tuffley. “An increase in major construction projects is a good sign as businesses begin to feel more confident about committing to large-scale projects.”

“Positive construction activity is flowing through to firm demand in other areas as employment opportunities continue to pull new workers to the region. Households are feeling more confident about making major purchases, and this is reflected in increased car sales.”

“Tourism in the region is recovering, albeit at a slower rate than other areas of the economy. However, the addition of international capacity flying into Christchurch Airport should boost visitor numbers to the region over the coming year.”

Outlook

Construction growth should continue to remain a key driver of Canterbury economic activity over the next couple of years, says Mr Tuffley.

“The earthquake rebuild will likely continue to underpin further strengthening in the Canterbury labour market as more workers flock to the region. The consequent lift in incomes should continue to underpin healthy discretionary household spending, particularly in big-ticket items.”

About the Cantometer

The Cantometer is designed to summarise activity in Canterbury. The study takes a range of publicly available regional economic data, which are standardised and aggregated into a summary measure. The index has been rebased to zero in June 2010 (the end of the quarter immediately preceding the first earthquake) such that a positive number represents activity being above pre-earthquake levels.

Along with the aggregate Cantometer index, there are five sub categories: Construction, Housing, Employment, Consumer spending and Miscellaneous*. These sub-indices will provide some insight into which sectors are driving the rebuild activity at a given point in time.

For most activity the data reference the level of activity. However, when incorporating wages and house prices into the index we believe levels are less informative. Instead the index uses prices relative to the rest of the country. An increase in relative prices is a signal for resources to be reallocated to the Canterbury region.

The historical Cantometer series represented on the charts is a simple average of the complete set of data for each month.

*The miscellaneous category includes car registrations, guest nights and permanent and long-term net migration. A common factor driving these areas will be population growth, and we expect all these indicators to increase as the rebuild gathers momentum.

If you would like to receive ASB updates and reports by email: https://reports.asb.co.nz/register/index.html

Vegetables New Zealand: Asparagus Season In Full Flight: Get It While You Still Can

Vegetables New Zealand: Asparagus Season In Full Flight: Get It While You Still Can  Bill Bennett: Download Weekly - How would NZ telecoms cope with another cyclone

Bill Bennett: Download Weekly - How would NZ telecoms cope with another cyclone NZ On Air: Firm Audience Favourites Lead NZ On Air Non-Fiction Funding

NZ On Air: Firm Audience Favourites Lead NZ On Air Non-Fiction Funding Insurance and Financial Services Ombudsman: Woman Gets $40k More After Disputing Insurer’s Decision

Insurance and Financial Services Ombudsman: Woman Gets $40k More After Disputing Insurer’s Decision BNZ: A Quarter Of Older NZers Fear Going Online Due To Scam Concerns

BNZ: A Quarter Of Older NZers Fear Going Online Due To Scam Concerns University of Auckland: Scientists Develop Tool To Monitor Coastal Erosion In Fine Detail

University of Auckland: Scientists Develop Tool To Monitor Coastal Erosion In Fine Detail