Support for capital gains tax misguided

Support for capital gains tax misguided

Nearly half of the respondents to

TV One’s Vote Compass survey supported a Capital Gains Tax

(CGT). This is hardly surprising given the information

presented to them.

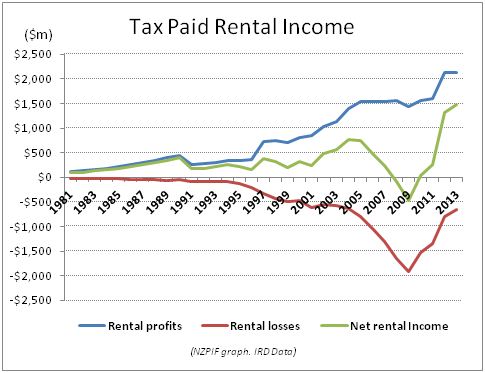

“Most people believe that rental property owners don't pay any tax and they are the prime reason for property price increases. But this isn't true” said Andrew King, Executive Officer of the NZ Property Investors’ Federation. “This graph, using Inland Revenue data, shows that rental property owners do pay tax on their rental earnings."

In addition, most people would believe that a CGT would lower house prices, provide opportunities for other taxes to be reduced and would only apply to speculators. However overseas experience of CGT is that it has no effect on house price growth and provides minimal tax revenue. The CGT would not apply to speculators as their capital gains are already taxed. Inland Revenue has a highly successful property unit tasked with making sure property speculators pay their fair due.

What people are unlikely to know, is that a CGT, as proposed by Labour, would affect all investments except the family home. This means farms, businesses, shares etc would all have to pay this tax.

The consequences of a CGT are also unlikely to be known by many. The fact is that lack of a CGT lowers the cost of renting. Currently it is $135pw cheaper to rent than own the average New Zealand home. This means there is room for rental prices to rise as the only options to renting are owning your home or moving in with others to keep costs down. In other words, a CGT would mean rising rental prices for most and overcrowding for some.

As a CGT will affect businesses and farms, the cost

is likely to be passed onto consumers through higher prices

and hinder our overseas competitiveness.

In summary, a

CGT won't reduce property prices and will raise little

revenue. It will increase rental and other prices making it

harder for first home buyers to save a deposit.

If a CGT was the easy solution for everything it would have been implemented years ago. The biggest risk is that when it doesn't produce the expected revenue, then it will be applied to the family home.

If respondents to the Vote Compass survey were actually aware of the consequences, it is unlikely that nearly half of them would want to see it introduced.

ENDS

Canterbury Museum: Mystery Molars Lead To Discovery Of Giant Crayfish In Ancient Aotearoa New Zealand

Canterbury Museum: Mystery Molars Lead To Discovery Of Giant Crayfish In Ancient Aotearoa New Zealand Ngā Pae o te Māramatanga: Māori Concerns About Misuse Of Facial Recognition Technology Highlighted In Science

Ngā Pae o te Māramatanga: Māori Concerns About Misuse Of Facial Recognition Technology Highlighted In Science Retail NZ: Retailers Call For Flexibility On Easter Trading Hours

Retail NZ: Retailers Call For Flexibility On Easter Trading Hours WorkSafe NZ: Worker’s Six-Metre Fall Prompts Industry Call-Out

WorkSafe NZ: Worker’s Six-Metre Fall Prompts Industry Call-Out PSGR: Has MBIE Short-Circuited Good Process In Recent Government Reforms?

PSGR: Has MBIE Short-Circuited Good Process In Recent Government Reforms? The Reserve Bank of New Zealand: RBNZ’s Five Year Funding Agreement Published

The Reserve Bank of New Zealand: RBNZ’s Five Year Funding Agreement Published