Current Market Reflects Traditional Winter Slowdown

18 August 2014

Current Market Reflects Traditional Winter Slowdown

Summary

Data

released today by the Real Estate Institute of NZ

(“REINZ”) shows there were 74 more farm sales (+16.9%)

for the three months ended July 2014 than for the three

months ended July 2013. Overall, there were 512 farm sales

in the three months to end of July 2014, compared to 544

farm sales for the three months ended June 2014 (-5.9%).

1,923 farms were sold in the year to July 2014, 25.2% more

than were sold in the year to July 2013.

The median price per hectare for all farms sold in the three months to July 2014 was $26,680 compared to $20,667 recorded for three months ended July 2013 (+29.1%). The median price per hectare rose 2.6% compared to June.

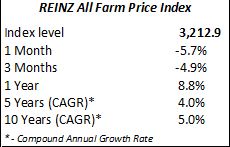

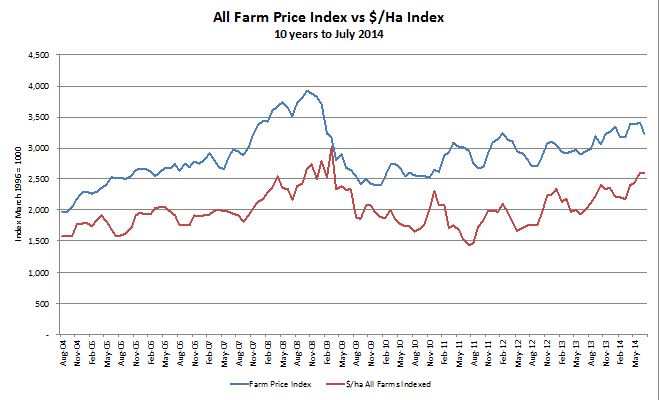

The REINZ All Farm Price Index fell 5.7% in the three months to July compared to the three months to June, moving from 3,405.7 to 3,212.9. Compared to July 2013 the REINZ All Farm Price Index rose by 8.8%. The REINZ All Farm Price Index adjusts for differences in farm size, location and farming type compared to the median price per hectare, which does not adjust for these factors.

10 regions recorded increases in sales volume for the three months ended July 2014 compared to the three months ended July 2013. Canterbury recorded the largest increase in sales (+18 sales), followed by Nelson (+16 sales) and Northland, Auckland and Bay of Plenty all with an increase of 11 sales each. Compared to the three months ended June 2014, four regions recorded an increase in sales.

“While annual statistics confirm a solid increase in volumes and prices over the past 12 months, three monthly figures to the end of July indicate an easing in both volumes and prices”, says REINZ Rural Spokesman Brian Peacocke, “Apart from a small burst of activity in Westland, and as expected at this time of year when peak workloads dominate all other activity, dairy farm sales have virtually come to a standstill.”

“By contrast, sales of finishing and grazing properties have maintained some momentum, with reasonable enquiry for beef farms in the north, for dairy support properties through the centre of the country, and for sheep, beef properties and diary support farms in the lower south. Sales in the horticultural sector have been steady during the three months to July.”

Grazing properties accounted for the largest number of sales with 43.9% share of all sales over the three months to July, Finishing properties accounted for 20.5%, Dairy properties accounted for 9.2% and Horticulture properties accounted for 10.9% of all sales. These four property types accounted for 84.6% of all sales during the three months ended July 2014.

Dairy

Farms

For the three months ended July 2014

the median sales price per hectare for dairy farms was

$36,673 (47 properties), compared to $33,543, for the three

months ended June (69 properties), and $34,882 (47

properties) for the three months ended July 2013. The median

dairy farm size for the three months ended July 2014 was 111

hectares.

Included in sales for the month of July were six dairy farms at a median sale value of $27,491 per hectare. The median farm size was 89 hectares with a range of 41 hectares in the Waikato region to 636 hectares in Westland. The median production per hectare across all dairy farms sold in July 2014 was 650 kgs of milk solids.

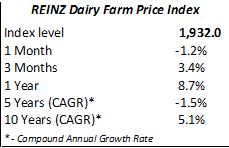

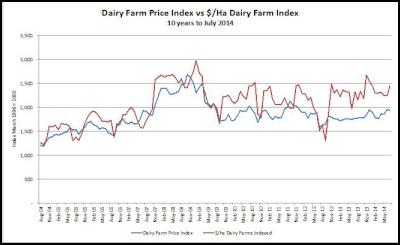

The REINZ Dairy Farm Price Index fell by 1.2% in the three months to July compared to the three months to June, from 1,956.4 to 1,932.0. Compared to July 2013, the REINZ Dairy Farm Price Index rose by 8.7%. The REINZ Dairy Farm Price Index adjusts for differences in farm size and location compared to the median price per hectare, which does not adjust for these factors.

Finishing Farms

For

the three months ended July 2014 the median sale price per

hectare for finishing farms was $27,907 (105 properties),

compared to $26,694 for the three months ended June (115

properties), and $22,500 (109 properties) for the three

months ended July 2013. The median finishing farm size for

the three months ended July 2014 was 44

hectares.

Grazing Farms

For the

three months ended July 2014 the median sales price per

hectare for grazing farms was $15,500 (225 properties)

compared to $15,833 for the three months ended June (236

properties), and $15,367 (193 properties) for the three

months ended July 2013. The median grazing farm size for the

three months ended July 2014 was 65

hectares.

Horticulture

Farms

For the three months ended July 2014

the median sales price per hectare for horticulture farms

was $134,640 (56 properties) compared to $193,745 (57

properties) for the three months ended June, and $100,667

(39 properties) for the three months ended July 2013. The

median horticulture farm size for the three months ended

July 2014 was eight hectares.

Lifestyle

Properties

The lifestyle property market saw

a 13.5% fall (-242 sales) in sales volume in the three

months to July 2014 compared to July 2013. 1,548 sales were

recorded in the three months to July 2014 compared to 1,790

sales in the three months to July 2013. 24 fewer sales were

recorded compared to the three months to June 2014 (-1.5%).

For the 12 months to July 2014 there were 6,400

unconditional sales of lifestyle properties, an increase of

0.5% (+32 sales) over the 12 months to July 2013.

Just one region recorded an increase in sales compared to July 2013 while 12 recorded decreases in sales. Compared to June, six regions recorded an increase in sales with seven regions recording decreases.

The national median price for lifestyle blocks rose by $36,000 (+7.5%) from $488,500 for the three months to July 2013 to $525,000 for the three months to July 2014. The median price for lifestyle blocks in Auckland rose by $67,500 (+8.1%) from $830,000 for the three months to July 2013 to $897,500 for the three months to July 2014. Over the same time period for the three months ending July, the median price rose by 2.4% in Waikato to $486,500, and fell by 12.3% in Canterbury to $527,500. Compared to June 2014, the National median sales price rose by $10,000 (+1.9%) to $525,000.

The number of days to sell for lifestyle properties eased by six days, from 74 days for the three months to the end of June to 80 days for the three months to the end of July. Compared to the three months ended July 2013 the number of days to sell eased by eight days from 72 days to 80 days. Gisborne recorded the shortest number of days to sell in July at 44 days, followed by Canterbury at 57 days and Auckland at 58 days. West Coast recorded the longest number of days to sell at 224 days, followed by Nelson at 150 days and Hawkes Bay at 111 days.

Commenting on the lifestyle property market Brian Peacocke said, “Reports from around the country indicate a mixed bag in the lifestyle sector, depending on the severity of winter being experienced. Overall, sales volumes and prices have been reasonably consistent, with a slight increased in prices and a modest decline in volumes.”

Points to note:

• Northland, Auckland,

Waikato, Taranaki, Manawatu/Wanganui and Wellington have all

experienced slightly increased volumes.

• Canterbury

has also seen a slight lift in volumes, although the latest

feedback from the mid to lower South Island indicates a

tightening in the market.

• Parts of the better

performing northern regions report increased caution amongst

buyers with an increased focus on due diligence

investigations underpinned by a clear focus on schooling

options.

REINZ All Farm Price Index –

Additional Data

The table below sets out the

returns for the REINZ All Farm Price Index for the three

months ending July 2014.

The graph below shows the trends in the REINZ All Farm Price Index compared to an index of movements in the $/hectare measure of farm prices.

REINZ Dairy Farm Price Index

– Additional Data

The table below sets out

the returns for the REINZ Dairy Farm Price Index for the

three months ending July 2014.

The graph below shows the trends in the REINZ Dairy Farm Price Index compared to an index of movements in the $/hectare measure of farm prices.

Click for big version.

Click here for the REINZ rural market report.

Real

Estate Institute of New Zealand

For more real

estate information and market trends data, visit

www.reinz.co.nz. For New Zealand's most comprehensive range

of listings for residential, lifestyle, rural, commercial,

investment and rental properties, visit www.realestate.co.nz - REINZ's official

property directory website.

The information provided by REINZ in relation to the rural real estate market covers the most recently completed three month period; thus references to February refer to the period from 1 May 2014 to 31 July 2014.

The REINZ Farm Price Indices have been developed in conjunction with the Reserve Bank of New Zealand. It adjusts sale prices for property specific factors such as location, size and farm type which can affect the median $/hectare calculations and provides a more accurate measure of farm price movements. The REINZ Farm Price Indices has been calculated with a base of 1,000 for the three months ended March 1996. The REINZ Farm Price Indices is best utilised in assessing percentage changes over various time periods rather than trying to apply changes in the REINZ Farm Price Index to specific property transactions.

ENDS

NZ Trucking Association: TruckSafe New Zealand Launches | A Game-Changer For Heavy Vehicle Safety And Compliance

NZ Trucking Association: TruckSafe New Zealand Launches | A Game-Changer For Heavy Vehicle Safety And Compliance Gaurav Mittal, IMI: How Can We Balance AI’s Potential And Ethical Challenges?

Gaurav Mittal, IMI: How Can We Balance AI’s Potential And Ethical Challenges? Science Media Centre: Several US-based Environmental Science Databases To Be Taken Down – Expert Reaction

Science Media Centre: Several US-based Environmental Science Databases To Be Taken Down – Expert Reaction Consumer NZ: Despite Low Confidence In Government Efforts, People Want Urgent Action To Lower Grocery Bills

Consumer NZ: Despite Low Confidence In Government Efforts, People Want Urgent Action To Lower Grocery Bills NZ Banking Association: Banks Step Up Customer Scam Protections And Compensation

NZ Banking Association: Banks Step Up Customer Scam Protections And Compensation The Reserve Bank of New Zealand: CoFR Seeking Feedback On Access To Basic Transaction Accounts

The Reserve Bank of New Zealand: CoFR Seeking Feedback On Access To Basic Transaction Accounts