Fees and rates: savvy shoppers can get bang for their buck

media release

Fees and rates: savvy shoppers can get

bang for their buck

CANSTAR releases its 2014 deposit accounts star ratings report today, researching and rating 59 products from 12 institutions across six transaction profiles to determine which deposit accounts offer outstanding value for consumers

Significant difference in interest rates on offer

With the official cash rate rising three times already this year - and deposit account interest rates not keeping pace, on average, with those changes – CANSTAR analysis finds that it is more important than ever for savers to shop around for a good rate on their cash.

“Looking at online saver accounts as an example, our analysis has found that the average increase in interest rate being paid has been just 0.23% this year,” said CANSTAR General Manager – New Zealand, Derek Bonnar. “That’s against a rise in the official cash rate of 0.75%. While on the face of it that news is discouraging to savers, it’s important to note that there is a significant variation in the rates on offer. Of the online saver accounts researched by CANSTAR, the top-quartile rates average 4.15%, compared to the bottom quartile at 2.33%. So when it comes to at-call accounts, savers absolutely must shop around.”

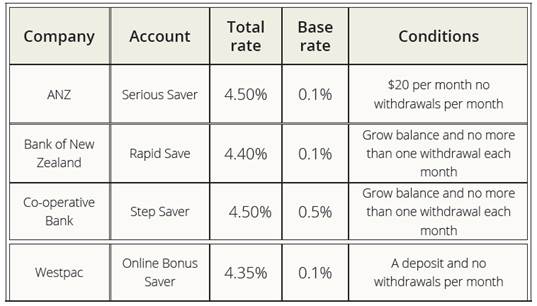

Then there are the bonus rates on offer, with CANSTAR advising that a selection of well-rated bonus offers currently available include:

Significant difference in fees as well

When it comes to transaction accounts, CANSTAR has found that setting aside time to research their transaction account options could potentially save shoppers some handy cash each year.

“There are a wide range of transaction accounts available in the market and there will be an account to suit the needs of all types of shoppers,” said Mr Bonnar. “Unfortunately though it’s easy to have a set-and-forget mentality when it comes to bank accounts. We don’t tend to change our bank account structure as often as we change our spending habits. This can lead to us paying out a lot of money in fees that we could otherwise avoid.”

When it comes to transaction accounts, CANSTAR have calculated the minimum, maximum and average fees that consumers could attract, based on the products researched, as follows:

Low Transactors (around 10 transactions per month) could pay –

• A minimum of $0 per month

• A maximum of $27 per month

• An average of $7 per month

High Transactors (around 40 transaction per month) could pay –

• A minimum of $1 per month

• A maximum of $126 per month

• An average of $20 per month

Electronic Transactors (around 25 transactionms per month, mainly online) could pay –

• A minimum of $0 per month

• A maximum of $84 per month

• An average of $13 per month

Mr Bonnar encourages consumers not to be put off by the hassle of changing financial institutions. “Switching institutions isn’t that difficult,” he said. “Generally speaking, you can give your new banking institution a written authority to contact your old bank and get hold of all your details. Your new bank will be able to open your new account, switch over any automatic debits and credits and close your old account for you. There may be a crossover period of a week or two where both accounts are running, but it shouldn’t cause too many headaches.”

Where to start the search for a great-value product? CANSTAR has taken the hard work out of it with their deposit account star ratings report. In total CANSTAR has found:

• 4 accounts that offer outstanding value for Electronic Transactors

• 3 accounts that offer outstanding value for High Transactors

• 3 accounts that offer outstanding value for Low Transactors

• 2 accounts that offer outstanding value for Online Savers

• 3 accounts that offer outstanding value for Full Access Savers

• 4 accounts that offer outstanding value for Regular Savers

Consumers can download the deposit account star ratings report at www.canstar.co.nz

NZAS: New Zealand Association Of Scientists Awards Celebrate The Achievements Of Scientists And Our Science System

NZAS: New Zealand Association Of Scientists Awards Celebrate The Achievements Of Scientists And Our Science System Stats NZ: Retail Spending Flat In The September 2024 Quarter

Stats NZ: Retail Spending Flat In The September 2024 Quarter Antarctica New Zealand: International Team Launch Second Attempt To Drill Deep For Antarctic Climate Clues

Antarctica New Zealand: International Team Launch Second Attempt To Drill Deep For Antarctic Climate Clues Vegetables New Zealand: Asparagus Season In Full Flight: Get It While You Still Can

Vegetables New Zealand: Asparagus Season In Full Flight: Get It While You Still Can  Bill Bennett: Download Weekly - How would NZ telecoms cope with another cyclone

Bill Bennett: Download Weekly - How would NZ telecoms cope with another cyclone NZ On Air: Firm Audience Favourites Lead NZ On Air Non-Fiction Funding

NZ On Air: Firm Audience Favourites Lead NZ On Air Non-Fiction Funding