Property values rise again after a period of flattening off

Media release

Property values rise again after a period of flattening off

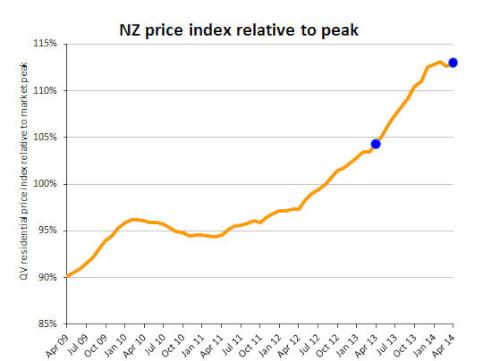

The latest monthly QV Residential Price Movement Index shows that nationwide residential values for April have increased 8.4% over the past year, and 0.2% over the past three months. This means they are now 13% above the previous market peak of late 2007. When adjusted for inflation the nationwide annual increase drops slightly to 6.8% and values remain below the 2007 peak by -2.9%.

The Auckland market has increased 13.9% year on year and values are up 29.2% since 2007. When adjusted for inflation values are up 12.2% over the past year and are 10.9% above the 2007 peak.

Andrea Rush QV National

Spokesperson said, “New Zealand property values took a

downward turn last month and predictions were that this

would level out, but instead the trend show values are

starting to increase again.”

“The nationwide index

for April shows values accelerating at a similar rate to

last year and Auckland values have also risen across all

five main former territorial authority areas after a few

months of slowing earlier this year.”

“First home

buyer numbers picked up in the month of March at a New

Zealand wide level and across all regional markets according

to CoreLogic NZ data.”

“This would lead us to

believe that the LVR changes have resulted in only small

changes to the number of sales made to first home buyers and

could indicate that they are now finding alternative ways to

finance

property.”

Auckland

Property growth in the Super City region continues to rise, up 13.9% year on year and 1.5% in the past three months.

Values in Auckland City Central are showing the

largest increase over the past three months, up 5% since

February, while the North Shore - North Harbour increased 3%

and Rodney North was up 2.9% over the same period.

The average value of properties in Auckland City East

is $1,043,098 and this part of Auckland is up 14.9% year on

year and 30.7% since 2007. Values in Auckland City South

increased 0.9% over the past three months, 13.9% since April

last year and are 37.7% above the previous peak of 2007,

which is a national high.

QV Valuer Bruce Wiggins

said, “Values are still increasing but at a slower rate

than last year and some properties are taking a little

longer to sell.”

“The number of sales is down on late mid to late last year and we have begun to see price reduction stickers appearing in some areas, which have been a rarity up until now.”

“This could show that sellers are needing to re-align their sale price expectations to the true market trends and the fact that market conditions are less competitive than they were prior to October last year when the LVR speed limits were introduced.”

“With the Kiwi dollar higher against other major currencies including the Chinese Yuan overseas buyers, as well as migrants from China and other major migrant groups, have had their purchasing power reduced, which could be contributing to softening prices a bit too.”

Hamilton and Tauranga

Values in Hamilton City are up 0.9 percent in the past three months, 4.7% year on year and 0.6% above the previous peak of 2007. The market that has seen with the greatest increase in values is the North East of the city which is up 1.6% over the past three months, 6.7% over the past year and is 2.3% above the 2007 peak. Hamilton Central and North West is up 5% in the past three months and 5.5% year on year but remains 4.8% below the peak of 2007.

QV Valuer Richard Allen said,

“There continues to be minimal activity at the lower end

of the market since the Loan to Value Ratio limits were

brought in.”

“Although the values increased

slightly for March there has not been lot of activity across

the board with most of it in the middle to upper market.

Suburbs such as Huntington and Rototuna continue to sell

well with suburbs such as Fairfield, Nawton and Melville

being less popular.”

“Rental levels have

increased, which is likely to be caused by less

first-home-buyers purchasing and opting to rent

instead.”

The Tauranga City market has increased

2.1% in the past three months and 4.8% year on year.

However, the market is still 6.7% below the peak of 2007.

The Western Bay of Plenty is up 4.2% year on year and 2.6%

in the past three months but remains 8.4% below the 2007

peak.

Wellington

Values across the Wellington Region as a whole are up 0.6 % over the past three months.

2.8% year on year and are sitting at 0.1% below the 2007 peak.

Wellington West is the market leader with values there up 1.4% since February, 4.6% year on year, and 2.5% above the previous peak of 2007. The average value in the area is $607,444 which is also the highest in the Wellington region.

Values in Lower Hutt

are up 1.8% over the past three months and 3.6% year on year

but remain 3.3% below the 2007 peak while values in Upper

Hutt are down by 2.1% since February, up 0.4% since April

last year and 4.9% below 2007 levels.

QV Valuer,

Kerry Buckeridge said, “Buyers who have been in the market

for property for some time are now knuckling down to make

some decisions so that they have time to lock in a good

interest rate before further rate rises.”

“There is no lack of supply in most of Wellington and the excess of choice often leads to slower decision-making from potential buyers.”

“Sales activity in the Eastern suburbs, previously has been driven in popularity by Peter Jackson and Weta Workshop projects, is currently in a lull with no projects underway however values there are still up 2.1% since April last year.”

“Tenant demand for inner city apartments is high, particularly from people wanting to rent studio and 1-bedroom apartments, with good rentals being obtained and some landlords noting full waiting lists. These apartments are proving capable of generating attractive net returns for investors”

Christchurch

Property values in Christchurch City have decreased 1% over the past three months, but are up 7.9% since April last year and are 19.1% higher than the peak of 2007.

Values in Southwest

Christchurch have increased 0.1% higher over the past three

months 10. 8% since this time last year and 26.4 % since

2007.

The average value in the Christchurch Hills is

the highest in the city at $604,697 but the area is down

3.3% over the past three months, up 1.1% year on year, and

9.3% above the previous peak of 2007.

QV Valuer Daryl

Taggart said “The market is flatter at the moment and

while there is the usual activity there doesn't seem to be

the hype and fierce competition for property seen this time

last year.”

“Some properties are on the market

longer as vendors hold out for the right buyer, which could

suggest there is a bit more choice in the

market.”

“The general feeling is that the market

has steadied although we are still seeing growth, just not

that rapid rise of early 2013. In some areas, I would

suggest that properties have increased very little in the

last year, as there are not the buyers that are prepared to

pay over the

odds.”

Dunedin

Dunedin City values increased 0.3% over the past three months, 1.7% year on year and are 1.3% above the peak of 2007.

Dunedin -Taieri has the highest average value in

the city of $301,459 and values in the area have increased

1% over the past three months, 2.3% year on year, and 2.6%

since the peak of 2007.

QV Valuer Duncan Jack said

“Value levels within Dunedin remain steady and demand

continues to be fairly strong for the majority of properties

currently on the market however listings are low for this

time of year.”

“Buyers are cautious, perhaps with one eye on the rising interest rates and real estate agents are finding they need to work hard to achieve sales.”

“Activity in the lower end of the market continues to be at lower levels than prior to the LVR changes brought in on October 1.”

“Recent rises in the average sale price would appear to be due to the numbers of sales in the mid to upper price range relative to that of the numbers in the lower price range so value levels are not increasing significantly.”

Provincial centres

The majority of values in the provincial centres still remain below the previous peak of 2007 with the exceptions mainly being centres or districts closer to Auckland and Christchurch where the property markets have increased significantly since that time.

In the North Island, New Plymouth

District is one region that has gone against this trend and

values there are up 1.1% in the past three months, 5.7% year

on year and 5.9 % since the previous peak of 2007.

In

the South Island, Nelson City is also above the previous

peak of 2007, however the city has benefitted from migration

from Christchurch since the earthquakes. Values there are up

0.3 % in the past three months, 3.1% year on year and 5.3%

since 2007.

Full Release with more charts &

data

http://img.scoop.co.nz/media/pdfs/1405/QV_release_May_8_2014_V1.pdf

ENDS

Bill Bennett: Download Weekly - Review Of 2024

Bill Bennett: Download Weekly - Review Of 2024 Bill Bennett: One NZ scores worldwide first as Starlink direct-to-mobile launches

Bill Bennett: One NZ scores worldwide first as Starlink direct-to-mobile launches Hugh Grant: How To Reduce Network Bottlenecks

Hugh Grant: How To Reduce Network Bottlenecks Dominion Road Business Association: Auckland Transport's 'Bus To The Mall' Campaign: A Misuse Of Public Funds And A Blow To Local Businesses

Dominion Road Business Association: Auckland Transport's 'Bus To The Mall' Campaign: A Misuse Of Public Funds And A Blow To Local Businesses Parrot Analytics: A Very Parrot Analytics Christmas, 2024 Edition

Parrot Analytics: A Very Parrot Analytics Christmas, 2024 Edition Financial Markets Authority: Individual Pleads Guilty To Insider Trading Charges

Financial Markets Authority: Individual Pleads Guilty To Insider Trading Charges