Price trumps coverage as reason for mobile switching

Kiwis who have switched their mobile phone service provider are now over 2.5 times more likely to say they switched for price than coverage, the latest research from Roy Morgan shows.

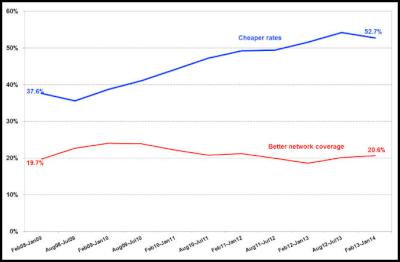

Five years ago, 37.6% of those who had switched provider said ‘cheaper rates’ was a deciding factor, and 19.7% cited ‘better network coverage’. But since then, intense competition has driven an increase in the proportion of switchers for whom cheaper rates was a motive—to a majority 52.7%. Meanwhile, the proportion who switched to get better coverage has barely changed.

Proportion of switchers who cited price or coverage as switching reason:

Click for big version.

Source: Roy Morgan Single Source (New Zealand), February 2008 – January 2014, average annual sample n = 3599 New Zealanders 14+ who are the main user of a mobile phone and switched service provider.

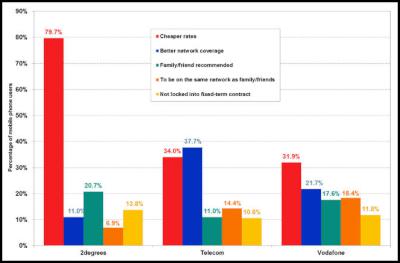

In the year to January 2014, around 4 in 5 mobile users who had switched to 2degrees say they did so to get cheaper rates (79.7%), with coverage a reason for fewer switchers (11%) than the recommendation of family or friends (20.7%) or the absence of a fixed-term contract (13.8%). Only 6.9% of 2degrees’ switchers moved to the network to be on the same one as family and friends.

Network coverage is the dominant reason among those who switched to Telecom (37.7%), just ahead of cheaper rates (34.0%), while wanting to be on the same network as our regular contacts is third (14.4%).

However switchers to Vodafone are more evenly split as to their reasons. Although price is the most common reason (31.9%), only around 4% points separates coverage, recommendations and network sharing, with contract freedom also a reason for a decent chunk (11.8%) of customers.

Proportion of switchers to mobile providers who cited each switching reason:

Click for big version.

Source: Roy Morgan Single Source (New Zealand), February 2013 – January 2014, sample n = 4728 New Zealanders 14+ who are the main user of a mobile phone and switched service provider. Totals may exceed 100% as respondents can select multiples reasons.

Pip Elliott, General Manager, Roy Morgan Research NZ, says:

“Since 2degrees entered the mobile phone service market in August 2009, there has been a significant increase in respondents switching mobile phone service provider because of cheaper rates. 2degrees also has the highest proportion of switchers who chose them due to dissatisfaction with the service of their previous provider.

“Recognising the increasing importance of price to consumers, Telecom’s launch of sub-brand Skinny Mobile in 2012—and subsequent rebranding a year ago—has created a clearly defined ‘discount’ offering from the telco.

“Of those who switched to Skinny, around 77% cited price as a reason—nearly the same proportion 2degrees has. Where Skinny’s new customers differ from 2degrees’ is in a higher proportion who switched to get free call time and better network features on the parent network.

“Although price was a similarly dominant reason among switchers to Slingshot, those customers are well over twice as likely as those with any other provider to cite helpfulness of staff and better billing details as deciding factors, suggesting that there are still spaces where mobile providers can differentiate themselves beyond price and network reliability.”

Roy Morgan Research

Roy

Morgan Research is Australia’s best known and longest

established market research and public opinion survey

company. Roy Morgan Single Source is thorough, accurate, and

provides comprehensive, directly applicable information

about current and future customers. It is unique in that it

directs all the questions to each individual from a base

survey sample of around 55,000 interviews in Australia and

15,000 interviews in New Zealand annually - the largest

Single Source databases in the world. The questions asked

relate to lifestyle and attitudes, media consumption habits

(including TV, radio, newspapers, magazines, cinema,

catalogues, pay TV and the Internet), brand and product

usage, purchase intentions, retail visitations, service

provider preferences, financial information and recreation

and leisure activities. This lead product is supported by a

nationally networked, consultancy-orientated market research

capability.

ENDS

EDS: Oceans Symposium Highlights Need To Establish Independent Oceans Commission

EDS: Oceans Symposium Highlights Need To Establish Independent Oceans Commission Antarctic Heritage Trust: NZ-made ‘Cutting-Edge’ VR Experience Tours The UK

Antarctic Heritage Trust: NZ-made ‘Cutting-Edge’ VR Experience Tours The UK Brian Gaynor Business Journalism Initiative: Brian Gaynor Initiative Business Journalism Funding Award Moves To Rolling Applications

Brian Gaynor Business Journalism Initiative: Brian Gaynor Initiative Business Journalism Funding Award Moves To Rolling Applications  Inland Revenue: Fifth Anniversary Of The SBC Loans - Time To Repay

Inland Revenue: Fifth Anniversary Of The SBC Loans - Time To Repay Te Runanga o Ngati Hinemanu: First Marae Based Fresh Water Testing Science Lab Grand Opening 16-17 May 2025

Te Runanga o Ngati Hinemanu: First Marae Based Fresh Water Testing Science Lab Grand Opening 16-17 May 2025 Raise Communications: NZ Careers Expo Kicks Off National Tour Amid Record Unemployment

Raise Communications: NZ Careers Expo Kicks Off National Tour Amid Record Unemployment