Even green-leaning Kiwis think environmentally-friendly products are overpriced

Whether you’re a climate change sceptic, a tree-hugging eco-warrior or something in between, there’s no avoiding the environmental debate these days. And with nearly four out of five New Zealanders believing that ‘if we don’t act now we’ll never control our environmental problems’, it makes sense that their shopping habits would reflect this. After all, buying sustainable, eco, biodegradable, non-toxic and/or organic products is an easy way for each individual to play their part in saving the planet, right?

Perhaps not. You see, there’s one small problem: three-quarters of Kiwis also believe that ‘environmentally friendly products are overpriced’ (compared to 68% of Australians). This presents a challenge for retailers and manufacturers of such items.

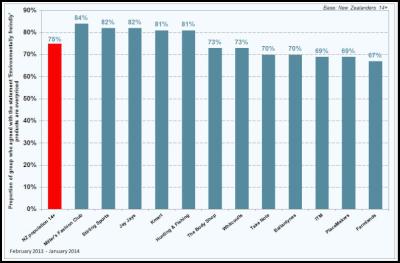

Roy Morgan Research looked at the customers of several high-profile New Zealand retailers to see how their attitudes towards environmentally friendly products stacked up against the national average.

How attitudes to environmentally-friendly products vary among Kiwi shoppers

Click for big version.

Source: Roy Morgan Single Source (New Zealand), July 2011 – June 2012 (n = 19,690).

As the chart shows, 84% of Miller’s Fashion Club customers believe that ‘environmentally friendly products are overpriced’, followed closely by Stirling Sports and Jay Jays customers (82% each). Kmart and Hunting & Fishing aren’t far behind: 81% of each store’s customers believe these items are too costly.

At the other end of the scale, 67% of Farmlands customers, and 69% of both ITM and Placemakers shoppers share this attitude. Curiously, these three retailers specialise in ‘trade’ supplies: agricultural in Farmlands’ case, and building/DIY in the case of the other two. Does this mean they’d choose an organic fertiliser over a chemical one, or wood sourced from approved plantations over cheaper, less sustainable options?

Pip Elliott, General Manager, Roy Morgan Research NZ, says:

“It’s interesting to see how different kinds of customers vary in their attitude towards environmentally friendly products. Our findings show that shoppers at clothing boutiques and sportswear stores are most likely to believe these items are overpriced, suggesting that they probably wouldn’t be willing to pay more for ethically produced (non-sweatshop) garments and sporting goods.

“Though trade and agricultural supplies customers seem less likely to share this perception of green-friendly products, and some may not think twice about buying them, the fact remains that nearly seven out of 10 do think they’re overpriced.

“But with more than six out of every 10 New Zealanders claiming to be ‘an environmentalist at heart’ (slightly more than Australia’s 58%) and less than a third believing threats to the environment are exaggerated, there is a golden opportunity for any retailer or manufacturer who either offers reasonably priced, green-friendly goods, or who can dispel this widespread belief that they cost too much.”

We have delivered this press release via the Newsmaker media distribution service. If you would like to browse our extensive archive of detailed research findings please visit our website. To stay up-to-date with all our latest research findings you may also join our free weekly newsletter.

Roy Morgan

Research

Roy Morgan Research is Australia's best

known and longest established market research and public

opinion survey company. Roy Morgan Single Source is

thorough, accurate, and provides comprehensive, directly

applicable information about current and future customers.

It is unique in that it directs all the questions to each

individual from a base survey sample of around 55,000

interviews in Australia and 15,000 interviews in New Zealand

annually - the largest Single Source databases in the world.

The questions asked relate to lifestyle and attitudes, media

consumption habits (including TV, radio, newspapers,

magazines, cinema, catalogues, pay TV and the Internet),

brand and product usage, purchase intentions, retail

visitations, service provider preferences, financial

information and recreation and leisure activities. This lead

product is supported by a nationally networked,

consultancy-orientated market research capability.

ENDS

Electricity Authority: Welcomes Plan For Boosting Consumer-Supplied Flexibility

Electricity Authority: Welcomes Plan For Boosting Consumer-Supplied Flexibility University of Auckland: How Can Finance Be Harnessed For Good?

University of Auckland: How Can Finance Be Harnessed For Good? Michael Ryan, The Conversation: NZ Budget 2025 - Economic Forecasting Is Notoriously Difficult, But Global Uncertainty Is Making It Harder

Michael Ryan, The Conversation: NZ Budget 2025 - Economic Forecasting Is Notoriously Difficult, But Global Uncertainty Is Making It Harder KiwiRail: Aratere To Retire In August

KiwiRail: Aratere To Retire In August GE Free NZ: Chief Science Advisor Needs Courage To Take Honest Look At GE Failures

GE Free NZ: Chief Science Advisor Needs Courage To Take Honest Look At GE Failures IAG New Zealand: New Zealand’s $64 Billion Spend On Natural Hazards Heavily Skewed To Recovery Over Resilience

IAG New Zealand: New Zealand’s $64 Billion Spend On Natural Hazards Heavily Skewed To Recovery Over Resilience