Bills Paid in Record Time

MEDIA RELEASE

26 March 2014 – Immediate release

Bills Paid in Record

Time

Payment times drop below 40

days

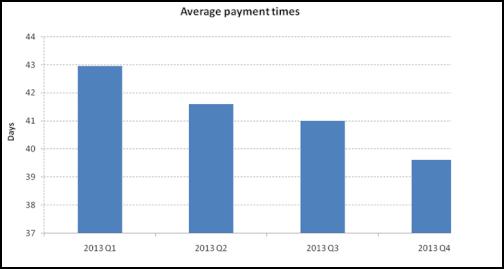

Businesses have been paying their bills at the fastest rate recorded in 10 years of commercial invoice data, with payment times across New Zealand dipping below the 40-day mark in the last quarter of 2013 to an average of 39.6 days.

The findings by credit reporting body Dun & Bradstreet underscore the healthier financial position of many companies and industries over the past year, and the relative strength of the New Zealand economy which this month became the world’s first advanced market to increase interest rates.

In comparison to Australia, where company payment times have stalled at an average of 53 days, the corporate sector in New Zealand has been able to steadily increase the rate of its invoice payments through 2013 as it benefits from strong business and consumer confidence, trade activity and investment.

Invoice payment times typically indicate the financial position of firms, and by association reflect the performance of the wider economy. When experiencing stronger sales and profitability they have a greater capacity to pay their expenses in a timely fashion. In turn, this returns finance back into circulation at a faster rate, providing a positive knock-on effect through to the entire economy.

D&B’s latest Trade Payments Analysis highlights the improved financial capacity of New Zealand companies, with findings that during the last quarter 66 per cent of invoices were paid within the standard 30-day period, an increase from 61 per cent a year earlier.

“Average invoice payment times have fallen below the 40-day mark for just the second time in the past decade, reaching a new low in the last quarter,” said Dennis Martin, Managing Director of Dun & Bradstreet New Zealand.

“These findings continue a clear and positive trend in the performance of the corporate sector, and follow additional positive movements in business and consumer confidence, the current account deficit and jobs growth.

“Our forecasts are for New Zealand’s key economic measures to continue improving this year, and consequently we also expect to see consolidation of this trend of faster business payment times,” Mr Martin added.

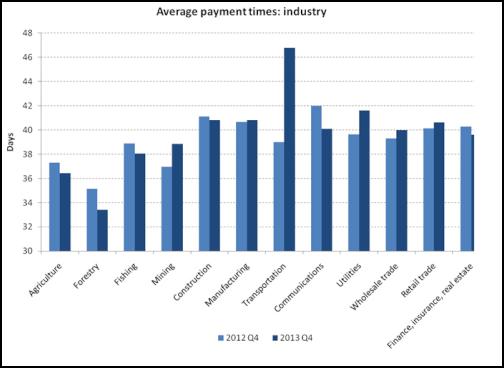

Across industries, the forestry sector performed the most strongly during Q4 2013, with payments by the country’s third largest export sector improving to an average of 33 days, compared to 35 days last year.

New Zealand’s substantial agriculture industry also improved the rate at which it settled its accounts, with average payment times moving to 36 days, compared to 37 days last year. The sector has benefited from strong dairy and meat product export volumes and prices during 2013, in addition to an easing of drought conditions.

While smaller operations in New Zealand have recorded faster invoice payment times, larger companies bucked the trend during Q4 2013, with average payment times slowing compared to the previous year.

Businesses employing between 200 and 499 people were one day slower to settle their accounts, while larger operations were significantly slower. D&B’s analysis shows that companies with more than 500 staff paid their invoices in an average of 45 days, up from 41 days.

“The ongoing favourable news on the New Zealand economy has shown up in a 10-year low in the time taken by firms to pay their bills,” said Stephen Koukoulas, Economics Advisor to Dun & Bradstreet.

“These findings confirm that the stronger growth that prompted the RBNZ to hike interest rates earlier this month is contributing to a more positive cash flow position for the business sector.

“Even though the RBNZ has commenced an interest rate tightening cycle, the boost to the economy from the dairy sector, construction and household spending is likely to see company payment times remain low for at least the near term,” Mr Koukoulas added.

Ngā Pae o te Māramatanga: Māori Concerns About Misuse Of Facial Recognition Technology Highlighted In Science

Ngā Pae o te Māramatanga: Māori Concerns About Misuse Of Facial Recognition Technology Highlighted In Science Retail NZ: Retailers Call For Flexibility On Easter Trading Hours

Retail NZ: Retailers Call For Flexibility On Easter Trading Hours WorkSafe NZ: Worker’s Six-Metre Fall Prompts Industry Call-Out

WorkSafe NZ: Worker’s Six-Metre Fall Prompts Industry Call-Out PSGR: Has MBIE Short-Circuited Good Process In Recent Government Reforms?

PSGR: Has MBIE Short-Circuited Good Process In Recent Government Reforms? The Reserve Bank of New Zealand: RBNZ’s Five Year Funding Agreement Published

The Reserve Bank of New Zealand: RBNZ’s Five Year Funding Agreement Published Lodg: Veteran Founders Disrupting Sole-Trader Accounting in NZ

Lodg: Veteran Founders Disrupting Sole-Trader Accounting in NZ