Wellington Drive Reports 2013 Annual Results

Wellington Drive Reports 2013 Annual Results with continued operational and margin improvements

Auckland, 28 February 2014 - Wellington Drive Technologies today announced its financial results for the year ended December 31, 2013.

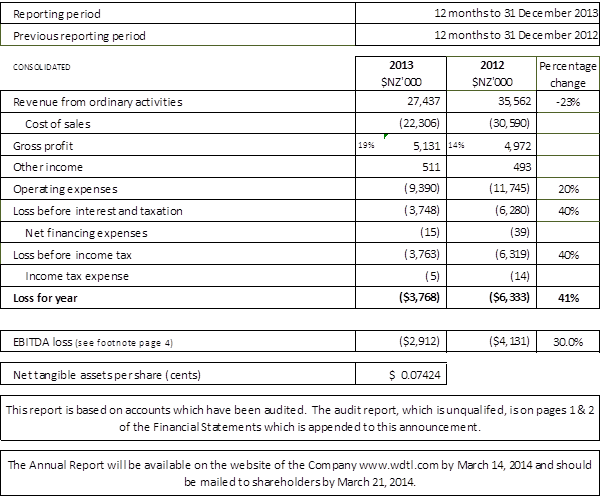

Click for big version.

2013

Highlights:

• Total Revenues decreased by 23% to

$27.4 million attributable to Wellington’s planned exit

from the unprofitable Ventilation business;

• US

Dollar revenue breakdown:

Refrigeration Revenue was

stable at US$20.7 million (2012: US$20.6) million with 1.1

million motors shipped to customers. This result

demonstrates a stable core motor business;

Europe

Refrigeration Revenues increased 27% as a result of improved

commercial agreements with targeted customers and new

development activities starting to deliver

results;

Revenues in the Americas increased 4% despite

lower than normal Mexico demand;

• Gross Profit of

18.7%, increasing from 4.9% in 2011 and 14% in

2012;

• Operating Costs reduced from $11.7 million to

$9.4 million;

• Inventory reduced from $4.5 million to

$4.0 million;

• Launched new Supermarket products –

the 4 watt ECR01 motor and Fanpack

Solution;

• Completed a strategic partnership with East

West Manufacturing that will deliver manufacturing cost and

supply chain capability improvements;

• Recruited two

growth focused executives, Gerardo Gonzalez leading the

Intelligent Solutions Business based in North America and

Clayton Thomas, based in China, leading the new Asia Pacific

growth strategy;

• Secured 10 new EC Motor customers,

in Asia, Northern Europe and Latin America;

• The

raising of $5.8m of new capital.

2013 was the second year of the Company’s turnaround plan and was marked by significant progress in its five main priorities of market expansion, lead-time reduction, cost reduction, strategic partnering and strengthening the Company’s resources.

Of particular note was the progress made on enabling a more competitive supply chain with the strategic partnership agreement signed with East West, a contract manufacturer and induction motor supplier based in Atlanta USA. The partnership is initially focused on supply chain improvement, but will progress to collaboration on growth projects in the USA with joint sales initiatives and ventilation motor product development.

The project to transfer part of Wellington’s supply chain to East West’s Vietnam factory is progressing well, and the Company expects to be purchasing motors from that facility by the end of the first half of 2014.

Beyond the East West

partnership, other supply chain improvements were made in

the year and plans were put in place to secure further

improvements and cost reductions, these include:

• The

use of some of the proceeds of new capital raised to secure

improved commercial terms with our China based motor

supplier.

• The decision to move the balance of our

electronics supply chain (that part not committed to East

West) from our existing China based supplier to a new

Indonesian based supplier. This supplier is headquartered in

Singapore and has manufacturing assets in China and

Indonesia.

• Due to the increased capability of the new

supply chain, the Company decided to close business

operations in its Singapore office and move its supply chain

management to the New Zealand headquarters in Qtr1 2014.

Resident engineers will continue to be located at supplier

sites to ensure product quality.

CEO Greg Allen

commented:

“The team is satisfied with its

operating and gross profit improvements and the new customer

wins it has achieved in 2013, despite the lower than

expected revenue in the second half of the year.

Over the last two years we have significantly reduced Wellington’s internal operating costs and supply chain costs. We believe the strategic decisions made, and now being executed around East West and other supply chain improvements, will continue to drive cost out of the business and help to improve financial performance.

As a stepping stone to our three year growth plan we have re-developed Wellington’s product road-map to include Smart Controllers and Advanced Smart EC motors, exciting new products that are focused on Supermarket display case manufacturers as well as bottle cooler customers.

We will continue to innovate for our customers in both motors and Smart Controllers, diversifying further beyond bottle cooler refrigeration and into new markets for our products. We will work with our partner East West to complete our supply chain transition and explore ventilation motor growth opportunities with them.

In 2014 we will increase our focus on growth in both our core (or existing) refrigeration business as well as new products and markets as part of our three-year growth plan. The success of that plan will be measured predominately by our progress in winning new customers and entering new markets.”

2014 Plan and guidance

As the

Company now moves from its turnaround phase to its growth

plan, it will be primarily focused on growing revenue to

deliver improved profitability. The five main growth

priorities for 2014 will be:

1. Establish sales

partnerships to access growth opportunities in new

markets;

2. Revenue diversification through increased

business with supermarket display manufacturers;

3.

Launch the Company’s first Smart Controller into the

Commercial Refrigeration market;

4. Grow product

development capacity to broaden our product portfolio and

solution offering; and

5. Complete the East West supplier

transition and enable a lower manufacturing cost

point.

Initial trading guidance for

2014

• Revenue of NZ$30 to $35m - targeting

20% volume growth in 2014 from existing product lines. It

should be noted that the initial wide range in revenues is

due to lower than normal Latin America sales experienced

over the last six months of 2013. This is the result of

emerging demand weakness from some retail brands, which the

Company believes may be partly a result of the new ‘sugar

sweetened foods’ sales tax announced in Mexico in Qtr4

2013. The outcome of this market volatility is not yet

clear.

• Gross profit of 20% to 23% - gross

profit % is projected to be at its lowest in Qtr1 2014, at

15% to 18%. Qtr1 guidance is driven mainly by customer price

incentives intended to secure business, with gross profit %

expected to improve through the year as manufacturing cost

reductions relating to supply chain changes are

realised.

• Net profit after tax (NPAT) loss of less

than $2.7m.

• EBITDA loss of less than $2m

– Supply chain cost reductions will not be fully

implemented until Qtr4 2014 as higher cost inventories are

sold down. Operating costs are planned to increase by

approximately NZ$0.5m as expense reductions are offset by

increased investment in sales and product development

staff.

Chairman Tony Nowell commented:

“Wellington had previously targeted a result of

EBITDA breakeven in 2014. The Company has decided to bring

forward its growth plans which will mean sacrificing

short-term profitability for future business growth. This

will ensure it does not forgo new market, new product and

new customer opportunities.

The Company’s new three-year growth plan is driving increased investment in growth resources, expansion into new geographies and further commercial incentives to new and existing customers to enable new business. We will also increase capital investment to support a broader product road map. The Company expects these investments to deliver increasing revenues and continued margin growth over the next three years.”

ENDS

School Lunch Collective: Compass Group New Zealand To Acquire Libelle Group Securing Healthy School Lunch Programme

School Lunch Collective: Compass Group New Zealand To Acquire Libelle Group Securing Healthy School Lunch Programme PSA: PPPs Pose Risks To New Zealand Workers

PSA: PPPs Pose Risks To New Zealand Workers Office of the Privacy Commissioner: New Research Shows Business Leaders Fear Being On The Hook For Others’ Privacy Breaches

Office of the Privacy Commissioner: New Research Shows Business Leaders Fear Being On The Hook For Others’ Privacy Breaches E Tū: E Tū Members Send Open Letter To James Grenon And NZME Board

E Tū: E Tū Members Send Open Letter To James Grenon And NZME Board Commerce Commission: Commission Calls For Comments On Copper Access Deregulation

Commerce Commission: Commission Calls For Comments On Copper Access Deregulation New Zealand Association of Scientists: NZAS Supports Saving Biotechnology Capacity In Callaghan; Asks What Now For Applied Technology Group

New Zealand Association of Scientists: NZAS Supports Saving Biotechnology Capacity In Callaghan; Asks What Now For Applied Technology Group