Heavy Tax on KiwiSaver to be a Hot Election Issue

December 2 2013

Heavy Tax on KiwiSaver to be a Hot Election Issue

KiwiSaver will be a Budget and Election issue in 2014 as middle New Zealanders’ awareness grows of just how much poorer they will be in retirement than other developed countries, including their cousins in Europe and siblings in Australia, says Financial Services Council CEO, Peter Neilson.

“Our aim is to build and protect the wealth of New Zealanders and within that ambit is what we believe politicians need to do to correct the inequities, particularly in relation to harsh taxes on long term savings, and make KiwiSaver fairer, more accessible, affordable and harder working so that our citizens can have a comfortable retirement and our economy can benefit from a deeper savings pools.”

The FSC sees as one of its priorities in the next year a big push to talk directly to savers so they are aware of the tax system and its punishing impact on their nest eggs as well as show them the options that politicians do have available to level the tax playing field and the choices they can make about moving to higher earning balanced or growth KiwiSaver funds to suit their life stage.

“We want to continue the conversation at the grassroots and let their voices be heard at the highest levels, and in all political caucuses, because we believe that there is an urgent need to have the retirement income issue sorted in the next few years so people have the security, stability and support they need to save for their future and have a dignified retirement,” Mr Neilson said. “Voters go to the polls later in 2014 and retirement income savings will be on the agenda.”

The FSC has presented a package of options to policy and decision makers which suggests that it would be possible to bring down the harsh taxes on KiwiSaver so they are level with property investments by eliminating the hundreds of millions of dollars Government pays in tax incentives to KiwiSavers, who are often contributing just the minimum $1042 p.a. to get their $521 return, and redirecting this money to make KiwiSaver fund tax cuts fiscally neutral.

“Lower taxes on savings in KiwiSaver funds would have a benefit for the economy too, dampening the attractiveness of investments in rental properties and the overheated property market and instead turning the light on to lifting productivity, wages, export competitiveness with a lower dollar and building a more robust national savings pool to fund greater investment in New Zealand enterprises and infrastructure. It may also serve to keep younger New Zealanders as contributing taxpayers at home rather than going to Australia where they could expect to receive double New Zealand’s average retirement income,” Mr Neilson said in the Council’s annual review released today (2 December) and available on www.fsc.org,nz.

In OECD countries including Australia, most employees can look forward to the same sort of retirement incomes and security as our longest serving senior civil servants and politicians who achieve a retirement income of 60-70% of their previous salaries. For someone on the average wage, NZ Super pays about 43% of their previous earnings.

“Perhaps the lack of urgency by the policymakers in correcting the situation and shortfall in retirement savings by ordinary New Zealanders is that these legions are well catered for so there is no problem as far as they can see,” Mr Neilson said. “As a former cabinet minister who served the minimum nine years I am eligible for an MP’s pension, in addition to NZ Super, and so I am guaranteed a retirement income that is much more than double NZ Super to assure me of a comfortable retirement. I am also in KiwiSaver.”

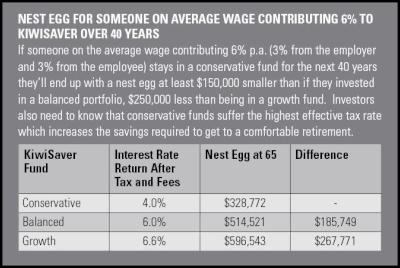

There are 2 million New Zealanders enrolled in KiwiSaver, but around half of them are on a contribution holiday or are irregular contributors. Unfortunately most of the 1 million people who are regular contributors cannot save enough at 6% p.a., split with their employer, to have a comfortable retirement – and they know it. To exacerbate the situation, they are probably unknowingly invested in a conservative default fund which attracts the highest effective tax rates. An independent Horizon poll showed only 8% of New Zealanders believe that they could survive on NZ Super alone – could you live on $357 a week?

Over the past year, the FSC has conducted consumer research and brought on board the best brains in the business to look at the pressing issues of taxation on savings like KiwiSaver, the amount of money savers leave on the table for often staying in conservative portfolios rather than shifting to balanced or higher growth funds, and what can be done for the low income earners and women, who spend more time out of the paid workforce caring for family and also do not have pay equality. “The current government recently confirmed that it would retain the default funds’ conservative approach to KiwiSaver rather than encouraging a shift to, or having KiwiSaver members default into, balanced or higher growth funds. That decision will cost New Zealanders dearly and mean they will have to save a lot more for a lot longer and pay a lot more tax on those savings as they try and build their retirement nest egg,” Mr Neilson said in his annual review.

“We see a pressing need to up our efforts to ensure they know just how much money - as much as $250,000 - will be left on the table if they stay in a conservative, default fund and we will also work to lift their understanding of the impact of compound interest on their savings and the amount of tax they will pay over the decades.”

Click for big version.

The FSC plan provides options that are safe for politicians to consider as a basis for a new retirement income policy agreement updating the one agreed back in 1993 that will enable all New Zealand employees to save enough over their working life to fund a second pension that will give them the comfortable retirement they expect, he says.

The FSC Plan

We have a plan to:

- gradually increase the contribution rate to 7% starting at 1% for new KiwiSaver members so you can buy a second pension to provide a retirement income double NZ Super- that’s only

1% more if you are already putting aside 6% (3% from the employee and 3% from the employer)

- keep NZ Super as is

To get to the 7% contribution target four things need to happen:

- move savings to higher earning funds depending on your life stage

- offset the higher risk with insurance to guarantee a level of savings at retirement

- level the tax playing field with other forms of savings

- target the money spent on KiwiSaver incentives to fund the lower tax rates to make it fiscally neutral

And to get that to happen we need all the parties represented in Parliament to agree and commit to providing a new, updated retirement savings policy that:

- continues to support KiwiSaver to help New Zealand employees save for a comfortable retirement over their working lives

- progressively steps up KiwiSaver contributions and coverage

- does not put New Zealanders who save for retirement in KiwiSaver at a tax disadvantage compared with other savers

- lowers taxes over time to level the playing field so KiwiSaver members are not at a tax disadvantage in saving for retirement

“The options we’re putting forward for consideration would work whether KiwiSaver remains voluntary or becomes compulsory which international best practice recommends as the most effective means for increasing contributions and coverage as well as creating a culture of savers,” Mr Neilson said.

“ Compulsion is seen by New Zealanders as inevitable in due course, and not a bad thing to help people develop good saving habits, according to our polling, so even that issue is unlikely to be contentious if that is where the politicians decide to settle.

“We’ve also moved the discussion beyond the endless arguments over age of eligibility to focus on what really will make the difference to New Zealanders wanting comfortable retirement incomes – finding practical and politically implementable ways to plug the desperate shortfall in retirement savings and strengthen the national savings base,” Mr Neilson said.

ENDS

Science Media Centre: Cyclone Gabrielle's Impacts On NZ's Ecosystems - Expert Reaction

Science Media Centre: Cyclone Gabrielle's Impacts On NZ's Ecosystems - Expert Reaction RNZ: Parts Of Power System Could Be Out For 36 Hours In Event Of Extreme Solar Storm

RNZ: Parts Of Power System Could Be Out For 36 Hours In Event Of Extreme Solar Storm NZAS: New Zealand Association Of Scientists Awards Celebrate The Achievements Of Scientists And Our Science System

NZAS: New Zealand Association Of Scientists Awards Celebrate The Achievements Of Scientists And Our Science System Stats NZ: Retail Spending Flat In The September 2024 Quarter

Stats NZ: Retail Spending Flat In The September 2024 Quarter Antarctica New Zealand: International Team Launch Second Attempt To Drill Deep For Antarctic Climate Clues

Antarctica New Zealand: International Team Launch Second Attempt To Drill Deep For Antarctic Climate Clues Vegetables New Zealand: Asparagus Season In Full Flight: Get It While You Still Can

Vegetables New Zealand: Asparagus Season In Full Flight: Get It While You Still Can