Market Update GoldCore 24 June 2013

Market Update GoldCore

Ron Paul: Gold Could Go To 'Infinity'

Today’s AM fix was

USD 1,283.25, EUR 978.98 and GBP 836.21 per ounce.

Friday’s AM fix was USD 1,290.25, EUR 976.28 and GBP

833.33 per ounce.

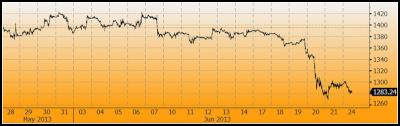

Gold climbed $15.50 or 1.21% on Friday and closed at $1,294.00/oz. Silver reached a high of $20.121 and finished up 2.19%. Gold and silver were both down on the week -6.93% and -9.07% respectively.

Gold has fallen another 1% this morning and remains at its lowest level since September 2010. While gold rose over 1% on Friday, it recorded its worst weekly performance - down nearly 7% - since September 2011.

Click for big version.

Traders are the most bearish in 3 1/2 years, with 15 analysts surveyed by Bloomberg expecting prices to fall this week. Six were bullish and five neutral, the largest proportion of bears since January 2010. Gold rose in February 2010 and was 27% higher by year end 2010.

Sentiment is as bad as we have

seen it in many years which is bullish from a contrarian

perspective.

Weak hands have been washed out of the

market and strong hands are accumulating again on this dip

and will continue to do so in the coming weeks.

Falling gold prices are beginning to impact the gold mining sector in a big way. Newcrest Mining Ltd.’s decision to write down the value of its mines by as much as A$6 billion ($5.5 billion) will lead to the biggest one-time charge in gold mining history. It also heralds pain for competitors. Barrick Gold Corp., the world’s biggest producer, Newmont Mining Corp. and Gold Fields Ltd. may be next, according to Jefferies International Ltd.

Click for big version.

Gold Support and Resistance Chart – (GoldCore)

Ron Paul still likes

gold. In fact, he thinks it could go to "infinity".

"I

think If you look at the record of the value of the dollar

since the Fed's been in existence we have about a 2 cent

dollar where gold was worth $20/oz. I would say the record

is rather clear on the side of commodity money. And history

is on our side, 6,000 years of history shows it maintains

value while paper money self destructs.

I would say that long term as long as we have excessive spending and excessive computerized money you're going to see gold go up and eventually if we're not careful it could go to infinity while dollar could collapse totally.”

News From Around The World

Video: Ron Paul: Gold Could Go to 'Infinity' CNBC

"Fundamental Case For Gold Is Growing, Not Diminishing" Zero Hedge

Video: Marc Faber: "I Buy Gold Regularly" Casey Research

Download Comprehensive Guide To Investing

In Gold

Everything you need to know

about investing in gold. This complimentary ebook is a must

have for anyone thinking of investing in

gold.

In this ebook you will find out

about:

• Owning Gold

• The Investment Pyramid

• The Instruments of Gold Ownership

• How to

Buy Gold

• Dangers of Digital or e-Gold

• The

Difference Between Physical Gold and Paper Gold

ENDS

Greenpeace: Taranaki - Greenpeace Activists Stop Unloading Of Palm Kernel Sourced From Indonesian Rainforests

Greenpeace: Taranaki - Greenpeace Activists Stop Unloading Of Palm Kernel Sourced From Indonesian Rainforests Seafood New Zealand: Seafood Situation Saved By A Sausage - New Plymouth Locals Innovate, Using Crayfish Bait

Seafood New Zealand: Seafood Situation Saved By A Sausage - New Plymouth Locals Innovate, Using Crayfish Bait Takeovers Panel: Takeovers Panel Convenes Meeting To Inquire Into The Acquisition Of Shares In NZME Limited

Takeovers Panel: Takeovers Panel Convenes Meeting To Inquire Into The Acquisition Of Shares In NZME Limited WorkSafe NZ: Conveyor Belt Death-Trap Was A Danger In Plain Sight

WorkSafe NZ: Conveyor Belt Death-Trap Was A Danger In Plain Sight Commerce Commission: 2degrees Fined $325,000 For Misleading Claims About ‘Free’ Aussie Business Roaming

Commerce Commission: 2degrees Fined $325,000 For Misleading Claims About ‘Free’ Aussie Business Roaming  Natural Hazards Commission: Hub Launched To Empower Architects And Engineers To Build Above Code

Natural Hazards Commission: Hub Launched To Empower Architects And Engineers To Build Above Code