Home loan affordability worst in nearly 3 years in May

Roost Home Loan Affordability report

For May 2012 – For immediate release

Home loan affordability worst in nearly 3 years in May

Rising housing prices and flat interest rates have seen housing affordability deteriorate to its worst levels in almost three years in May, according to the Roost Home Loan Affordability reports.

Affordability was the hardest for first home buyers on the North Shore in Auckland, where the Roost reports estimated a single first home buyer would have to spend almost 95% of their after-tax income on servicing their mortgage, even with a 20% deposit.

Affordability for regular home buyers and first home buyers worsened across most of the country and remains at its toughest in the biggest cities of Auckland, Christchurch and Wellington, where housing supply shortages and a fall in fixed mortgage rates over the last year have heated up the housing market.

Life looks set to get even tougher for first home buyers in the big cities in coming months if, as expected, the Reserve Bank puts 'speed limits' on low deposit home loans. The government is pushing for some sort of exemption for first home buyers, but the Reserve Bank is determined to slow riskier lending growth. About a third of mortgages with deposits of less than 20% are to first home buyers.

"First home buyers will need to work harder in their negotiations with their bank to achieve their aims," said Colleen Dennehy, a spokeswoman from Roost Mortgage Brokers, which sponsors the reports prepared by Interest.co.nz.

"A mortgage broker can help a first home buyer negotiate the best deal when the banks toughen their rules," Dennehy said.

Roost Mortgage brokers had already seen some banks tighten their rules around low deposit lending over the last month in response to Reserve Bank pressure, she said. Some banks had reduced their availability of 90% plus mortgages or effectively increased interest rates for very low deposit mortgages.

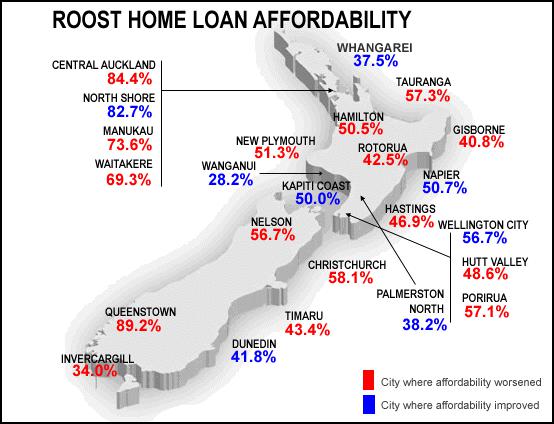

The Roost Home Loan Affordability reports showed a slight deterioration in Auckland, Hamilton, Christchurch and Invercargill, with more significant falls in Tauranga and Nelson because of sharp rises in house prices. Affordability improved slightly in Wellington, Whangarei, Palmerston North and Wanganui.

Only interest rates remaining near record lows is stopping a further worsening, the Roost Home Loan Affordability reports show.

It is toughest for first home buyers in Auckland. It took 87.7% of a single median after tax income to afford a first quartile priced house in South Auckland in May, while it took 94.8% in the North Shore.

Central Auckland affordability is at its worst level since March 2010, although it remains below its worst ever levels of 107.3% of income required in November 2007 when interest rates were over 10%. They are now closer to 5%.

Nationally, affordability for someone on a single median income worsened by 0.1% in May from April, which meant it took 56.3% of after tax income to afford an 80% mortgage on a median house, according to the Roost home loan affordability report released today.

Interest rates were broadly flat in May and after-tax wages rose just over NZ$1 per week. A rise in the national median house price to NZ$392,000 in May from NZ$390,500 in April was the main cause of the deterioration.

Housing affordability is shaping up as a major economic and political issue over the next 18 months. The Reserve Bank and Government agreed on a toolkit of 'macro-prudential' controls last month that could see the central bank impose limits growth in high loan to value ratio mortgages. Central and local governments are also moving to address housing supply shortages.

For first home buyers – which in this Roost index are defined as a 25-29 year old who buys a first quartile home – there was also a deterioration in affordability in most cities.

It now takes 48.3% of a single first home buyer's income to afford a first quartile priced house nationally, up from 48.0% a month earlier. The most affordable city in New Zealand for first home buyers is Wanganui, where it takes 22.9% of a young person's disposable income to afford a first quartile home. The least affordable is the North Shore of Auckland.

Any level over 40% is considered unaffordable, whereas any level closer to 30% has coincided with increased buyer demand in the past.

For working households, the situation is similar, although bringing two incomes to the job of paying for a mortgage makes life considerably easier. A household with two incomes would typically have had to use 37.1% of their after tax pay in May to service the mortgage on a median priced house. This is up from 37.0% in April.

On this basis, most smaller New Zealand cities have a household affordability index below 40% for couples in the 30-34 age group. This household is assumed to have one 5 year old child.

For households in the 25-29 age group (which is assumed to have no children), affordability also worsened, with 23.4% of after tax income in households with two incomes required to service the debt, up from 23.2% the previous month.

Any level over 30% is considered unaffordable in the longer term for such a household, while any level closer to 20% is seen as attractive and coinciding with strong demand.

First home buyer household affordability is measured by calculating the proportion of after tax pay needed by two young median income earners to service an 80% home loan on a first quartile priced house.

--------------------

Roost Home loan

affordability for typical buyers

General/New

Zealand Report: http://www.interest.co.nz/property/home-loan-affordability

Links

to individual reports for regions can be found here

Roost Home loan affordability for first-home buyers

General/New Zealand Report:

http://www.interest.co.nz/first-home-buyer

Links

to individual reports for regions can be found here

Contact

For more information, contact Interest.co.nz publisher David Chaston on 09 360 9670 or 021 997 311 or david.chaston@interest.co.nz for more information.

Question and Answers about the

report

How does interest.co.nz work out these

numbers?

Interest.co.nz gathers data from Statistics New Zealand and IRD on wages in each region, data from the Real Estate Institute from each region each month, and data from banks and non-banks on interest rates. It has calculated home loan affordability going back to the beginning of 2002.

How is this survey different from the Massey

University survey of affordability?

The Massey study is only done quarterly rather than monthly and uses an index of Home affordability rather than actually measuring home loan affordability. It uses an index rather than the actual measure of the proportion of after tax pay needed to service an 80% mortgage on a median home. The exact composition and meaning of the index is not detailed.

Why use a single

median income rather than household income?

It’s true that most homebuyers are using a combination of one or more full or part time incomes to service their mortgage. Each household is different and may be using incomes from different sources. The best measure of average national household income is calculated officially once in every three years by Statistics New Zealand. Interest.co.nz chose to use the median income data series from IRD and Statistics NZ because it can be measured monthly and can be drilled down by region and by age. We do include a chart showing how many median incomes are required to keep mortgage payments at 40% of take home pay. It is currently around 2 median incomes.

Why is home loan affordability

important?

It is a useful way to work out if a housing market is overvalued. It’s clear house prices stopped rising when the national affordability ratio rose above 80% or 2 median incomes to service the average home loan. It’s a way of comparing affordability of housing markets with a national average and comparing housing values from one year to the next. For example, the affordability ratio in 2002 before the housing boom really took off was around 41%.

About Roost

Roost is the sponsor of this Report, and the Reports must be referred to as the Roost home loan affordability reports. Roost, owned by AMP, is one of New Zealand’s largest independent home loan and investment property mortgage brokers with 16 franchisees nationwide. Roost offers to source the perfect loan for its customers from a panel of lenders and insurance advice from Roost insurance specialists. Roost was established in 1996. For more information please visit www.roost.co.nz

Office of the Privacy Commissioner: New Research Shows Business Leaders Fear Being On The Hook For Others’ Privacy Breaches

Office of the Privacy Commissioner: New Research Shows Business Leaders Fear Being On The Hook For Others’ Privacy Breaches E Tū: E Tū Members Send Open Letter To James Grenon And NZME Board

E Tū: E Tū Members Send Open Letter To James Grenon And NZME Board Commerce Commission: Commission Calls For Comments On Copper Access Deregulation

Commerce Commission: Commission Calls For Comments On Copper Access Deregulation New Zealand Association of Scientists: NZAS Supports Saving Biotechnology Capacity In Callaghan; Asks What Now For Applied Technology Group

New Zealand Association of Scientists: NZAS Supports Saving Biotechnology Capacity In Callaghan; Asks What Now For Applied Technology Group Stats NZ: Business Employment Data - December 2024 Quarter

Stats NZ: Business Employment Data - December 2024 Quarter Transpower: System Operator Launches Review Of Electricity Risk Forecasting Framework

Transpower: System Operator Launches Review Of Electricity Risk Forecasting Framework