Consolidating angels holding their own

MEDIA RELEASE

4 April 2013

Consolidating angels holding their own

Angel investment in New Zealand is consolidating at around 100 deals a year involving $30 million of investment into start-up companies a year, New Zealand Venture Investment Fund chief executive Franceska Banga said today.

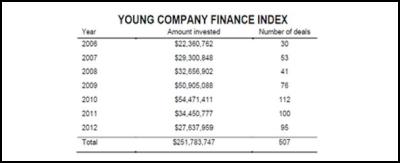

Releasing the latest Young Company Finance Index, Franceska Banga said that angels invested $27.6 million across 95 deals involving young New Zealand companies in 2012. This compares to $34.5 million invested across 100 deals in 2011. It is similar to the investment levels in 2007 and 2008, although below the 2009 and 2010 boom years when annual investment reached $50 million.

Cumulatively, $251.8 million has now been invested into young companies by angels since the Young Company Finance Index began measuring activity in 2006.

Click for big version.

Franceska Banga said that the consolidation of activity at around $30 million a year shows that angel investor support for New Zealand start-up companies in 2012 remained solid.

“Investment markets continue to be a challenging environment, especially at the riskier end of the market. By international standards, nearly 100 angel investments per year is a healthy rate per capita and a positive result for the early-stage capital market.

“Angels are tending to invest smaller amounts than in previous years - the average deal size in 2012 was just under $300,000 and has been declining since 2006. Nearly 70 percent of all deals in 2012 were of $250,000 or less. A lower deal size is in line with international investment trends. It shows that angels are investing in smaller tranches based on companies reaching performance milestones. “Angels are continuing to make new investments, alongside the support they are giving to existing investee companies. Of the $27.6 million invested in 2012, 75 percent – or $19.7m - was follow-on investment and 25 percent - $7.9m - was new investments.”

Suse Reynolds, Executive Director of the Angel Association of New Zealand, said that a focus of the next 12 months will be on recruitment of new angel investors to lift the level of investment from around the $30 million annual level.

“Angel investment is a small but critical part of our capital markets feeding the pipeline of start-ups. We have a number of established and active angel groups which have backed companies like Lanzatech, Booktrack and PowerbyProxi. We aim to recruit another 200 angel investors to continue the growth in the sector, and which plays a key role in building and supporting the startup company pipeline. “2012 saw the emergence of specialist angel investment funds - such as the Manawatu Investment Group’s MIG One Fund and the Global from Day 1 Fund (a collaboration between the Icehouse and Sparkbox Ventures) - to fill gaps in the New Zealand angel investment market.

“A key advantage of these funds is that they provide a more nimble and streamlined investment decision making process, supported by a professional management structure. They are vehicles through which angels can get exposure to a portfolio of companies more easily than if they were investing as individuals on a deal-by-deal basis, and reducing the risk in what is a highly risky investment destination. The expectation is that other specialist funds will be launched over the next few years.”

2012 saw 70 percent of deals syndicated between different angel groups. This shows a significant increase in collaboration between angel groups, which is welcome given the small size of the New Zealand market and the need to give angels throughout New Zealand access to a range of deals. Since 2006, by region, 54 percent of investment was in Auckland, 11 percent in Christchurch, 10 percent in Wellington, 8 percent in Dunedin, 6 percent in Palmerston North, and 5 percent in Hamilton. Software & services received 27 percent of the amount invested, followed by pharmaceuticals/life sciences technology (23%), technology hardware and equipment (15%), and food & beverage (10%).

The fastest growing region

for angel investment over the last year has been Bay of

Plenty, which in 2012 accounted for 9.4 percent of

investment by amount (fourth biggest region for investment),

reflecting the presence there of a strong and growing local

angel investment group, Enterprise Angels. This is up from

just over one percent the year before.

Click here to view:

Young_Company_Finance_Issue_14_April_2013.pdf

ENDS

Raise Communications: NZ Careers Expo Kicks Off National Tour Amid Record Unemployment

Raise Communications: NZ Careers Expo Kicks Off National Tour Amid Record Unemployment Hugh Grant: How To Build Confidence In The Data You Collect

Hugh Grant: How To Build Confidence In The Data You Collect Tourism Industry Aotearoa: TRENZ 2026 Set To Rediscover Auckland As It Farewells Rotorua - The Birthplace Of Tourism

Tourism Industry Aotearoa: TRENZ 2026 Set To Rediscover Auckland As It Farewells Rotorua - The Birthplace Of Tourism NIWA: Students Representing New Zealand At The ‘Olympics Of Science Fairs’ Forging Pathway For International Recognition

NIWA: Students Representing New Zealand At The ‘Olympics Of Science Fairs’ Forging Pathway For International Recognition Coalition to End Big Dairy: Activists Protest NZ National Dairy Industry Awards Again

Coalition to End Big Dairy: Activists Protest NZ National Dairy Industry Awards Again Infoblox: Dancing With Scammers - The Telegram Tango Investigation

Infoblox: Dancing With Scammers - The Telegram Tango Investigation