Kiwi Small Businesses Less Confident About 2013 - Survey

Media Release

11

December 2012

Kiwi Small Businesses Less Confident About 2013 - Survey

A survey has revealed that New Zealand small businesses are less confident about their prospects than they were a year ago. And while 28 per cent of small Kiwi firms expect the economy to shrink in 2013, 64 per cent still expect to see some growth in their own businesses.

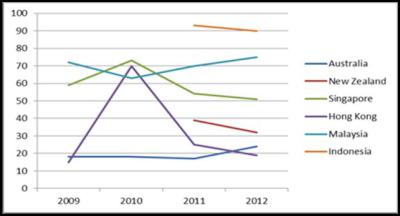

The results of the CPA Australia Asia-Pacific Small Business Survey 2012 show that, for most small businesses across the region, continued tough economic conditions are weighing on confidence levels (see Figure 1).

CPA Australia Country Manager for New Zealand David Jenkins said while New Zealand small business confidence levels are comparatively low, they are still slightly better than their counterparts in Australia and Hong Kong. “Overall the results show that small businesses in New Zealand, Australia and Hong Kong have similar expectations of little or no growth. This isn’t surprising if you look back over the past year. Only ten per cent of New Zealand small businesses increased employee numbers, and only 13% say they will hire in 2013 – the lowest in the region.

“But on the positive side, 64% of Kiwi small businesses do expect to see some growth in 2013.”

Mr Jenkins said that demographics may be playing a part in the results. “The survey clearly shows that growth and employment expectations are higher in younger businesses and younger respondents. It follows that the higher proportion of older businesses and older respondents in New Zealand – and Australia for that matter – may have affected their responses.”

Another key area explored by the survey is access to finance. Mr Jenkins says it was interesting to note that while the majority of New Zealand small businesses expect some growth in 2013, only 40% say they will need additional funding to help achieve it.

“The most common activities being considered by Kiwi small businesses to support their growth in 2013 are increased marketing and promotion activity (33 per cent say they will undertake such activity), following up on late payments from customers (36 per cent) and debt reduction (24 per cent), which are all positive signs of committing to growth.”

The survey results highlighted a number of important issues for policymakers to consider, says Mr Jenkins. “Small businesses are the engine room of our economy and so it’s important that regulators and policymakers understand what they can do to help fuel this growth.

“Firstly, responsible economic management by governments builds small business confidence and the likelihood of hiring new staff. Secondly, reasonable access to finance helps fuel small business growth, and this needs to be monitored regularly. Thirdly, it must be as easy as possible to set up and run a small business, especially for young people who tend to be highly motivated and more confident about growth. Governments must keep focusing on reducing the compliance burden.

“Finally, the results of our survey over the past four years indicate that business skill levels vary greatly amongst small businesses. Providing access to knowledge and training on business management will drive greater productivity and growth. Governments should therefore work with education institutions, industry associations and accountants to ensure these resources are available to our small businesses.”

--

Notes:

1. The CPA Australia

Asia-Pacific Small Business Survey 2012 was conducted with

1,764 owners or senior managers of businesses with less than

20 employees in Australia, Hong Kong, Malaysia, Singapore,

New Zealand and Indonesia. The New Zealand sample comprised

258 participants. The survey measured growth prospects,

hiring intentions, access to finance and management

activities, and was conducted in October 2012. The full

report can be accessed here.

2. A

fact sheet summarising the New Zealand results is attached

to this email. An image of David Jenkins is available on

request.

3. Relevant graphs

from survey, as referenced in media release

above:

Figure 1: Small business expectations for

their business – 2009 to 2012

Click for big version.

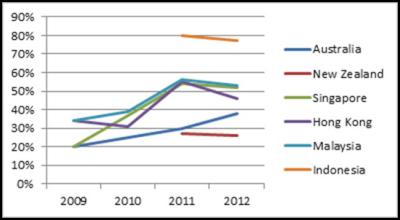

Figure 2: Percentage of small businesses that have a business loan – 2009 to 2012

Click for big version.

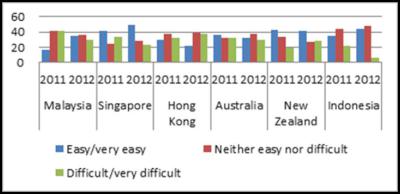

Figure 3:

Ease in obtaining funds – 2001 vs

2012

Click for big version.

4. CPA Australia’s five tips for small businesses to manage in difficult times:

1. Reduce your reliance on external debt

2. Improve your productivity

3. Review your cost structures for savings

4. Adopt appropriate risk management strategies

5. Review your business plan for the changed environment

About CPA Australia:

CPA Australia is one of the world's largest accounting bodies, representing more than 139,000 finance, accounting and business professionals in 114 countries. With a proud 125-year history, CPA supports its members with education, training and technical support, and has a particular emphasis on providing rewarding career pathways for top accounting graduates. CPAs are recognised as strategic business leaders and New Zealand members include senior finance professionals from some of the country’s largest public and private sector organisations. CPA Australia advocates not only on behalf of its members, but also on behalf of public interest. The organisation is committed to New Zealand and actively works with government and regulatory bodies to continuously improve standards and confidence in the local accounting and finance sector. For more information please visit www.cpaaustralia.co.nz

ENDS

Dominion Road Business Association: Auckland Transport's 'Bus To The Mall' Campaign: A Misuse Of Public Funds And A Blow To Local Businesses

Dominion Road Business Association: Auckland Transport's 'Bus To The Mall' Campaign: A Misuse Of Public Funds And A Blow To Local Businesses Parrot Analytics: A Very Parrot Analytics Christmas, 2024 Edition

Parrot Analytics: A Very Parrot Analytics Christmas, 2024 Edition Financial Markets Authority: Individual Pleads Guilty To Insider Trading Charges

Financial Markets Authority: Individual Pleads Guilty To Insider Trading Charges Great Journeys New Zealand: Travel Down Memory Lane With The Return Of The Southerner

Great Journeys New Zealand: Travel Down Memory Lane With The Return Of The Southerner WorkSafe NZ: Overhead Power Lines Spark Safety Call

WorkSafe NZ: Overhead Power Lines Spark Safety Call Transpower: Transpower Seeks Feedback On Electricity Investment Short-list For Upper South Island

Transpower: Transpower Seeks Feedback On Electricity Investment Short-list For Upper South Island