Lack Of Listings Impacts On September Real Estate Market

News Release 8 October

2012

Lack Of Listings Impacts On September Real Estate Market

Summary

• Sales

up 8 per cent year on year

• National median

house price just below record median

• National

days to sell has fallen by 13 days since February (46 days

to 33 days)

• New record median house price for

Auckland and Nelson/Marlborough regions

• 20% of

all sales for the month of September were auction sales, a

new national record

A shortage of new listings is causing buyers to make rapid decisions lifting house prices around the country .

“The traditional rush of spring listings has not eventuated this year and the market is tightening as buyers face a limited choice of offerings,” said REINZ Chief Executive Helen O’Sullivan.

“This has been reflected by increases in the median price across much of the country.”

“Auckland continues to be the key region in terms of price increases and demand for housing, however, other regions are now starting to see pressure building with the median price in five regions within 10% of their record medians and the number of days to sell falling quite rapidly in some parts of the country.”

Data from the Real Estate Institute of New Zealand (REINZ) shows there were 5,653 unconditional sales in September, an increase of 418 sales (+8.0%) compared with the same time last year and a fall of 6.3% compared to August. Over the past 10 years September sales have averaged 2.2% higher than August, indicating that sales this September were weaker than average.

The national

median house price increased by $1,000 from $370,000 in

August to $371,000 in September; an increase of 0.3%.

Auckland’s median house price moved up 1.9 per cent

compared to August to a new record median price of $515,000.

Nelson/Marlborough also reached a new record median price of

$353,000. The national median house price is up 6.0%

compared to September last year and is $1,000 below the

record median price set in June this year.

Sales

volumes

Eight regions recorded increases in

sales volume compared to September last year, with Central

Otago Lakes recording an increase of 25.9%, followed by

Auckland with 17.4% and Waikato/Bay Of Plenty with 15.1%.

Only two regions recorded increases in sales in September

compared to August, with Otago recording a 12.8% increase

and Central Otago Lakes a 7.4% increase. Taranaki recorded

a 22.1% fall in sales in September compared to August, with

Southland recording a 21.5% fall and Manawatu/Wanganui a

16.4% fall in sales.

Prices

For the month of

September, Nelson/Marlborough recorded the highest lift in

prices for the month with an increase of 7.0%, followed by

Manawatu/Wanganui with 5.1%, and Wellington with 4.2%.

Compared to September 2011, Southland recorded the highest

lift in prices with an increase of 17.0%, followed by

Central Otago Lakes with 14.4% and Auckland with 8.4%.

The REINZ Stratified House Price Index, which adjusts for some of the variations in mix that can impact on the median price, is 5.0% higher than September 2011 and is now at a new record high. The House Price Index for Other South Island also set a new record high in September.

Days to sell

The national

median days to sell improved by two days in September

compared to August, from 35 to 33 days, with the number of

days to sell also improving by four days compared to

September 2011. Since February this year the number of days

to sell has fallen by 13 days, from 46 days in February to

33 days in September, with Taranaki and Southland regions

seeing the number of days to sell over the same period fall

by 22 days, Waikato/Bay Of Plenty seeing a fall of 21 days

and Central Otago Lakes seeing a fall of 18 days. Auckland

region saw a fall of eight days and Canterbury/Westland a

fall of six days.

For the month of September, Canterbury/Westland and Southland recorded the shortest days to sell at 29 days, followed by Auckland with 30 and Otago with 32 days. Northland recorded the longest number of days to sell at 72 days, followed by Hawkes Bay with 46 days and Central Otago Lakes with 45 days. Over the past 10 years the median days to sell for the month of September has averaged 34 days across New Zealand.

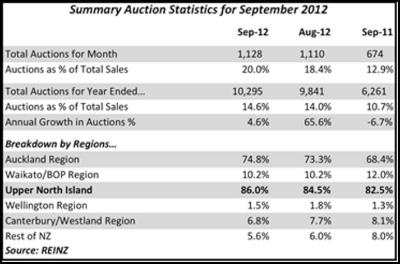

Auctions

Nationally

there were 1,128 dwellings sold by auction in September

representing 20.0% of all sales, up from 674 sales in

September 2011 representing 12.9% of all sales. This is a

new national record for the percentage of sales by auction

and beats the previous high of 18.4% reached in August 2012.

Auction sales in Auckland also reached a new record with

more than 37% of all sales in the region in September sold

by auction.

Transactions in Auckland again dominated the auction market, representing 74.8% of the national total of auction sales. 37.4% of all dwelling sales in Auckland were by this method in September; this was up strongly from the 24.0% of sales by auction in September 2011. Sales by auction in Waikato/Bay Of Plenty accounted for 10.2% of the national total, Canterbury/Westland accounted for 6.8% of the national total, and all other regions combined accounted for the remaining 8.2% of auction sales in September 2012.

Click for big version.

Further Data

Across New Zealand the total value of residential sales, including sections was $2.62 billion in September, compared to $2.79 billion in August, and $2.27 billion in September 2011. For the 12 months ended September 2012 the total value of residential sales was $31.59 billion.

The breakdown of the value of properties sold in September 2012 is:

$1 million

plus 245 4.3%

$600,000 to$999,999 877 15.5%

$400,000

to $599,999 1,421 25.1%

Under

$400,000 3,110 55.0%

All Properties

Sold 5,653 100.0%

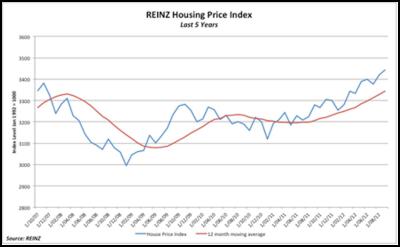

REINZ Stratified

Median Housing Price Index

The REINZ Housing

Price Index increased 0.6% in September compared with August

to sit at 3,442.1,a new record high. The REINZ Housing

Price Index also recorded a new record high in Other South

Island. Wellington and Other South Island recorded

increases in September, while Auckland, Christchurch and

Sections recorded falls. Compared to September 2011 the

REINZ Housing Price Index rose 5.0%, Auckland rose 8.4% and

Christchurch 2.3%.

Click for big version.

* CAGR

is Compound Annual Growth Rate

* The Christchurch

data needs to be treated with some caution due to

compositional changes in the suburb mix caused by the

earthquakes in the city

REINZ Stratified Median Housing Price Index Chart

Click for big version.

REINZ_Residential_Market_Statistics_September_2012.pdf

REINZ_Regional_Data__September_2012.pdf

--

investment

and rental properties, visit www.realestate.co.nz

- REINZ's official property directory

website.

Editor’s

Note:

The monthly REINZ residential sales

reports remain the most contemporary and up-to-date

statistics on house prices and sales in New Zealand. They

are based on actual sales reported by real estate agents.

These sales are taken as of the date that a transaction

becomes unconditional and includes sales as of 5:00pm on the

last business day of the month. Other surveys of the

residential property market are based on information from

Territorial Authorities regarding settlement and the receipt

of documents by the relevant Territorial Authority from a

solicitor. As such, this information involves a lag of four

to six weeks before the sale is recorded by the Territorial

Authority.

The REINZ Monthly Housing Price Index is

calculated using a technique known as stratification, which

provides an averaging of sales prices for common groups of

houses. This approach is considered a more robust analysis

of actual house price trends and was developed in

conjunction with the Reserve Bank.

The REINZ

Monthly Housing Price Index is based on a value of 1000 in

January 1992, the first month for which electronic

information is available. Changes in the index represent

movements in housing prices, where the mix of sales between

the groups is held constant and are more likely to reflect

genuine property price

movements.

ENDS

Dawn Aerospace: Historic Flight - Breaks Sound Barrier And Global Records

Dawn Aerospace: Historic Flight - Breaks Sound Barrier And Global Records SEEK: SEEK NZ Employment Report - October

SEEK: SEEK NZ Employment Report - October University of Auckland: Protecting Young Minds With AI

University of Auckland: Protecting Young Minds With AI Greenpeace: Greenpeace Calls On Fonterra Investors To Consider Big Picture With Giant Puzzle

Greenpeace: Greenpeace Calls On Fonterra Investors To Consider Big Picture With Giant Puzzle Hugh Grant: How New Tech Helps Kids Love Soccer More

Hugh Grant: How New Tech Helps Kids Love Soccer More Bill Bennett: Download Weekly - 100% claim lands One New Zealand in criminal court action

Bill Bennett: Download Weekly - 100% claim lands One New Zealand in criminal court action