Financial Worry to Prompt Cut in Christmas Spending

Financial Worry to Prompt Cut in Christmas Spending

Concern over finances has prompted Kiwis to tighten the purse strings over the Christmas period, with more than two-thirds of people less likely to spend on non-essentials compared to the same time last year.

These findings are from the latest Dun & Bradstreet (D&B) Consumer Credit Expectations Survey, which measures expectations for savings, credit usage, spending and debt performance during the December quarter 2012.

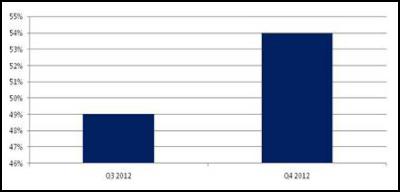

The survey reveals that more than half of Kiwis (54 per cent) are worried about their current financial situation, a figure which is up five per cent quarter-on-quarter. At the same time, expectations for spending over the Christmas season are low, with two in three New Zealanders (68 per cent) less likely to spend on non-essentials and only five per cent more likely to purchase non-essential items such as entertainment or beauty treatments.

Additionally, 63 per cent of people intend to avoid making major purchases* in the December quarter, while 18 per cent plan to delay a purchase they previously intended to make. Sixty-two per cent of people are also less likely to use credit or a loan to buy the things they want compared to the same time last year.

Concern over financial situation, Q3 2012 – Q4 2012

According to Dun & Bradstreet’s New Zealand General Manager, John Scott, D&B data indicates consumers will remain conservative on spending at a time where most retailers hope to see a surge in sales.

“We are seeing increased concern about consumer finances flowing through to expectations for spending and credit usage. At the same time, the cost of living is rising, and heightened caution** since the global financial crisis has encouraged many New Zealanders to save, or pay down their debt, rather than spend. As a result, most consumers are adopting a prudent approach this Christmas.”

These findings come off the back of the latest Statistics New Zealand data, which reveals an increase in the Consumer Price Index. Basic items such as electricity and vegetables are becoming more expensive, as are non-essentials such as overseas holidays and international air fares.

Expectations for credit usage are also down quarter-on-quarter – only four per cent of people intend to apply for a new credit card, compared with six per cent in the September quarter 2012. D&B data also indicates that more than half of New Zealanders do not plan to increase their credit limit, down seven percentage points quarter-on-quarter and down 25 percentage points year-on-year.

Concern over finances is also evident from the number of consumers anticipating difficulties paying off their credit bills in the December quarter, with 27 per cent of New Zealanders falling into this category.

At the same time, D&B data also indicates that nearly one in four people would be unable to survive for longer than a month on their savings, if they lost their job tomorrow. Eleven per cent would last only two to three months on their savings alone, and just four per cent could survive for seven to 12 months.

“Despite more conservative consumer expectations and

an improvement in household saving rates, a portion of

people still experience difficulties meeting their credit

obligations. Many New Zealanders struggle with elevated

levels of debt and are dependent on each pay cheque to fund

day-to-day expenses.”

*Major

purchases refer to items such as a car, television, home

improvement project or a holiday.

** This is

according to the Reserve Bank’s Financial Stability Report

for May 2012, which can be found here.

Note:

This national

survey was conducted online on behalf of D&B by TNS Global

from 10-17 September, surveying 930 respondents aged 18-64

years.

Ngā Pae o te Māramatanga: Māori Concerns About Misuse Of Facial Recognition Technology Highlighted In Science

Ngā Pae o te Māramatanga: Māori Concerns About Misuse Of Facial Recognition Technology Highlighted In Science Retail NZ: Retailers Call For Flexibility On Easter Trading Hours

Retail NZ: Retailers Call For Flexibility On Easter Trading Hours WorkSafe NZ: Worker’s Six-Metre Fall Prompts Industry Call-Out

WorkSafe NZ: Worker’s Six-Metre Fall Prompts Industry Call-Out PSGR: Has MBIE Short-Circuited Good Process In Recent Government Reforms?

PSGR: Has MBIE Short-Circuited Good Process In Recent Government Reforms? The Reserve Bank of New Zealand: RBNZ’s Five Year Funding Agreement Published

The Reserve Bank of New Zealand: RBNZ’s Five Year Funding Agreement Published Lodg: Veteran Founders Disrupting Sole-Trader Accounting in NZ

Lodg: Veteran Founders Disrupting Sole-Trader Accounting in NZ