More Of The Same For The Property Market

Media release

11th September

2012

More Of The Same For The Property Market

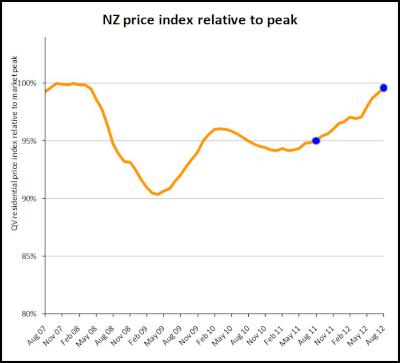

Nationwide residential property values continue to rise according to the latest QV index for August. Values have risen 1.6% in the past three months, 4.8% over the past year, and are now only 0.4% below the market peak of 2007.

Click for big version.

Jonno Ingerson, QV.co.nz Research Director said “the

main centres continue to lead the growth in national values,

with values increasing fastest in Auckland. Wellington and

Tauranga are the notable exceptions, with values in both

remaining steady for the past few months. Outside of the

main centres values in most areas have remained relatively

stable for the past year”.

“Across most of the country there are a few common trends; a shortage of listings leading to a lack of choice for buyers, first home buyers are active due to low interest rates, investors are back in the market for properties that can return a good yield, and it appears that there are about to be more properties coming onto the market as we head into spring” said Ingerson.

“Typically at this time of the year we would expect to see more properties come onto the market, with the number of sales increasing each month from now through to November. This trend looks set to continue in most parts of the country this year, although the low level of stock may constrain the number of sales in some areas” said Ingerson.

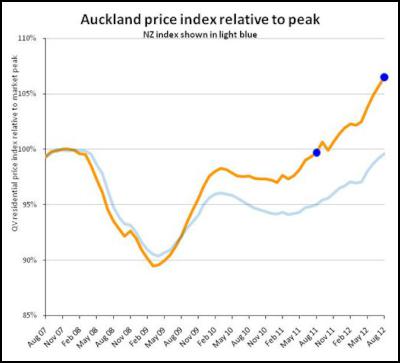

Auckland

Values in the

wider Auckland area have risen 2.6% over the past three

months and 6.8% over the past year.

Over the past year values have increased the most in old Auckland City, where they are up by 7.7%, but Manukau (up 6.8%), Waitakere (6.2%) and North Shore (6.0%) aren’t far behind. In the past three months Manukau has increased the most (up 3.2%) with the other three areas mentioned up between 2.3% and 2.7%.

Compared to the previous market peak in late 2007 values in the wider Auckland area are now 6.5% higher, with the old Auckland City up 9.3% since peak, North Shore up 5.1%, Manukau 3.9% and Waitakere 2.5%.

QV Valuer Jan O’Donoghue said “there hasn’t been the same heat in the Auckland market over the past month as we have seen for much of the past year. Buyer enquiry dipped, and a few properties were selling below expectations. This is in stark contrast to the strong activity through winter, and came as something of a surprise”.

“There are pockets of property close to the CBD, such as Sandringham and Mt Albert, where values are catching up to the rest of central Auckland, and so recent increases in value have been quite strong” said O’Donoghue.

“The amount of properties on the market is still low meaning many potential buyers can’t find the properties they want. Despite the recent slowdown in activity, we expect the market to pick up over the next few months, especially with the number of new listings increasing as you would expect at this time of year” said O’Donoghue.

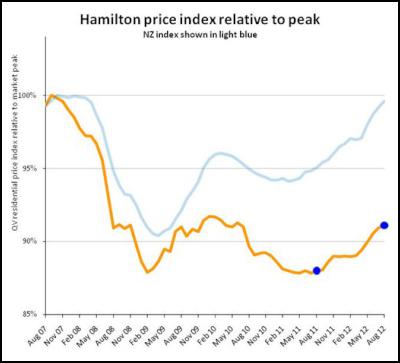

Hamilton and

Tauranga

Values in Hamilton have risen 1.3% over

the past three months, and are now 3.5% higher than the same

time last year. First home buyers and investors are driving

the lower end of the market while there has been a steady

level of sales and enquiry at the upper end of the market.

This positive activity is likely to carry on through

spring.

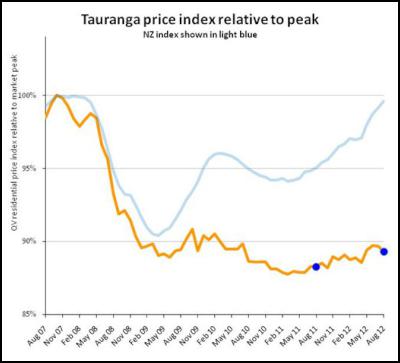

In Tauranga values have faltered in recent months

and are only 1.2% above the same time last

year.

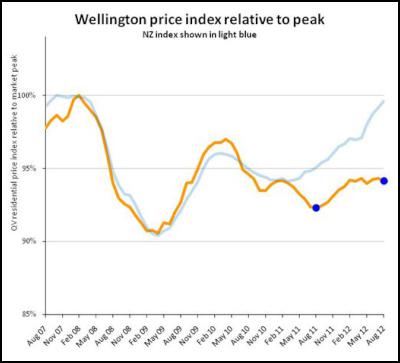

Wellington

In

the Wellington area values have been flat for the past six

months, and as a result are only 2.0% above the same time

last year.

QV Valuer Pieter Geill said “there is still a lack of choice for many buyers who have been searching for some time, but like other main centres there are signs that people are now preparing their properties for sale in spring. Although confidence is still low overall, some top end properties have been selling well and first home buyers are still actively looking for homes and smaller apartments”.

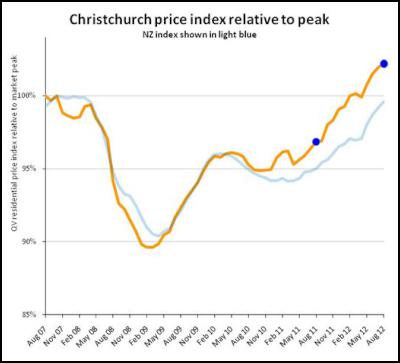

Christchurch

Values in

Christchurch have risen 5.5% over the past year and 1.4%

over the past three months.

QV Valuer Daryl Taggart said “There is still strong demand for properties in the least affected parts of Christchurch, and areas that have been largely repaired. The strongest activity, and the most competition, is in the $300,000 to $400,000 range. It’s not great news for the bargain hunters, with shorter listing times, multi offer situations and strong bidding becoming features of these areas. On the other hand it’s good for the vendors who are securing good prices on suitable terms”.

“In contrast the affected areas of the city, including the eastern and hill suburbs, have stumbled through the last few months, with limited volumes of sales. For some home owners in these areas repair dates are still a long way out” said Taggart.

“Properties in the TC3 (technical category three) zone have not been selling well with buyer resistance to the amount of damage still to be repaired” said Taggart.

As has been the case for most of the past year, values in the Waimakariri and Selwyn Districts are increasing faster than anywhere else in the country, with both now well above the 2007 market peak. Waimakariri is up 13.4% over the past year, and Selwyn up 14.4%.

QV Valuer Daryl Taggart said “the townships in these areas offer a good lifestyle alternative, with many in close proximity to work opportunities that are now on the periphery of Christchurch. These areas are generally more affordable than the well performing Christchurch City areas and have good township amenities”.

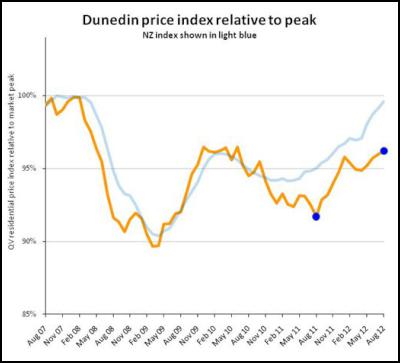

Dunedin

Values in

Dunedin have increased 1.1% in the past three months, and up

4.9% over the past year.

QV Valuer Tim Gibson said

“there is strong interest at the lower end of the market

with good turnouts at open homes. Affordable, well presented

properties are getting multiple offers particularly in good

suburban areas such as Mosgiel. There continues to be a

shortage of good properties on the

market”.

Provincial centres

Values

in most of the provincial centres have remained relatively

stable, with changes over the past year falling within a

2.2% band. The exception is Gisborne, which is down 3.6%

over the past

year.

Residential

Property - Monthly price index

Time period: as

at August 2012

| Territorial authority | Average sale

price over the past 3 months | Property Value

Growth Over the past 12 months based on the QV index | |

| Far North | 307,616 | 0.5% | |

| Whangarei | 303,395 | 0.5% | |

| Kaipara | 269,810 | -3.2% | |

| Auckland - Rodney | 523,052 | 4.1% | |

| Hibiscus Coast | 508,983 | 4.6% | |

| Rodney (North) | 542,107 | 3.7% | |

| #A | Auckland - North Shore | 642,968 | 6.0% |

| Coastal North Shore | 735,465 | 4.8% | |

| North Shore Onewa | 507,668 | 8.0% | |

| North Harbour | 668,288 | 6.5% | |

| #A | Auckland - Waitakere | 426,321 | 6.2% |

| #A | Auckland - City | 659,639 | 7.7% |

| Auckland City (Central) | 567,739 | 9.6% | |

| Auckland City (East) | 819,063 | 6.1% | |

| Auckland City (South) | 604,532 | 9.4% | |

| Islands | 528,657 | -1.7% | |

| #A | Auckland - Manukau | 485,635 | 6.8% |

| Manukau East | 607,305 | 6.9% | |

| Manukau Central | 364,593 | 6.7% | |

| Manukau North West | 439,997 | 4.3% | |

| #A | Auckland - Papakura | 387,531 | 5.0% |

| Auckland - Franklin | 403,941 | 5.6% | |

| Thames Coromandel | 428,980 | 1.8% | |

| Hauraki | 270,400 | -1.0% | |

| Waikato | 268,329 | -8.0% | |

| Matamata Piako | 271,831 | -4.3% | |

| # | Hamilton | 351,517 | 3.5% |

| Hamilton North East | 431,309 | 3.3% | |

| Central City/North West | 314,095 | 3.0% | |

| Hamilton South East | 324,160 | 3.1% | |

| Hamilton South West | 306,846 | 4.5% | |

| Waipa | 335,518 | -0.2% | |

| Otorohanga | N/A | N/A | |

| South Waikato | 152,542 | -4.7% | |

| Waitomo | 205,769 | 3.0% | |

| Taupo | 351,886 | -2.1% | |

| Western BOP | 383,277 | -8.6% | |

| # | Tauranga | 396,079 | 1.2% |

| Rotorua | 282,672 | -0.5% | |

| Whakatane | 333,828 | -3.0% | |

| Kawerau | N/A | N/A | |

| Opotiki | N/A | N/A | |

| Gisborne | 227,075 | -3.6% | |

| Wairoa | N/A | N/A | |

| Hastings | 309,730 | 0.9% | |

| # | Napier | 327,352 | -2.1% |

| Central Hawkes Bay | 204,432 | 5.4% | |

| New Plymouth | 327,598 | 1.4% | |

| Stratford | 205,769 | -0.7% | |

| South Taranaki | 211,037 | 1.0% | |

| Ruapehu | 167,060 | -7.6% | |

| Wanganui | 222,067 | -0.2% | |

| Rangitikei | 157,558 | -3.7% | |

| Manawatu | 255,805 | 3.4% | |

| # | Palmerston North | 287,558 | 1.9% |

| Tararua | 141,469 | -4.5% | |

| Horowhenua | 185,732 | -3.6% | |

| Kapiti Coast | 344,677 | -1.0% | |

| #W | Porirua | 403,058 | 3.5% |

| #W | Upper Hutt | 354,143 | 1.9% |

| #W | Hutt | 372,388 | 1.0% |

| #W | Wellington | 502,319 | 2.0% |

| Wellington City & Southern Suburbs | 512,592 | 0.8% | |

| Eastern Suburbs | 537,222 | 5.2% | |

| North Wellington | 456,236 | 1.9% | |

| Western Suburbs | 556,561 | 1.4% | |

| Masterton | 221,275 | -1.8% | |

| Carterton | 250,342 | -0.2% | |

| South Wairarapa | 307,357 | 0.5% | |

| Tasman | 360,653 | 0.0% | |

| # | Nelson | 372,513 | 2.2% |

| Marlborough | 314,623 | 0.8% | |

| Kaikoura | N/A | N/A | |

| Buller | 228,199 | 11.0% | |

| Grey | 252,725 | -1.0% | |

| Westland | 240,410 | -1.0% | |

| Hurunui | 294,119 | 7.8% | |

| Waimakariri | 359,719 | 13.4% | |

| # | Christchurch | 387,955 | 5.5% |

| East | 308,358 | 5.9% | |

| Hills | 506,465 | 6.7% | |

| Central City and North | 439,944 | 4.6% | |

| Southwest | 375,025 | 7.8% | |

| Banks Peninsula | 420,206 | 5.4% | |

| Selwyn | 434,779 | 14.4% | |

| Ashburton | 281,313 | 8.8% | |

| Timaru | 258,197 | 5.4% | |

| MacKenzie | N/A | N/A | |

| Waimate | 179,355 | 5.6% | |

| Waitaki | 228,152 | 7.0% | |

| Central Otago | 305,557 | 3.3% | |

| Queenstown Lakes | 562,135 | -0.1% | |

| # | Dunedin | 275,525 | 4.9% |

| Central/Northern City | 282,386 | 2.9% | |

| Peninsula/Coastal Dunedin | 239,943 | 6.3% | |

| Southern City | 271,053 | 6.3% | |

| Taieri | 286,301 | 6.0% | |

| Clutha | 174,190 | -0.2% | |

| Southland | 201,667 | 1.5% | |

| Gore | 186,277 | 5.5% | |

| # | Invercargill | 217,333 | 1.4% |

| Auckland Area | 569,705 | 6.8% | |

| Wellington Area | 442,411 | 2.0% | |

| # | Main Urban Areas | 472,265 | 5.5% |

| Total NZ | 423,569 | 4.8% |

Notes

on the above data:

1. The information included in the above table is calculated based on the sales data entered into QV's system for the previous 3 month period. For example, information for the period ending June will be calculated based on sales entered between April 1 and June 30.

2. Property Value Growth is the annual % change in residential property values, calculated using QV's House Price Index methodology. The residential sales entered into QV's system for previous 3 month period are compared to the same period of the previous year to identify the annual % change in residential property values. Average Sale Prices are calculated based on residential sales entered into QV's system for the previous 3 month period.

3. Any of the statistical data shown in italics are calculated based on a sample set of data that is less than the recommended minimum. These results should be used with caution. Those showing N/A had too few sales to generate an index

Click for big version.

Click for big version.

Click for big version.

Click for big version.

Click for big version.

Click for big version.

ENDS

Science Media Centre: Government Plans To Double Mineral Exports By 2035 – Expert Reaction

Science Media Centre: Government Plans To Double Mineral Exports By 2035 – Expert Reaction University of Canterbury: AI-powered Tool To Combat Rising Wildfire Danger

University of Canterbury: AI-powered Tool To Combat Rising Wildfire Danger NZ Certified Builders: BCITO And NZCB Announce Apprentice Challenge 2025

NZ Certified Builders: BCITO And NZCB Announce Apprentice Challenge 2025 NIWA: Seasonal Climate Outlook February To April 2025

NIWA: Seasonal Climate Outlook February To April 2025 Bill Bennett: Are New Zealand's Submarine Links Safe?

Bill Bennett: Are New Zealand's Submarine Links Safe? Bill Bennett: DeepSeek Shock Could Spur AI Space Race

Bill Bennett: DeepSeek Shock Could Spur AI Space Race