August Real Estate Market Sets Strong Platform For Spring

News Release 10 September

2012

August Real Estate Market Sets Strong Platform For Spring

Summary

• Sales

up over 16 per cent year on year

• Auckland

property market continues to strengthen

• House

prices up 2.5 per cent nationally since July

• REINZ Stratified House Price Index at all

time high nationally, and again in Auckland and

Christchurch

• New record level of auction sales

for the month of August

Signs of a modest revival in the housing market are being confirmed by a lift in sales and prices in August.

Data from the Real Estate Institute

of New Zealand (REINZ) shows there were 6,035 unconditional

sales in August, an increase of 843 sales (+16.2%) compared

with the same time last year and an increase of 2.2%

compared to July.

The national median house price

increased by $9,000 from $361,000 in July to $370,000 in

August, an increase of 2.5%. Auckland’s median house

price moved up 1.1 per cent, from the $500,000 level it has

stayed steady on for three months, to reach a new record

median price of $505,500. The national median house price

is up 4.2% compared to August last year.

Sales

volumes

All regions recorded increases in

sales volume compared to August last year, with Northland

recording an increase of just under 31%, followed by

Auckland with 25.6% and Taranaki with 22.2%. Seven regions

recorded increases in sales in August compared to July, with

Central Otago Lakes recording a 25.0% increase, Southland an

11.2% increase and Nelson/Marlborough an 8.9% increase.

Taranaki recorded a 14.0% fall in sales in August compared

to July, with Manawatu/Wanganui recording an 8.2% fall and

Wellington a 2.8% fall in sales.

Prices

For the month of

August, Nelson/Marlborough recorded the highest lift in

prices for the month with an increase of 9.6%, followed by

Taranaki with 7.3%, and Southland with 5.9%.

Compared to August 2011, Auckland recorded the highest lift in prices with an increase of 11.6%, followed by Canterbury/Westland with 6.2% and Wellington with 5.2%.

The REINZ Stratified House Price Index, which adjusts for some of the variations in mix that can impact on the median price, is 6.1% higher than August 2011 and is now at a new record high. The House Price Indices for Auckland and Christchurch also set new record highs in August.

“House buyers in Auckland are increasingly driving the New Zealand real estate market with a widening gap opening up between the dynamics of the Auckland market and the rest of the country. While both Auckland and Christchurch recorded new record median prices during the month it is the strong sales volume growth in Auckland that is most notable,” said REINZ Chief Executive Helen O’Sullivan. “Normally at this time of year we see a dip in sales volumes; this year, apart from the weather, winter was cancelled in Auckland. Across the rest of the country while we are continuing to see rising sales volumes, prices continue to reflect the general caution around the economic outlook. In many parts of the country we are also seeing shortages of houses available for sale, often a market feature at the end of winter, although expectations for a rush of listings in the spring are not strong.”

“This increased level of activity does need to be seen in context of an overall housing market that is still subdued and with prices yet to catch-up with increases in the consumer price index over the last five years.”

“A sure sign that housing market was back to normal levels of activity would be turnover reaching the pre 2008 long run average. This has yet to happen.”

Days to sell

The national

median ‘days to sell’ improved by three days in August

compared to July, from 38 to 35 days, with the number of

days to sell also improving by four days compared to August

2011. Over the past 10 years the median days to sell for

the month of August has averaged 36 days across New

Zealand.

Auckland recorded

the shortest days to sell at 30 days, followed by

Canterbury/Westland with 33 and Otago with 37 days.

Northland recorded the longest number of days to sell at 76

days, followed by Taranaki and Central Otago Lakes with 58

days.

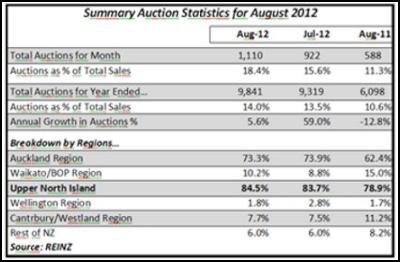

Auctions

Nationally

there were 1,110 dwellings sold by auction in August

representing 18.4% of all sales, up from 588 sales in August

2011 representing 11.3% of all sales. This is a new

national record for the percentage of sale by auction and

beats the previous high of 16.2% reached in March 2012.

Auction sales in Auckland also reached a new record with

more than one in three sales in the region in August sold by

auction.

Transactions in Auckland again dominated the auction market, representing 73.3% of the national total of auction sales. Just over a third, 34.2%, of all dwelling sales in Auckland were by this method in August; this was up strongly from the 19.4% of sales by auction in August 2011. Sales by auction in Waikato/Bay Of Plenty accounted for 10.2% of the national total, Canterbury/Westland accounted for 7.7% of the national total, and all other regions combined accounted for the remaining 8.8% of auction sales in August 2012.

Click for big version.

Further Data

Across New Zealand the total value of residential sales, including sections was $2.79 billion in August, compared to $2.62 billion in July, and $2.18 billion in August 2011. For the 12 months ended August 2012 the total value of residential sales was $31.24 billion.

The breakdown of the value of properties sold in August 2012 is:

$1 million plus 252 4.2%

$600,000

to$999,999 912 15.1%

$400,000 to

$599,999 1,507 25.0%

Under

$400,000 3,364 55.7%

All Properties

Sold 6035 100.0%

REINZ Stratified

Median Housing Price Index

The REINZ Housing

Price Index increased 1.3% in August compared with July to

sit at 3,420.1 to reach a new record high. The REINZ

Housing Price Index also once again recorded new record

highs in Auckland and Christchurch. By contrast,

Wellington’s measure remains 4.6% below its peak, set in

October 2009. Wellington, Other North Island and Other

South Island recorded falls in August. Compared to August

2011 the REINZ Housing Price Index rose 6.1%, Auckland rose

11.5% and Christchurch 9.3%.

Click for big version.

* CAGR is Compound Annual Growth

Rate

* The Christchurch data needs to be treated

with some caution due to compositional changes in the suburb

mix caused by the earthquakes in the

city

REINZ Stratified Median Housing Price

Index Chart

Click for big version.

REINZ_Residential_Market_Statistics__August_2012.pdf

ENDS

Stats NZ: Total Greenhouse Gas Emissions Fall 0.7 Percent In The September 2024 Quarter

Stats NZ: Total Greenhouse Gas Emissions Fall 0.7 Percent In The September 2024 Quarter Takapuna Beach Business Association: Takapuna Outpaces Auckland With Strong Economic Growth In 2024

Takapuna Beach Business Association: Takapuna Outpaces Auckland With Strong Economic Growth In 2024 Commerce Commission: Bed, Bath And Beyond Sentenced Over Record Number Of Unsafe Products

Commerce Commission: Bed, Bath And Beyond Sentenced Over Record Number Of Unsafe Products GE Free NZ: Minister Reti Asked For Two Week Delay Of Select Committee Deadline

GE Free NZ: Minister Reti Asked For Two Week Delay Of Select Committee Deadline Science Media Centre: Government Plans To Double Mineral Exports By 2035 – Expert Reaction

Science Media Centre: Government Plans To Double Mineral Exports By 2035 – Expert Reaction University of Canterbury: AI-powered Tool To Combat Rising Wildfire Danger

University of Canterbury: AI-powered Tool To Combat Rising Wildfire Danger