Main centres push national values up

Media release

10th July 2012

Main centres push national values up

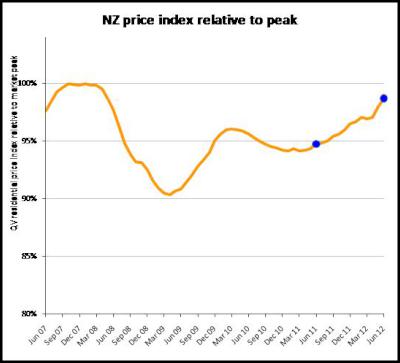

Nationwide residential property values have risen again in June according to the latest QV index. Values are up 1.8% over the past three months, 4.2% up over the past year, and are now only 1.3% below the previous market peak of late 2007.

Jonno Ingerson, QV.co.nz Research Director said “all the main centres have increased in value over the past year, and all apart from Wellington have increased over the past three months. The fastest increasing areas are Auckland and Christchurch. There is more variability in the provincial centres and smaller towns across the country, as values in those areas respond to local economic influences”.

Ingerson said “sales activity has been significantly higher in the last few months than it has been for several years, with Auckland again stronger than most other areas. In contrast, the number of new listings coming onto the market has slowed considerably in recent months meaning reduced choice for potential purchasers. As a result sales activity is likely to slow in the coming months until the number of properties for sale once again increases, which typically will occur in spring”.

“Despite the number of sales being up on recent years, and values increasing, we are not experiencing a boom. Nationwide, the current number of sales is still around one third below peak levels, and over the past year values have increased only one third as quickly as they did in the boom years 2003 to 2007. Even in Auckland the rapid increase in values over the past few months is less than the rate seen in the boom years. Overall, New Zealander’s remain cautious around house buying and selling decisions”.

Auckland

Values in the wider Auckland

area are up 5.9% over the past year, but recent months have

seen more rapid growth with values up 1.0% over the past

month and up 2.6% over the past three months.

Values are increasing the fastest in the old Auckland city, up 6.8% over the past year, followed by 5.6% in North Shore and Manukau.

Across the Auckland area values are now 4.8% higher than the 2007 market peak and in old Auckland City values are 7.6% higher than this previous peak.

QV Valuer Glenda Whitehead said “the shortage of listings and strong buyer demand in many Auckland suburbs is pushing value levels up to varying degrees. The leafy inner city suburbs continue to show the strongest value lifts, but this upward pressure has also now filtered out widely in all directions, as buyers are forced to look wider to meet their needs within their affordability range”.

“Subject to stock being available, there appears to be firm market conditions with good activity level for the winter period. Run-down properties in the central area are selling extremely well with buyers intending to fully redevelop the sites, and as always, there is good demand in popular school zones”.

“First home buyers continue to step into the market and professional couples are either trading up or upgrading their current homes. Investors are active in areas where return levels are adequate, but they are increasingly being outbid by first home buyers. Many buyers are refinancing to take advantage of favourable interest rates and banks competing for business”.

“New builds in many new subdivisions, such as the Ormiston – Flat Bush area, are selling relatively quickly leading to further projects being initiated. A steady supply of housing in new subdivisions now seems evident. Sections within new subdivisions are either now coming to the market vacant or via developer build-sell projects. Infill housing is taking place in some older developed suburbs, where zoning allows, or investors are land banking suitable sites for the future”.

Hamilton

Values in Hamilton have risen 1.7%

over the past three months, and are now 2.9% higher than the

same time last year. In contrast to Auckland, values in

Hamilton remain 9.5% below the 2007 market

peak.

Tauranga

Tauranga values have continued their

gradual increase, up 1.0% over the past three months and

2.1% above the same time last year. Like Hamilton, values in

Tauranga remain well below the 2007 market peak, currently

sitting 10.3% below their peak at that

time.

Wellington

While values in the Wellington area

have increased over the past year by 1.4% this is much more

modest than the other main centres. Values have been flat or

decreased slightly in the past few months in the cities

across the Wellington area, as concern around public service

restructuring continues to dampen confidence. Values in the

Wellington areas are currently 5.8% below the previous

market peak.

Christchurch

Values in Christchurch have

risen 5.8% over the past year and 1.3% over the past three

months to now sit 1.5% above the previous market peak of

late 2007.

The Waimakariri and Selwyn Districts continue to increase in value faster than anywhere else in the country, with both now well above the previous market peak. Waimakariri is up 13.4% over the past year and 12.2% above the 2007 peak, and Selwyn is up 12.2% over the past year and is 11.1% above peak.

QV Valuer Daryl Taggart said “just as stocks of residential sections were dwindling, new stages within some of the city’s larger subdivisions and within new developments have started to take shape. There now looks to be a good supply of sections becoming available in the coming months with plenty of choice across the city and surrounding townships.”

Dunedin

Values in Dunedin

have been variable over the past few months but are now 2.8%

above the same time last year and 4.3% below the 2007

peak.

“The winter slow down has started taking affect with few enquiries coming in, and agents are reporting a lack of good listings. Properties that aren’t well presented are tending to hang around. Typically, lower valued properties are the only ones performing well in the market” said QV Valuer Tim Gibson.

Provincial

centres

Most of the provincial centres have values within

2% of this time last year. The exceptions are Rotorua and

Gisborne which are down 2.3% and 3.6% respectively, while

steadily increasing values over the past six months mean

that Palmerston North and Invercargill are 2.1% and 2.0% up

respectively on this time last year.

Residential

Property - Monthly price index

Time period: as at June

2012

Territorial authority Average sale

price

over the past 3 months Property Value

Growth

Over the past 12 months

based on the QV

index

Far

North 305,842 -0.7%

Whangarei 304,793 1.7%

Kaipara 331,213 -12.4%

Auckland

- Rodney 510,808 2.6%

Hibiscus

Coast 505,796 3.5%

Rodney

(North) 518,386 1.6%

#A Auckland - North

Shore 627,824 5.6%

Coastal North

Shore 714,711 4.5%

North Shore

Onewa 510,387 7.7%

North

Harbour 632,475 5.8%

#A Auckland -

Waitakere 423,960 5.1%

#A Auckland -

City 627,411 6.8%

Auckland City

(Central) 553,128 9.2%

Auckland City

(East) 781,107 5.0%

Auckland City

(South) 576,361 7.7%

Islands 571,056 0.3%

#A Auckland -

Manukau 480,441 5.6%

Manukau East 604,608 7.3%

Manukau Central 352,308 4.5%

Manukau North

West 432,424 3.8%

#A Auckland -

Papakura 377,314 4.4%

Auckland -

Franklin 401,367 5.6%

Thames

Coromandel 405,125 -1.8%

Hauraki 238,189 1.3%

Waikato 253,469 -2.1%

Matamata

Piako 270,981 -1.1%

# Hamilton 344,945 2.9%

Hamilton North East 424,091 3.0%

Central City/North

West 311,934 2.7%

Hamilton South

East 318,892 2.3%

Hamilton South

West 297,727 2.8%

Waipa 342,688 3.4%

Otorohanga N/A N/A

South

Waikato 147,344 0.0%

Waitomo N/A N/A

Taupo 352,975 -2.0%

Western

BOP 359,135 -7.8%

# Tauranga 399,662 2.1%

Rotorua 284,775 -2.3%

Whakatane 321,413 -2.9%

Kawerau N/A N/A

Opotiki N/A N/A

Gisborne 248,679 -3.6%

Wairoa N/A N/A

Hastings 322,026 0.7%

# Napier 339,882 -1.7%

Central

Hawkes Bay 228,441 -1.1%

New

Plymouth 323,537 1.4%

Stratford 182,146 -8.0%

South

Taranaki 228,986 1.9%

Ruapehu 165,604 -9.3%

Wanganui 219,046 -2.0%

Rangitikei 182,554 -5.1%

Manawatu 256,172 4.3%

# Palmerston

North 289,951 2.1%

Tararua 169,789 -3.3%

Horowhenua 197,205 -6.5%

Kapiti

Coast 363,550 0.3%

#W Porirua 389,686 1.2%

#W Upper

Hutt 349,670 1.3%

#W Hutt 374,365 1.1%

#W Wellington 511,317 1.5%

Wellington City & Southern Suburbs 533,307 0.3%

Eastern Suburbs 556,827 4.1%

North

Wellington 449,649 1.6%

Western

Suburbs 560,363 1.1%

Masterton 241,283 -0.5%

Carterton 235,681 1.8%

South

Wairarapa 294,467 3.6%

Tasman 380,409 -0.6%

# Nelson 371,446 1.8%

Marlborough 324,094 1.7%

Kaikoura N/A N/A

Buller 209,563 11.0%

Grey 255,429 0.4%

Westland 232,653 -1.5%

Hurunui 303,231 9.1%

Waimakariri 367,302 13.4%

# Christchurch 382,925 5.8%

East 302,086 5.7%

Hills 516,870 4.6%

Central City and North 426,833 4.0%

Southwest 372,420 9.5%

Banks

Peninsula 418,124 0.4%

Selwyn 429,506 12.2%

Ashburton 273,841 7.8%

Timaru 250,670 5.4%

MacKenzie N/A N/A

Waimate 181,680 2.0%

Waitaki 214,395 3.3%

Central

Otago 300,347 2.9%

Queenstown

Lakes 584,163 0.1%

# Dunedin 279,360 2.8%

Central/Northern City 298,671 0.9%

Peninsula/Coastal Dunedin 249,701 4.7%

Southern

City 261,934 3.5%

Taieri 282,614 4.7%

Clutha 168,905 1.6%

Southland 209,042 3.4%

Gore 190,049 3.3%

# Invercargill 220,971 2.0%

Auckland

Area 550,035 5.9%

Wellington Area 447,962 1.4%

# Main

Urban Areas 461,368 4.9%

Total

NZ 417,824 4.2%

Notes on the above data:

1.

The information included in the above table is calculated

based on the sales data entered into QV's system for the

previous 3 month period. For example, information for the

period ending June will be calculated based on sales entered

between April 1 and June 30.

2. Property Value Growth is

the annual % change in residential property values,

calculated using QV's House Price Index methodology. The

residential sales entered into QV's system for previous 3

month period are compared to the same period of the previous

year to identify the annual % change in residential property

values. Average Sale Prices are calculated based on

residential sales entered into QV's system for the previous

3 month period.

3. Any of the statistical data shown in

italics are calculated based on a sample set of data that is

less than the recommended minimum. These results should be

used with caution. Those showing N/A had too few sales to

generate an

index

Bill Bennett: Download Weekly - Review Of 2024

Bill Bennett: Download Weekly - Review Of 2024 Bill Bennett: One NZ scores worldwide first as Starlink direct-to-mobile launches

Bill Bennett: One NZ scores worldwide first as Starlink direct-to-mobile launches Hugh Grant: How To Reduce Network Bottlenecks

Hugh Grant: How To Reduce Network Bottlenecks Dominion Road Business Association: Auckland Transport's 'Bus To The Mall' Campaign: A Misuse Of Public Funds And A Blow To Local Businesses

Dominion Road Business Association: Auckland Transport's 'Bus To The Mall' Campaign: A Misuse Of Public Funds And A Blow To Local Businesses Parrot Analytics: A Very Parrot Analytics Christmas, 2024 Edition

Parrot Analytics: A Very Parrot Analytics Christmas, 2024 Edition Financial Markets Authority: Individual Pleads Guilty To Insider Trading Charges

Financial Markets Authority: Individual Pleads Guilty To Insider Trading Charges