Property values vary across the country

Media release

12th April

2012

Property values vary across the

country

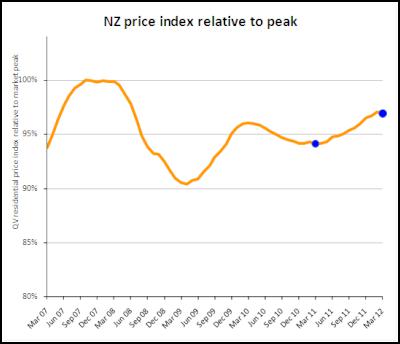

Nationwide residential property

values eased slightly in March according to the latest QV

index. Despite the slight drop in the last month, values are

still up 0.5% over the past three months and 3.0% up over

the past year. Values are now 3.0% below the previous market

peak of late 2007.

QV.co.nz Research Director, Jonno

Ingerson said “the marginal drop in values last month

follows a year of slight month on month increases. These

increases were driven initially by Auckland and Canterbury

but the rest of the main centres have also been increasing

over the past few months. It is too early to say if the drop

in the latest month represents a change in direction for the

market”.

Ingerson said “sales activity remained strong in March, returning to the highest levels since 2009. Activity levels have been bolstered by first home buyers having enough confidence to enter the market, while some existing home owners are now ready to make a move they may have been delaying for several years. The level of sales activity is still being constrained by a lack of supply in some areas, particularly Auckland, Christchurch and parts of Wellington.”

“The market remains variable across the

country, responding to local economic influences. Most of

the main centres have been increasing, most of the

provincial centres have been more or less stable, and the

rural centres have generally been increasing over the past

year” Ingerson

said.

Auckland

Values

in the wider Auckland area are up 0.8% over the past

quarter, and 5.0% up over the past year. This annual

increase is more than any of the other main centres and as a

result values are now 2.2% above the previous market

peak.

In the most recent month values have either steadied or dropped slightly in Rodney, North Shore, old Auckland City, and Manukau, and as a result the wider Auckland area has eased slightly. It is too soon to say if this is the beginning of a changing trend in the market or just a temporary dip.

The old Auckland City remains the fastest growing part of the Auckland Area, up 6.9% over the year and now 4.8% above the 2007 market peak. The Southern part of the old Auckland City within the area from Mt Eden to Waterview to Blockhouse Bay to Penrose has risen 8.8% over the past year and is now 6.1% above the previous market peak.

“Quality properties in good school zones and near the city centre remain in high demand. However there are insufficient properties coming onto the market to meet this demand which is tending to put upward pressure on prices” said QV Valuer Glenda Whitehead.

“In central areas, where zoning will allow, we are starting to see infill housing sites being created, with seemingly good demand for these vacant sections either from spec builders or potential owner/occupiers” said Whitehead.

Across the rest of Auckland values are up 4.4% over the past year in Papakura, 4.2% in Waitakere, 3.8% in North Shore and 3.1% in Manukau. All these areas have risen more in the past year than any of the other main centres apart from Christchurch which has risen 4.1%.

Hamilton

Values in

Hamilton have been steady for the past five months, but

increases in the months prior to that mean that values are

currently 1.2% up over the past year and 11.0% below the

previous market peak.

“Anecdotal evidence indicates

there has been renewed interest in residential property in

Hamilton over the last couple of months. Homes in the middle

to upper end of the market appear to be selling best with

less demand for homes in the bottom end of the market”

said QV Valuer Richard

Allen.

Tauranga

Tauranga

values have been relatively steady for the past six months,

and are 1.3% above the same time last year and 11.1% below

the 2007 market peak.

“There are some signs appearing

in the Tauranga market that a trickle down affect is

occurring from the growing Auckland market. Some buyers are

starting to perceive they are getting more relative value in

comparison. At this stage the market remains generally

steady” said QV Valuer Shayne

Donovan-Grammer.

Wellington

Over

the past twelve months values first dropped for six months,

then rose for the next six months to currently sit 0.1%

above the same time last year. Values are currently 5.9%

below the previous market peak.

QV Valuer Kerry Buckeridge said “activity in the market place is anything but static at the moment. Real estate agents continue to report being very busy since the beginning of the year as people returned from holiday with a “let’s get on with it” attitude. However despite a flurry of listings early in the year there are now emerging signs of a stock shortage in some areas. There remain good levels of activity in the first home buyer market, while higher end properties with the “X factor” have been achieving multiple offers at tender”.

Christchurch

Values in

Christchurch have risen 1.1% over the past three months and

4.1% over the past twelve months. Christchurch values are

now 0.2% above the 2007 market peak.

The areas neighbouring Christchurch are increasing in value faster than anywhere else in the country. Waimakariri District has increased 13.3% over the past year and Selwyn District 10.4%. Both areas are also the most above the previous market peak with Waimakariri 7.9% higher and Selwyn 6.8% higher.

“Demand in towns surrounding Christchurch continues to be high, especially as more contractors and their families start moving into the area to help with the rebuild. Whilst many seem to welcome the opportunity to work in the region, some are worried about another earthquake and want to live away from previously damaged areas. There are reports of some workers who are commuting daily from as far away as Ashburton” said QV Valuer Richard Kolff.

“Feedback from agents also suggests that many people are only selling when they have to, such as if they are a growing family and need more room. This is resulting in low levels of listings and is in turn pushing up prices” said Kolff.

Dunedin

Up until a couple

of months ago Dunedin values had been amongst the fastest

increasing in the country. Values have dropped slightly in

the last two months but are still up 0.2% over the past

three months and 2.6% up over the past year.

“Sales in the lower end of the market are occurring quite quickly with multiple offers evident. This is in contrast to the higher end properties where buyers are remaining hesitant” said QV Valuer Tim Gibson.

Provincial

centres

Over the past three months values

have increased between 1% and 2% in Rotorua, Palmerston

North and Invercargill. Gisborne has dropped 1% with the

other main provincial centres staying more or less

steady.

Over the past year Whangarei has increased 3.1%, Nelson 1.8% and Palmerston North 1.1%. Wanganui is down 4.3% over the year, Gisborne down 2.0%, Napier down 1.7%, Hasting down 1.3% and Queenstown Lakes down 1.1%. Values in Rotorua, New Plymouth and Invercargill are within 1% of last year.

ENDS

| Residential Property - Monthly price index | |||

| Time period: as at March 2012 | |||

| Territorial authority | Average sale

price over the past 3 months | Property Value

Growth Over the past 12 months based on the QV index | |

| Far North | 329,542 | -3.2 | |

| Whangarei | 321,800 | 3.1 | |

| Kaipara | 304,774 | -3.4 | |

| Auckland - Rodney | 510,623 | 2.0 | |

| Hibiscus Coast | 493,501 | 1.4 | |

| Rodney (North) | 534,809 | 3.1 | |

| #A | Auckland - North Shore | 586,719 | 3.8 |

| Coastal North Shore | 652,863 | 2.6 | |

| North Shore Onewa | 475,364 | 6.3 | |

| North Harbour | 653,046 | 3.1 | |

| #A | Auckland - Waitakere | 403,053 | 4.2 |

| #A | Auckland - City | 611,028 | 6.9 |

| Auckland City (Central) | 537,610 | 7.6 | |

| Auckland City (East) | 769,797 | 5.4 | |

| Auckland City (South) | 554,572 | 8.8 | |

| Islands | 567,111 | -2.2 | |

| #A | Auckland - Manukau | 463,342 | 3.1 |

| Manukau East | 560,952 | 5.6 | |

| Manukau Central | 357,886 | 2.8 | |

| Manukau North West | 417,726 | 0.7 | |

| #A | Auckland - Papakura | 361,615 | 4.4 |

| Auckland - Franklin | 378,842 | 2.7 | |

| Thames Coromandel | 432,370 | -2.8 | |

| Hauraki | 247,934 | 0.8 | |

| Waikato | 279,152 | -7.1 | |

| Matamata Piako | 260,141 | -4.4 | |

| # | Hamilton | 332,597 | 1.2 |

| Hamilton North East | 414,703 | 0.4 | |

| Central City/North West | 299,371 | 1.6 | |

| Hamilton South East | 311,053 | 1.5 | |

| Hamilton South West | 291,751 | 0.7 | |

| Waipa | 322,859 | 1.5 | |

| Otorohanga | N/A | N/A | |

| South Waikato | 153,726 | -3.8 | |

| Waitomo | N/A | N/A | |

| Taupo | 367,429 | -1.0 | |

| Western BOP | 375,678 | -6.1 | |

| # | Tauranga | 391,568 | 1.3 |

| Rotorua | 263,520 | 0.1 | |

| Whakatane | 330,464 | -8.9 | |

| Kawerau | N/A | N/A | |

| Opotiki | N/A | N/A | |

| Gisborne | 256,096 | -2.0 | |

| Wairoa | N/A | N/A | |

| Hastings | 320,069 | -1.3 | |

| # | Napier | 328,787 | -1.7 |

| Central Hawkes Bay | 222,229 | -1.5 | |

| New Plymouth | 323,631 | -0.6 | |

| Stratford | 219,788 | -0.1 | |

| South Taranaki | 197,491 | 3.6 | |

| Ruapehu | 165,694 | -2.5 | |

| Wanganui | 217,661 | -4.2 | |

| Rangitikei | 190,806 | 1.6 | |

| Manawatu | 250,170 | 0.6 | |

| # | Palmerston North | 287,811 | 1.1 |

| Tararua | 161,591 | -5.4 | |

| Horowhenua | 194,223 | -1.4 | |

| Kapiti Coast | 364,527 | 0.8 | |

| #W | Porirua | 397,968 | 0.6 |

| #W | Upper Hutt | 336,812 | 0.1 |

| #W | Hutt | 371,847 | -1.1 |

| #W | Wellington | 501,399 | 0.6 |

| Wellington City & Southern Suburbs | 489,688 | 0.8 | |

| Eastern Suburbs | 557,470 | 1.5 | |

| North Wellington | 451,960 | 0.5 | |

| Western Suburbs | 579,969 | -0.2 | |

| Masterton | 240,666 | -3.8 | |

| Carterton | 233,167 | -4.2 | |

| South Wairarapa | 319,007 | -1.7 | |

| Tasman | 372,942 | 1.6 | |

| # | Nelson | 362,190 | 1.8 |

| Marlborough | 322,021 | -1.2 | |

| Kaikoura | N/A | N/A | |

| Buller | 234,422 | 10.1 | |

| Grey | 240,447 | -5.4 | |

| Westland | 208,712 | -4.2 | |

| Hurunui | 319,357 | 10.0 | |

| Waimakariri | 356,818 | 13.3 | |

| # | Christchurch | 388,629 | 4.1 |

| East | 317,937 | 3.1 | |

| Hills | 490,088 | 0.7 | |

| Central City and North | 435,374 | 3.9 | |

| Southwest | 365,821 | 5.5 | |

| Banks Peninsula | 458,042 | 1.5 | |

| Selwyn | 404,947 | 10.5 | |

| Ashburton | 258,369 | 8.2 | |

| Timaru | 245,730 | 3.1 | |

| MacKenzie | N/A | N/A | |

| Waimate | N/A | N/A | |

| Waitaki | 198,779 | 5.3 | |

| Central Otago | 297,355 | 0.7 | |

| Queenstown Lakes | 508,438 | -1.1 | |

| # | Dunedin | 272,137 | 2.6 |

| Central/Northern City | 280,718 | 2.3 | |

| Peninsula/Coastal Dunedin | 266,045 | 2.1 | |

| Southern City | 254,045 | 3.9 | |

| Taieri | 281,024 | 1.9 | |

| Clutha | 159,766 | 1.1 | |

| Southland | 201,317 | 6.1 | |

| Gore | 185,236 | 2.7 | |

| # | Invercargill | 213,812 | 0.7 |

| Auckland Area | 529,508 | 5.0 | |

| Wellington Area | 437,705 | 0.2 | |

| # | Main Urban Areas | 444,009 | 3.6 |

| Total NZ | 402,317 | 3.0 | |

| Notes on the above data: 1. The information included in the above table is calculated based on the sales data entered into QV's system for the previous 3 month period. For example, information for the period ending June will be calculated based on sales entered between April 1 and June 30. 2. Property Value Growth is the annual % change in residential property values, calculated using QV's House Price Index methodology. The residential sales entered into QV's system for previous 3 month period are compared to the same period of the previous year to identify the annual % change in residential property values. Average Sale Prices are calculated based on residential sales entered into QV's system for the previous 3 month period. 3. Any of the statistical data shown in italics are calculated based on a sample set of data that is less than the recommended minimum. These results should be used with caution. Those showing N/A had too few sales to generate an index | |||

ENDS

Bill Bennett: Download Weekly - How would NZ telecoms cope with another cyclone

Bill Bennett: Download Weekly - How would NZ telecoms cope with another cyclone NZ On Air: Firm Audience Favourites Lead NZ On Air Non-Fiction Funding

NZ On Air: Firm Audience Favourites Lead NZ On Air Non-Fiction Funding Insurance and Financial Services Ombudsman: Woman Gets $40k More After Disputing Insurer’s Decision

Insurance and Financial Services Ombudsman: Woman Gets $40k More After Disputing Insurer’s Decision BNZ: A Quarter Of Older NZers Fear Going Online Due To Scam Concerns

BNZ: A Quarter Of Older NZers Fear Going Online Due To Scam Concerns University of Auckland: Scientists Develop Tool To Monitor Coastal Erosion In Fine Detail

University of Auckland: Scientists Develop Tool To Monitor Coastal Erosion In Fine Detail Oji Fibre Solutions: OjiFS Proposes To Discontinue Paper Production At Kinleith Mill

Oji Fibre Solutions: OjiFS Proposes To Discontinue Paper Production At Kinleith Mill