ASB Cuts Fixed Home Loan Interest Rates

Tuesday, 1 November 2011, 10:12 am

Tuesday, 1 November 2011, 10:12 am

Press Release: ASB Bank

ASB Cuts Fixed Home Loan Interest Rates

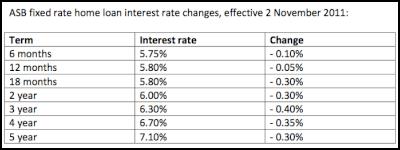

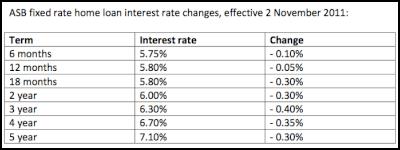

ASB is

reducing its fixed home loan interest rates by up to 0.40%.

The new rates are effective from tomorrow, Wednesday

2 November. They include a 0.40% reduction in the 3 year

rate to 6.30% per annum; a 0.35% reduction in the 4 year

rate to 6.70% per annum; and a 0.30% percent reduction to 18

month, 2 year and 5 year rates to 5.80%, 6.00% and 7.10% per

annum respectively.

"We are passing on the benefits

of movement in wholesale funding rates to our customers. Our

fixed home loan rate reductions mean ASB now offers the most

competitive 18 month, 3, 4 and 5 year fixed rates among the

major banks," said ASB Executive General Manager Strategy,

Payments and Product, Catherine McGrath.

Advertisement - scroll to continue reading

© Scoop Media

Helping you get one step ahead.

In 1847, ASB opened as the Auckland Savings Bank with the pledge: 'to serve the community; to grow and to help Kiwis grow'. And that is very much what ASB is about today.

ASB is a leading provider of integrated financial services in New Zealand including retail, business and rural banking, funds management and insurance.

ASB strives to consistently provide its customers with outstanding service and innovative financial solutions. They're dedicated to providing simple financial products that allow their customers to bank with them how and when they want.

We all have our own ways to measure progress, and our own stories about the things that matter to us. Whatever way you choose to measure progress, and whatever your goals, ASB is there to help you get one step ahead.

NZAS: New Zealand Association Of Scientists Awards Celebrate The Achievements Of Scientists And Our Science System

NZAS: New Zealand Association Of Scientists Awards Celebrate The Achievements Of Scientists And Our Science System Stats NZ: Retail Spending Flat In The September 2024 Quarter

Stats NZ: Retail Spending Flat In The September 2024 Quarter Antarctica New Zealand: International Team Launch Second Attempt To Drill Deep For Antarctic Climate Clues

Antarctica New Zealand: International Team Launch Second Attempt To Drill Deep For Antarctic Climate Clues Vegetables New Zealand: Asparagus Season In Full Flight: Get It While You Still Can

Vegetables New Zealand: Asparagus Season In Full Flight: Get It While You Still Can  Bill Bennett: Download Weekly - How would NZ telecoms cope with another cyclone

Bill Bennett: Download Weekly - How would NZ telecoms cope with another cyclone NZ On Air: Firm Audience Favourites Lead NZ On Air Non-Fiction Funding

NZ On Air: Firm Audience Favourites Lead NZ On Air Non-Fiction Funding