Alan Bollard: Speech to Deloitte Tax Conference

Alan Bollard: Speech to Deloitte Tax Conference

By Alan Bollard

Governor, Reserve Bank of New Zealand

19 November 2010

View the pdf version of The recovery, the aftershock and the economic future (PDF 291KB)

The

Crisis

The Global Financial

Crisis has been the major economic event of our time. As we

continue through the recovery phase and encounter unexpected

aftershocks it is timely to reconsider what this means for

New Zealand.

The Global Financial Crisis was not as harmful as the 1930s Depression, but from that event we learnt that recovery to economic normality can be a slow, fragile, uncertain process with temporary set-backs and aftershocks.

The 2008 Global Financial Crisis has been different from the 1930s: it was widespread and internationally synchronised, it hit deep, but not long. It originated from the banking sector, spread virally across a number of sectors, hit the housing sector particularly hard, and was ultimately arrested by active government stimulus.

The Global Financial Crisis finally troughed in mid-2009 in an internationally-synchronised way. There was general relief as the macroeconomic data became more reassuring, and the very large contractions in economic activity ceased. At that stage our focus turned to what the recovery would look like.

The history of major financial crises shows a consistent pattern emerges: a long period of building up stresses (averaging a decade), a rapid unwinding, then an equally long period of gradual recovery[1].

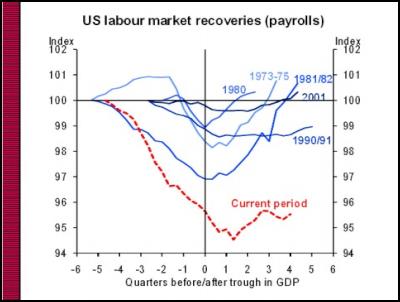

Following regular post-war business downturns that were not associated with financial and banking crises, economies have traditionally recovered speedily and strongly. Not this time in the West. Instead we have seen businesses very cautious about reinvestment, with scarcely any credit growth. In the US, households have been traumatised by the twin fear of losing their jobs and their houses.

We have observed two particular aftershocks to the crisis, neither of which was expected, as countries struggle to rebalance in two distinct ways.

External

Rebalancing

We are seeing

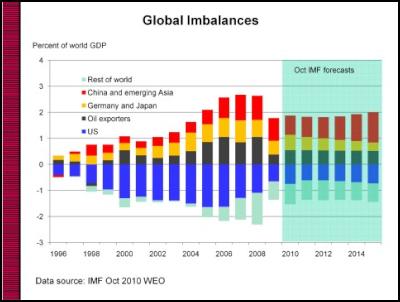

an external “aftershock” playing out across the globe

right at the moment with big movements in exchange rates to

cross-rate extremes not seen for decades. The need to

rebalance externally has been driven by the record build-up

of international imbalances that created the pre-conditions

for the Global Financial Crisis. In short-hand the East was

building trade surpluses, savings and high reserves, while

in the West the opposite was happening.

In late 2009 we saw an initial rebalancing, driven mainly by negative forces: a reduction in spending by Western consumers, a reduction in Western imports, and a deleveraging of Western balance sheets, rather than a shift to an export-led growth recovery. However the forecasts suggest this rebalancing may not continue, and we have not yet reduced these international imbalances to sustainable levels.

In the US these concerns have been manifested in weak labour and housing markets. Up to 30% of mortgagees face negative or near zero equity in their homes and long-term unemployment is stubbornly elevated, with intense political pressures on monetary policy to provide relief.

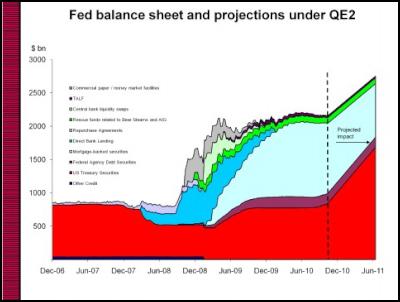

This has led to further moves to inject liquidity in unorthodox ways, referred to by the financial markets as “QE2”. So far these policy measures have had a major effect on equity and bond prices, on capital flows and on exchange rates. They have depressed the $US, generated a new carry trade in $US, and resulted in significant new capital inflows to emerging markets.

The US economy remains weak, with housing and labour markets mired as both households and businesses seek to rebuild impaired balance sheets. This requires a policy prescription of very easy monetary policy. But the growing currency tensions risk unleashing trade conflicts, a development that proved very costly in the 1930s. Many countries expected to have their recovery and external rebalancing aided by a softer currency, and when this did not happen they became very concerned.

Chinese – US economic tensions have risen, as the US sees the RMB staying unnaturally low, a result of the tie to the $US, with much rhetoric but a political reluctance to revalue. The Chinese response has been to increase regional convertibility mechanisms, but only to allow minimal RMB appreciation. As this dispute escalates, there is a risk of Congressional intervention and anti-dumping actions.

In the Eurozone, tensions between Germany and the peripheral PIIGS countries mirror the China-US relationship, with Germany running large current account surpluses via very strong exports, buoyant growth and the euro currency. Hurt most are the Swiss (who have been trying to intervene to depreciate the Swiss franc), and other peripheral European economies outside the EMS.

Japan, with its own economic problems and a strengthening yen, took major unexpected unilateral action in mid-September: a massive (2 trillion yen) sell-off of the Japanese currency. This has had some short-term effects on the value of the yen, but it angered other G-7 economies whose currencies are themselves at risk. In addition it has implications for other East Asian currency regimes, where countries under exchange rate pressure such as Thailand, Taiwan, South Korea and Philippines, could be encouraged to intervene. Other countries such as Malaysia that have been trying to liberalise, may find themselves under pressure to re-impose capital controls.

Internal

rebalancing

The second

aftershock has been a sovereign debt crisis resulting from

the need for countries to rebalance internally. Financial

markets pressured overstretched Western fiscal balance

sheets and the price of debt rose dramatically. Countries

needed to rebalance internally: domestic demand needed to

take over from public demand.

Governments have spent hugely on fiscal stimulus, liquidity injections, and bank support through the crisis. There was a broad expectation that the private sector would take over from public sector stimulus to once again be the engine of growth: businesses would restock and reinvest, and the household sector would regain confidence. But, as local economies slowed, the costs of stimulus and rescues, low tax revenue and high demand for social spending hit government fiscal accounts hard.

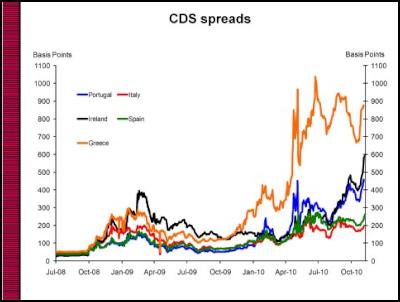

The resulting crisis first burst out in Ireland and the Southern European cluster of countries, collectively labelled the PIIGS, where there had been persistent over-stimulus and loose fiscal management. This profligacy meant that these countries were faced with a premium on their debt (see figure below) and the complex pan-European political and monetary institutions struggled to provide guarantees to bolster this situation, while also ensuring these countries took appropriately tough domestic fiscal actions.

Spurred by these events, financial markets have now also focussed on some more major G-7 sovereign risks, in particular in the UK, US and Japan, where demographic ageing adds pressure to major government funding burdens. With the recession delivering lower tax revenue, higher social spending, and banking sector liabilities, projected government funding requirements in these countries now look very tight, severely limiting the room for future support to (increasingly unorthodox) monetary policy.

Thus private demand in Western countries remains too weak to provide real impetus to the recovery. This reflects excesses prior to the crisis, the current outlook and the limited willingness and limited ability of fiscal policy to come to the rescue.

Of course this has significant imbalances for the New Zealand outlook. Demand from Western countries is gradually improving, but still not very encouraging. The sad US housing story is bad for our wood exports, the UK fiscal retrenchment is hurting our UK tourist numbers and the fragile Japanese recovery restrains our food exports.

Our own internal rebalancing is progressing, but very slowly. Substantial fiscal stimulus helped cushion the economy over the past few years. The fiscal deficit will need to be closed and private demand take over public sector support. Moreover, it appears that some of the fiscal deficit is structural and unwinding this support will subtract from growth for a number of years, with our housing market remaining weak, consumption impaired, balance sheets fragile and businesses remaining cautious. Private demand is still impaired.

What is yet to

come

However at the same

time the strong growth in East Asia and Australia emerging

markets has been very beneficial. These markets were much

less affected by the financial crisis, have themselves

enjoyed strong export prices, and are now being buoyed by

growing domestic demand. Russia, Brazil, energy exporters,

South Africa and the Southern American countries are also in

this group. They are developing a much stronger geopolitical

voice for the G-20.

The Chinese and India stories exemplify this – not by any means a simple picture, but here are two economies with continued strong export demand, government building of infrastructure, and evolving domestic demand. These economies have strong connections to regional growth that will benefit New Zealand indirectly over and above our direct trade exposure.

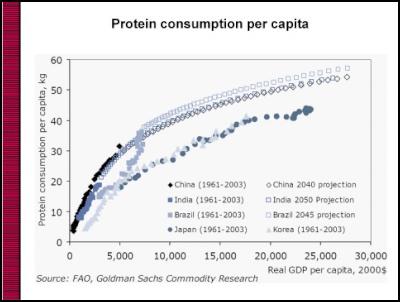

Other medium term implications look particularly interesting for New Zealand. Post-war evidence shows that as emerging markets develop significant middle classes, there is a commensurate increase in demand for protein, increasingly animal-based. That has been the pattern across a number of countries with different cultures in different geographies. Many of these countries are limited in expanding their own food production, by lack of suitable land, lack of water, increasing climatic volatility, and high oil prices. A recent Nomura report[2] argues that real food prices will need to rise significantly.

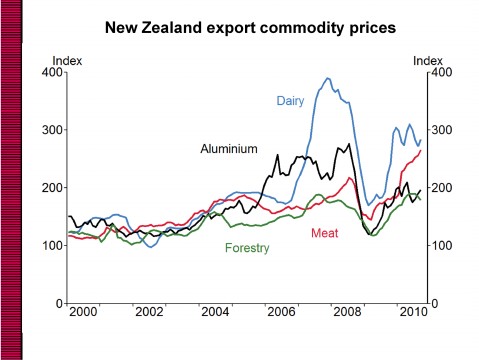

New Zealand is not a huge food producer (not being among the top half dozen producers of any of the world’s key food product groups). However our food exports (as a % of GDP) top the world, and we are the best placed in competitive terms in Nomura’s food vulnerability index. Food trade is volatile in the short term, but these trends are very positive for New Zealand’s terms of trade which have picked up significantly over the last decade.

The other important positive pressure is from Australian growth. The Australian mineral boom is now well documented, and expected to continue, if not intensify. The drivers in China and elsewhere look reasonably sustainable and as a low cost producer, Australia appears better positioned than most to weather any reduction in Chinese prices.

The strength of the mineral boom has meant a strong Australian recovery and a very strong AUD currency. Both of these outcomes are driving strong Australian demand for food and manufacturing exports from a more competitive New Zealand. We are a primary product supplier to Asia, but we need to see ourselves also as a post-primary supplier to Australia.

So the medium-term outlook looks favourable. In the meantime we see New Zealand continuing its recovery. The aftershocks identified so far, and other aftershocks yet to come, mean that this recovery could yet be a prolonged process.

[1] Carmen M. Reinhart & Reinhart, Vincent R. (2010) “After the Fall”, Jackson Hole Symposium

[2] “The coming surge in food prices”, Nomura, Sept 2010.

ENDS

Science Media Centre: Carbon-storing Construction Materials – Expert Reaction

Science Media Centre: Carbon-storing Construction Materials – Expert Reaction Vegetables New Zealand: New Web-Based Tool Will Help Greenhouse Growers Switch To Geothermal Heating

Vegetables New Zealand: New Web-Based Tool Will Help Greenhouse Growers Switch To Geothermal Heating Horizon Research Limited: New Poll - New Zealanders Prefer Rail Enabled Ferries

Horizon Research Limited: New Poll - New Zealanders Prefer Rail Enabled Ferries Watercare: Watercare Gets To Work On First Permanent Non-Potable Water Tanker Filling Station In Māngere

Watercare: Watercare Gets To Work On First Permanent Non-Potable Water Tanker Filling Station In Māngere Alcohol Healthwatch: Licensing Decision Lauded For Prohibiting Buy Now Pay Later Schemes In Bottle Stores

Alcohol Healthwatch: Licensing Decision Lauded For Prohibiting Buy Now Pay Later Schemes In Bottle Stores Motor Industry Association: Vehicle Registrations Up 5.6% In December, But Year-To-Date Sales Reflect Market Challenges

Motor Industry Association: Vehicle Registrations Up 5.6% In December, But Year-To-Date Sales Reflect Market Challenges