Daily Economic Briefing: January 19, 2010

Daily Economic Briefing: January 19,

2010

Click here for the full Research and

disclosures

Global data

summary

• In last week’s DEB and this week’s GDW, we flagged the potential for headline inflation rates in the near term to surprise on the upside on a year-ago basis as commodity prices have almost doubled over this period. This caution was underscored today in the UK by a stronger-than-expected 2.9% CPI reading for December. At the same time, core inflation jumped in line with our expectation (2.8%oya), but this too was above consensus and the BoE’s own projection. While we maintain that the MPC will look through some of the near-term bounce as a one-off event owing to commodity price base-effects and an unwind in last year’s VAT cut, the relative stickiness of underlying price inflation will likely push the central bank to lead most other developed-country majors in the start to policy rate normalization.

• A potential benefit of an unexpected jump in headline inflation rates around the world, even if temporary, is that it could encourage faster policy tightening in those economies where levels of economic activity are recovering swiftly to prior cycle peaks. To wit, should inflation in China quickly jump to the levels seen in 2007, it could induce an earlier appreciation in the CNY, which would also reduce pressure on other EM Asian currencies. The effect would be a shift toward more balanced global growth.

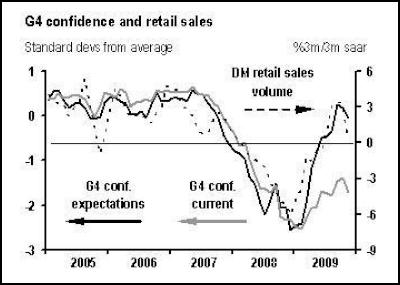

• Consumer sentiment in the developed markets has moved up well from its trough last year but has not yet marked a strong recovery. However, although households in the G-4 remain downbeat about their current conditions, they are considerably more sanguine about the near future. Moreover, consumer expectations have aligned much more closely with the solid recovery underway in developed market retail sales volumes. At the same time, today’s disappointing further move back down in the ESRI consumer sentiment index for Japan highlights the growing wedge between US and Japanese domestic demand prospects as we highlighted on page 2 of the January 13 DEB.

• The US housing market appears to have stalled late last year in response to the tentative ending of the first-time home buyers tax credit. (The credit has now been extended through early summer.) Mortgage applications have dipped, new home sales have started to roll over, and the 16% drop in pending home sales suggests existing home sales have also given up earlier gains. With mortgage rates set to move up and a large backlog of foreclosures, the market has some stiff headwinds. This is underscored by today’s slide in the NAHB survey, which suggests new home sales in January were flat.

• This week’s data will bring further

confirmation that EM Asia is still expanding robustly, with

China to report all of its December activity data (Thu),

4Q09 GDP data from China and Korea (Thu), and Taiwan

December export orders (Wed). Perhaps more importantly, the

release of the January business surveys begins this week.

The Euro area flash PMI (Thu) will be crucial for testing

our view that the recent spate of disappointing data is

temporary and that activity is set to pick up in 1Q10

Click to enlarge

Central banks set to

break ranks

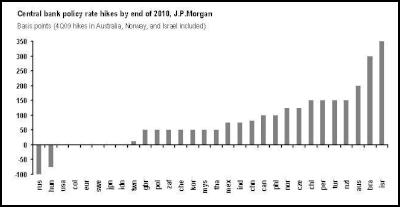

As the global shocks that pummeled financial and economic markets around the world last year have now faded considerably, the historically accommodative, one-size fits all global monetary policy stance is becoming increasingly inappropriate. Although GDP in almost every country J.P.Morgan tracks is set to rise at an above-trend pace in 2010, the magnitude of this rise relative to trend will vary. More importantly, because not all countries entered the downturn in the same cyclical positions, some countries were hit by the downturn harder than others, and some have rebounded more strongly than others, there are wide divergences in the level of activity relative to potential. This makes any analysis gauging the prospective paths to policy normalization an exercise that is inherently region-by-region, or even country-by-country.

In a recent report, we examine a relatively simply bivariate metric to gauge the disparate paths to policy rate normalization (“Central bank exits and FX performance,” Global Issues, December 18, 2009). Specifically, we note that monetary policy decisions will be informed by the traditional metrics—current inflation and economic slack—and that 4Q09 estimates of core inflation relative to central bank targets (headline or core) and the output gap align reasonably well qualitatively with our current projections for central bank hikes, as well as with market expectations.

In today’s DEB, we extend this analysis to the macroeconomic backdrop projected to be in place at the end of this year. In some ways, this exercise may more adequately reflect the forward looking decision making process of most monetary authorities. Moreover, the analysis has the advantage of removing the volatility in inflation from realized commodity price movements (much of which is faded by policymakers). The results are shown in the scatterplot below. Headline inflation projections are used for all countries except the US, where core inflation is used. However, because commodity prices are assumed to be relatively flat, the values provide a clean read of the underlying pace of price inflation in all cases.

The

results are largely consistent with those reported in the

original report, but a much sharper pattern emerges. The

analysis produces three clear groups of countries. The first

group will have a relative small output gap and inflation at

or above target. These are the “Early moves”, and this

includes Australia and Norway (both of which began hiking

rates in 4Q09), as well as China, India, Korea, and Brazil.

China and India have both begun hiking reserve ratios and

are projected to begin hiking rates soon, as are Korea and

Brazil.

The second group has a larger negative output gap

and inflation that is falling below target. This “Low for

long” group includes those banks that are projected to be

on hold for all of much of 2010 and includes the US, Euro

area, and Sweden. The UK and Canada are expected to begin

hiking in 3Q09 but this move will be challenged by the

macroeconomic conditions if our forecasts are right. Indeed,

as noted on page 1, the MPC in the UK will likely be

pressured by the temporary boost to headline inflation

resulting from the VAT hike even as underlying prices edge

down this year.

The last group (“The others”) all share a remarkably deep projected negative output gap for 4Q10 but have a much more diverse inflationary backdrop. Japan will continue to be in the deepest hole among the G10 economies by year-end, and with prices already in outright decline, policy will remain on hold and perhaps dip even further into QE. Consistent with their position in the group, Russia and Hungary are projected to ease further this month, while Turkey, Poland and the Czech Republic are expected to begin hiking in 2H10. Mexico also is expected to begin hiking in response to a rise in inflation pressures from tax hikes and only a mild disinflationary response to slack.

Click to enlarge

Click to enlarge

ENDS

NZ Trucking Association: TruckSafe New Zealand Launches | A Game-Changer For Heavy Vehicle Safety And Compliance

NZ Trucking Association: TruckSafe New Zealand Launches | A Game-Changer For Heavy Vehicle Safety And Compliance Gaurav Mittal, IMI: How Can We Balance AI’s Potential And Ethical Challenges?

Gaurav Mittal, IMI: How Can We Balance AI’s Potential And Ethical Challenges? Science Media Centre: Several US-based Environmental Science Databases To Be Taken Down – Expert Reaction

Science Media Centre: Several US-based Environmental Science Databases To Be Taken Down – Expert Reaction Consumer NZ: Despite Low Confidence In Government Efforts, People Want Urgent Action To Lower Grocery Bills

Consumer NZ: Despite Low Confidence In Government Efforts, People Want Urgent Action To Lower Grocery Bills NZ Banking Association: Banks Step Up Customer Scam Protections And Compensation

NZ Banking Association: Banks Step Up Customer Scam Protections And Compensation The Reserve Bank of New Zealand: CoFR Seeking Feedback On Access To Basic Transaction Accounts

The Reserve Bank of New Zealand: CoFR Seeking Feedback On Access To Basic Transaction Accounts