Confidence fell, firms' own outlook improved

Australia Economic Research

Business confidence fell in New Zealand, but firms' own activity outlook improved

Click here for the full Note and disclosures.

• Business confidence fell for the third straight

month

• A net 43% of those surveyed expect economic

conditions to improve

• Firms’ own activity outlook

more upbeat

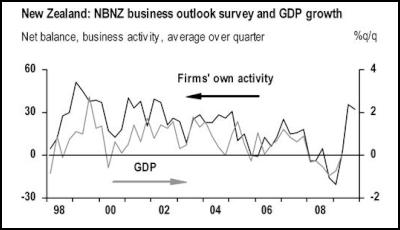

The NBNZ business confidence survey fell in November, falling to 43.4 (J.P. Morgan 47.0) from 48.2. We had anticipated a fall given that, since the last survey, the domestic data have generally disappointed. Economic data have shown a surge in unemployment, subdued wage growth, and softer consumer spending. Offshore, the data have been patchy, although there has been a continued improvement in economic conditions in Australia and New Zealand’s other major trading partners in Asia, which would have prevented an even larger fall in confidence in November.

The survey showed that a net 43.4% of firms believe the state of the New Zealand economy will improve over the next 12 months, compared to a net 48.2% in the previous survey. In contrast to the headline figure, the all important firms’ own activity outlook improved, rising to 33.7 in November from 30.5, confirming that New Zealand economy will continue to expand in coming quarters.

Click for big version

In the detail, slightly fewer respondents expect profits to improve, with a net 11% of respondents expecting profits to rise over the next 12 months (down mildly from 12%). Only a net 11% expect conditions in the commercial construction sector to improve (down from 47% - which marked the largest drop), while a net 45% expect conditions in residential construction to improve (up from 41%).

On a positive note, the employment component returned a positive result, with a net 5% now expecting to hire staff in the next year, compared to -0.3% in the previous survey. Although a net 35% still expect the unemployment rate to rise, this result was better than the 41% recorded in the previous month The investment outlook also improved, with a net 7% (up from 6%) expecting investment to pick up. It appears also that strong NZD has yet to adversely impact export growth expectations, with 24% expecting exports to increase in the next 12 months (up from 22%).

The NBNZ survey is the last piece of top-tier economic data scheduled for release ahead of the RBNZ’s December OCR announcement. The survey today showed that 73% of firms expect the RBNZ to hike the cash rate in the next year, compared to 57% in the October survey The results from the survey today will have few implications for the upcoming RBNZ decision next month. We expect that the RBNZ will reiterate that the OCR will remain “at” the current level until 2H10, and will not be any more hawkish in light of data this week showing that inflation expectations have risen. Inflation expectations may be rising, but other data of late has disappointed.

ENDS

Trademe: Trash To Treasure - Kiwi Make The Most Of Unwanted Christmas Gifts

Trademe: Trash To Treasure - Kiwi Make The Most Of Unwanted Christmas Gifts  Financial Markets Authority: FMA Seeks Clarity From High Court On Use Of Eligible Investor Certificates In Wholesale Investment Sector

Financial Markets Authority: FMA Seeks Clarity From High Court On Use Of Eligible Investor Certificates In Wholesale Investment Sector Scion: Scion’s Novel Internship Model Connects Talent With Industry

Scion: Scion’s Novel Internship Model Connects Talent With Industry Financial Markets Authority: Westpac Admits To Misleading Representations That Resulted In $6.35m In Overcharges

Financial Markets Authority: Westpac Admits To Misleading Representations That Resulted In $6.35m In Overcharges Bill Bennett: Download Weekly - Review Of 2024

Bill Bennett: Download Weekly - Review Of 2024 Bill Bennett: One NZ scores worldwide first as Starlink direct-to-mobile launches

Bill Bennett: One NZ scores worldwide first as Starlink direct-to-mobile launches