NZ employers - considerable drop in confidence

New Zealand employers express considerable drop in

overall confidence in latest Hudson

Report

Confidence remains in-tact in some industries, while down sharply in others

November 25, 2008 – Confidence among New Zealand employers to hiring new staff has fallen considerably. However, 83.5 per cent of employers still intend to hold or increase their existing staff levels.

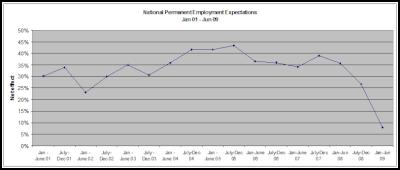

The Hudson Report: Hiring Expectations, a six-monthly survey of New Zealand organisations, shows a positive net effect of 7.9 per cent [All statistics in this survey refer to employment expectations relating to permanent staff, unless otherwise mentioned.] for the period January to June 2009. Net effect refers to the number of employers expecting increases in staff levels less the number expecting decreases [Therefore, for the period of January to June 2009, 24.3 per cent of businesses expect to increase their workforce, 16.5 per cent intend to decrease their workforce and 59.2 per cent intend to maintain their workforce at current levels. ].

The 7.9 per cent result is a considerable decrease of 18.9 percentage points from the previous period of July to December 2008 and is the lowest level recorded since the survey began in 1999.

Hudson’s executive general manager, Marc Burrage, said the results reflected the difficulties employers were having in forecasting future demand. He said the drop in confidence would not necessarily translate into widespread job losses.

“The shocks of the past few months have battered employers’ confidence and made it difficult for them to confidently forecast demand. We expect employers to regain some confidence after the Christmas period if there are no further shocks. In the meantime, it’s important to keep in perspective that most employers are taking a wait-and-see approach.

“Although the percentage of businesses intending to decrease staff has risen slightly from 11.53 to 16.46 per cent, the most notable shift is in those employers planning to increase staff levels which has dropped from 38.29 to 24.33 per cent.

“While there are clearly some sectors such as tourism, manufacturing and retail which are under considerable pressure, other industries such as IT and healthcare remain robust. Demand for skilled employees will continue to be high.”

Click to enlarge

Despite a noticeable drop in employer confidence overall, many industries remain strong

Economic and labour

market conditions

While 2009 has seen a crisis of the

financial system, this has not translated into an economic

crisis – rather a continued cooling of the economy after a

significant period of growth. The financial crisis has

knocked confidence, as the results of this Hudson Report

show. Whether a general loss of confidence will translate

into job losses is uncertain.

Labour market conditions have begun to deteriorate however, with the unemployment rate rising to 4.2 per cent from 3.4 per cent a year ago. At the same time, employment has held together far better than expected given the economy is now in a recession. Due to the skills shortage of the past several years, and the acute difficulty in sourcing staff, for many businesses the economic conditions have simply reduced their excess demand for staff rather than leaving them overstaffed.

Other key findings

By

industry. The industries forecasting negative sentiment

are manufacturing, retail, tourism and hospitality, and

wholesale and distribution. The IT industry continues to be

the most buoyant with 45.6 per cent of businesses expecting

to increase staff levels in the first half of 2009.

Other resilient industries include healthcare, resources

and utilities.

By region. Confidence is down in all

regions since the previous period. The lower North Island is

forecast to be the most stable region in the country,

supported by government and key private sector industries.

The South Island is the hardest hit with 21.7 per cent

of businesses surveyed looking to decrease staff levels in

the first half of 2009. Manufacturing is predicted to be the

most affected, followed by construction, retail and

telecommunications.

Auckland and the remainder of the

upper North Island have indicated areas of strong growth

such as healthcare and IT, but other industries such as

tourism and hospitality, manufacturing and retail are

feeling the pinch.

By size. Continued from the previous period, it is small businesses that are the most buoyant, followed by larger businesses. Medium-sized businesses are finding the current conditions the most challenging.

By Industry

The IT industry continues to make the largest positive contribution to employer sentiment nationally, with a net +36.1 per cent of IT employers reporting an intention to increase permanent staff levels over the coming six months. This result is nevertheless 18.9pp lower than that recorded the previous period.

Employer sentiment in the construction/property/engineering industry continues to fall due to weak residential construction and a steep decline in commercial building. Down 10.9pp from the previous period, a net +6.0 per cent of employers are intending to increase permanent staff levels over the coming six months.

The collapse in the residential housing market has heavily impacted on the financial services industry and several of the major financial institutions are looking to reduce costs by outsourcing support services, moving roles offshore or reducing the size of their management teams. A low net +2.6 per cent of employers are now expecting to increase their permanent staff levels over the coming six months, a considerable 22.3pp lower than that recorded the previous period.

In the professional services industry, a net +12.7 per cent of employers reported an intention to increase permanent staff, down 15.9pp from our last survey.

The manufacturing industry has experienced a 24.5pp decline in employer sentiment, with 29 per cent of employers now intending to reduce permanent staff levels over the coming six months.

In the government sector, a net +14.8 per cent of employers reported an intention to increase permanent staff levels over the coming six months. Down 20.2pp from the previous period, this result reflects the uncertainty government employers were experiencing in the lead up to the election when our survey was carried out.

Employers in the retail industry reported a 25.1pp drop in sentiment, with 25.7 per cent now expecting to reduce permanent staff levels over the coming six months.

In the telecommunications industry, employer sentiment fell 25.1pp with a net +2.5 per cent of employers now intending to increase permanent staff levels over the coming six months.

A net +12.0 per cent of employers in the transport industry reported an intention to increase permanent staff levels over the coming six months, down 19.0pp on the previous period.

“Economic conditions continue to impact differently across industries with a wide variation in sentiment in the upcoming January to June period,” Mr Burrage said.

“Some industries are showing much more resilience in these challenging conditions, but overall we are seeing a continuation of the softening of sentiment witnessed in the last period.”

By

region

Upper North Island: Employer

sentiment in the Upper North Island has dropped 16.3

percentage points as employers come to terms with continued

deterioration in economic conditions. A net 2.8 per cent of

employers reported an intention to increase permanent staff

during the January to June 2009 period.

Employer sentiment in the financial services and insurance industries has declined 8.3 percentage points with a net 2.1 per cent of employers now intending to reduce permanent staff. In the banking sector, major banks are looking to reduce costs by outsourcing support services, moving roles offshore and reducing the size of their management teams.

In the professional services sector, a net 1.3 per cent of companies expect to reduce their permanent staff levels over the coming six months, a considerable 23.1 percentage points lower than the result last period. Most companies are cutting back on engaging professional services consultants and are using in-house staff.

Employer sentiment in the IT industry has fallen 28.2 percentage points as large vendors feel the impact of cuts to technology projects by clients. With a net 20.2 per cent nevertheless intend to increase permanent staff over the coming six months, sentiment in the industry remains relatively strong in comparison to other industries in the region.

“This is linked to ongoing business as usual work for in-house IT teams, ongoing investment in government online strategies and IT projects related to public infrastructure and utilities,” said Mr Burrage.

Manufacturing and retail experienced steep drops with sentiment falling 29 percentage points and 33.6 percentage points respectively.

Lower North Island: A net 17.9 per cent of employers in the Lower North Island have reported an intention to increase permanent staff levels over the January to June 2009 period. Despite being 21 per cent lower than that recorded last survey, this result is nevertheless far higher than the national average.

A key driver of employer confidence in the region is the IT industry, with a net 58.9 per cent of employers intending to increase permanent staff over the coming six months, a result just 0.5 percentage points lower than the previous period. Many projects are still taking place in the government sector, driven by budgets put in place the previous year.

Employer sentiment in the government sector has fallen 20.4 percentage points from 20.4 percentage points to 18.6 per cent.

“This result is almost entirely driven by employers moving away from increasing headcount towards holding steady on headcount. It remains to be seen how the change of government will impact on hiring decisions within government departments.”

South Island: Just 0.3 per cent of employers have reported an intention to increase permanent staff during the January to June 2009 period. Reflecting a deteriorating business conditions in a number of key industries, this result is a considerable 23.1 percentage point drop on that recorded the previous period.

In the manufacturing industry, a net 6.7 per cent of employers reported an intention to reduce permanent staff levels over the coming six months. Down 10.2 percentage points on the previous period, this result is being driven by a number of manufacturing companies implementing redundancies and moving operations offshore.

“Many manufacturing sectors, such as meet processing, furniture manufacture and heavy engineering, appear to be in slow long-term decline, while the high technology sectors such as electronics are managing to hold on.”

Employer sentiment in the construction, property and engineering industries is continuing to fall as a result of the massive decline in commercial construction and commercial building. Down 24.8 percentage points on the previous period, a net 29.2 per cent of employers have indicated an intention to reduce permanent staff levels over the coming six months.

By size

The small business sector

has reported its first fall in sentiment in two years as

employers increasingly focus on maintaining rather than

growing their businesses. A net 18.4 per cent of small

business employers expect to increase their permanent staff

levels over the coming six months, 22.7 percentage points

down from the previous period.

Medium-sized organisations

are again showing increasing caution in their hiring

intentions, with expectations down 20.3 percentage points.

Just 3.7 per cent of businesses are intending to increase

permanent staff over the coming six months.

A net 9.9 per cent of large organisations report an intention to increase permanent staff levels over the coming six months, representing a decline of 17.2 percentage points on the last survey’s results.

“While hiring

intentions have dropped off considerably in larger

organisations, large companies have the resources to operate

on a longer-time scale to small to medium-sized enterprises,

and many continue to stay on the lookout for particular

skill sets in short supply.”

Contracting/temporary

overview

62.4 per cent of employers plan to hold

their contracting / temporary workforce steady, 15.7 per

cent intend to increase their contracting / temporary

workforce, and 22.0 per cent intend to decrease their

contracting / temporary workforce. The net result (-6.3 per

cent) is 11.2 percentage points lower than that reported in

the last Hudson Report, when a net 4.9 per cent reported an

intention to increase contracting / temporary staff.

Mr Burrage said in the current economic climate, employers are clearly taking action to reduce spend on contractors.

“A greater availability of candidates in the market also means employers are able to engage permanent staff where they previously had to turn to temporary or contract staff to meet the needs of candidates seeking flexibility.”

ENDS

About the Hudson

Report

The Hudson Report is uncovers and analyses the

hiring expectations of New Zealand employers.

Hudson recruitment professionals personally surveyed 2,285 participants to collect the data for the hiring expectations survey, which covers the intentions of New Zealand employers. The Hudson Report combines the expectations of key employment decision-makers from all major industries across the spectrum of organisation sizes.

Core findings are built on the premise that the expectation to increase or decrease net staffing levels represents a significant indicator of employers’ optimism for the growth of their organisations – and, as such, are strong indicators of more general economic trends.

About

Hudson

Hudson delivers specialised professional

staffing, outsourcing, and talent management solutions

worldwide. From single placements to total solutions, the

firm helps clients achieve greater organisational

performance by assessing, recruiting, developing and

engaging the best and brightest people for their

businesses.

Hudson is a division of Hudson Highland Group,

Inc. one of the world’s leading professional staffing,

retained executive search and talent management solution

providers. The company employs more than 3,800 professionals

serving clients and candidates in more than 20 countries.

More information is available at

www.hudson.com

Raise Communications: NZ Careers Expo Kicks Off National Tour Amid Record Unemployment

Raise Communications: NZ Careers Expo Kicks Off National Tour Amid Record Unemployment Hugh Grant: How To Build Confidence In The Data You Collect

Hugh Grant: How To Build Confidence In The Data You Collect Tourism Industry Aotearoa: TRENZ 2026 Set To Rediscover Auckland As It Farewells Rotorua - The Birthplace Of Tourism

Tourism Industry Aotearoa: TRENZ 2026 Set To Rediscover Auckland As It Farewells Rotorua - The Birthplace Of Tourism NIWA: Students Representing New Zealand At The ‘Olympics Of Science Fairs’ Forging Pathway For International Recognition

NIWA: Students Representing New Zealand At The ‘Olympics Of Science Fairs’ Forging Pathway For International Recognition Coalition to End Big Dairy: Activists Protest NZ National Dairy Industry Awards Again

Coalition to End Big Dairy: Activists Protest NZ National Dairy Industry Awards Again Infoblox: Dancing With Scammers - The Telegram Tango Investigation

Infoblox: Dancing With Scammers - The Telegram Tango Investigation