May Spending Shows Decline in High Value Items

May Spending Figures Show Decline in High Value Items

Click to enlarge

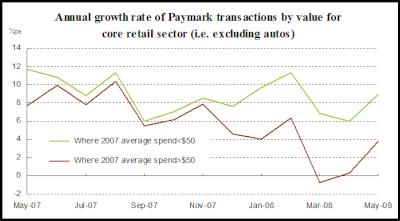

According to the latest figures from Paymark, Kiwis are still flexing their plastic and whilst electronic spending at ‘small ticket’ outlets is increasing, spending on ‘big ticket’ items has declined.

Data shows electronic sales growth through outlets that traditionally average smaller transaction sizes ($50 and below) is now much higher year-on-year compared with outlets that traditionally average larger transactions (more than $50).

Core retail sectors with ‘small’ transactions include supermarkets, chemists, cafes and bars, while retail sectors with ‘large’ transactions include motor vehicle retailers, recreational goods, appliance and furniture stores, and accommodation.

Paymark CEO, Simon Tong, says; “The total number of transactions processed through our network in May was 66.2 million, up 8 percent on May 2007. Kiwis are using credit and debit cards increasingly for small transactions when previously cheques or cash might have been used.”

Independent economist Anthony Byett suggests the squeeze from higher food prices coupled with weakened demand for ‘big ticket’ items are impacting on large transaction figures.

Store types with the fastest May to May growth were fuel - up 28 percent, due largely to price increases, and entertainment - up 21 percent, due largely to the rise in electronic payments.

Regions with the fastest annual growth were the West Coast, Taranaki/Taupo, South Canterbury and Waikato. Gisborne and the major centres of Wellington and Auckland/Northland experienced the slowest growth figures.

Paymark is New Zealand’s leading electronic payments provider. Its network processes three quarters of all electronic transactions and nearly 90% of Kiwis have a debit card. That puts us ahead of any other country in the world in terms of EFTPOS use.

ENDS

About

Paymark:

In 1989 three banks came together to form

Electronic Transaction Services Limited. They had the vision

of a national real time payment system. Through their

commitment to the retail payments industry the company has

developed what has arguably become the best EFTPOS system in

the world.

EFTPOS appeared on the New Zealand retail

scene in 1984, only five years after the country’s first

Bank ATM (cash dispenser) was installed. New Zealand’s

first EFTPOS system operated from a service station and a

supermarket attached to a bank computer.

In March 1990

volumes through the network exceeded 1 Million transactions

a month.

In 1994 the company increased its computer

processing power to accommodate volumes exceeding 10 Million

transactions a month. In 1996 Bank of New Zealand joined the

network and EFTPOS as a payment mechanism entered a

tremendous growth phase.

In 1998 ETSL passed another

milestone - as the 1 Billionth EFTPOS transaction was

processed. By the year 2000 EFTPOS was well and truly

identified as a public utility. ETSL saw its 2 Billionth

transaction pass through the system in November 2000 and 6

Billionth transaction mid way through 2007. The system,

rebranded as the Paymark EFTPOS network, processes nearly

75% of all electronic transactions in the New Zealand retail

market on behalf of more than 50 card issuers and acquirers.

More than 65,000 merchants and 80,000 terminals are

currently connected to the network that is now 3DES and EMV

compliant.

The company offers services to merchants, card

issuers and acquirers for eftpos, eCommerce, mCommerce and

ATM payment and related transaction

processing.

Canterbury Museum: Mystery Molars Lead To Discovery Of Giant Crayfish In Ancient Aotearoa New Zealand

Canterbury Museum: Mystery Molars Lead To Discovery Of Giant Crayfish In Ancient Aotearoa New Zealand Ngā Pae o te Māramatanga: Māori Concerns About Misuse Of Facial Recognition Technology Highlighted In Science

Ngā Pae o te Māramatanga: Māori Concerns About Misuse Of Facial Recognition Technology Highlighted In Science Retail NZ: Retailers Call For Flexibility On Easter Trading Hours

Retail NZ: Retailers Call For Flexibility On Easter Trading Hours WorkSafe NZ: Worker’s Six-Metre Fall Prompts Industry Call-Out

WorkSafe NZ: Worker’s Six-Metre Fall Prompts Industry Call-Out PSGR: Has MBIE Short-Circuited Good Process In Recent Government Reforms?

PSGR: Has MBIE Short-Circuited Good Process In Recent Government Reforms? The Reserve Bank of New Zealand: RBNZ’s Five Year Funding Agreement Published

The Reserve Bank of New Zealand: RBNZ’s Five Year Funding Agreement Published