NZ Consumer Confidence Falls To Record Low

New Zealand Consumer Confidence Falls To Record Low:

Nielsen

56% of Global Online Consumers Believe Their

Country is in a Recession

Auckland, May 29, 2008 - New Zealand consumer confidence in the economy plunged 18 points from the second half of 2007 to the first half of 2008, according to a global online survey by The Nielsen Company.

This was the biggest drop in consumer confidence of any country in the world monitored, with the United States and the Baltic nation of Latvia coming a close second with a drop of 17 points. Only a handful of countries reported gains in confidence, with the greatest increase (5%) taking place in The Netherlands, followed by Czechoslovakia, Russia, and Portugal (each up 3%).

Fifty six percent of global online consumers think their country is currently in recession and consumer confidence worldwide has fallen to its lowest level in several years, according to the Nielsen Global Consumer Confidence Index, which measures the confidence, major concerns and spending habits of online consumers in 51 countries.

The latest Nielsen Global Consumer Confidence Index dropped to 88 - down six points in the last six months – and the largest single drop the Index has recorded in the last three years.

“Consumer confidence fell in thirty-nine out of forty eight countries in the past six months, with New Zealand, USA and Latvia suffering the deepest declines,” said Stephen Mitchell, Managing Director, The Nielsen Company.

Among the 39 markets recording a decline in consumer confidence, 15 fell by double-digits.

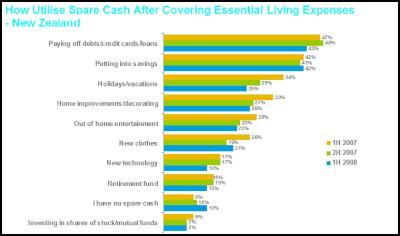

Twenty-three percent of New Zealand

consumers consider the economy their biggest concern over

the next six months. Debt comes in second place at 16

percent, followed by work/life balance (14 percent). Just

four percent cite job security and concerns about Global

Warming rank near the bottom at two percent.

(See Chart

1)

“With high fuel prices, food inflation and other economic pressures, it’s not a surprise that the economy is a top concern for many New Zealanders,” said Mitchell. “Manufacturers and retailers take note - because clearly, value and competitive pricing is becoming more important.”

So far, the negative view of the New Zealand economy appears not to have tainted most New Zealanders views of their own financial affairs. Over half (53%) say the state of their personal finances remains good, while just over one-third (35%) rank their situation as not so good. Forty-seven percent of consumers are positive about job prospects and 37 percent take a pessimistic view with the perception that job prospects are not so good. Just over one–third of consumers think the world will enter a global recession sometime in the next 12 months. Thirty-seven percent say they believe it will take place, while 34 percent don’t know and only 27 percent say they don’t think a global recession is on the horizon.

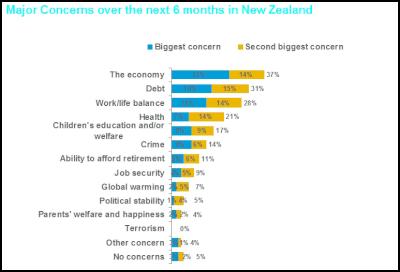

Seventy-one percent of New Zealand shoppers believe the next 12 months is either a bad or not so good time to buy things they want or need. Once they’ve covered essential living expenses, 43 percent use spare cash to pay off debt, credit cards, or loans. Forty-two percent play it safe, putting extra funds into savings. Thirteen percent of consumers report having no spare cash.

According to Nielsen’s research, just 26 percent also use such spare money for home improvements/decorating, while 22 percent opt for out-of-home entertainment or holidays/vacations. Shopping sprees rank low on their list of priorities, with 21 percent buying new clothes and 13 percent splurging on new technology. Few respondents have their eye on the future – just 13 percent put extra money into a retirement fund, while seven percent invest in shares of stock/mutual funds. (See Chart 2)

“These findings are really telling in that consumers are clearly feeling gun-shy when it comes to spending or investing,” said Mitchell. “While it’s definitely a good move for consumers to pay off their personal debt, it will do little to jumpstart the economy.”

David Parma, global head of Customized Research, The Nielsen Company said the last six months have been the most turbulent period for the global economy in several decades.

“When the USA sneezed at the outset of the sub prime disaster nearly a year ago – the rest of the world quickly caught a cold. No region and no country have been spared the domino effect of the US sub-prime and credit crisis.

“Consumers around the world are struggling with the same global issues that are impacting their daily lives. It’s an unfortunate pendulum. On the one hand we are seeing soaring global oil prices, rising commodity prices which are impacting grocery prices, rising interest rates and increasing inflation. This is happening in tandem with falling property prices, weakening labor markets, decreasing industrial output levels and growing unemployment rates which have all resulted in less spending power for the average person. Overall, it’s not a good picture,” commented Parma.

There are extreme levels of consumer pessimism in New Zealand, Latvia and Spain.

“Despite low levels of unemployment in New Zealand, consumer confidence has dropped to its lowest level in a decade mainly due to interest rates which have skyrocketed. Meanwhile Latvians are struggling to cope with runaway inflation which increased to 17.5 percent in April – the highest inflation rate among the 27 EU nations. Electricity costs have risen nearly forty percent in Latvia in the past year and food prices are up twenty percent,” said Parma.

ENDS

51 Markets Covered: Argentina, Australia, Austria, Belgium, Brazil, Canada, Chile, China, Colombia,Czech Republic, Denmark, Egypt, Estonia, Finland, France, Germany, Greece, Hong Kong, Hungary, India, Indonesia, Ireland, Israel, Italy, Japan, Korea, Latvia, Lithuania, Malaysia, Mexico, Netherlands, New Zealand, Norway, Pakistan, Philippines, Poland, Portugal, Russia, Singapore, South Africa, Spain, Sweden, Switzerland, Taiwan, Thailand, Turkey, UAE, United Kingdom, US, Venezuela and Vietnam.

About The Survey

The Nielsen Global Online

Consumer Survey, conducted by Nielsen Customized Research,

reaches more than 28,000 Internet users in more than 50

countries worldwide, Approximately 500 New Zealand

consumers took part in the April 2008 survey, which sought

to gauge sentiment and confidence in the future of the

economy, examine expenditure and saving patterns, and

identify major concerns.

About The Nielsen Company

The Nielsen Company is a global information and media

company with leading market positions in marketing

information (ACNielsen), media information (Nielsen Media

Research), online intelligence (NetRatings and BuzzMetrics),

mobile measurement, trade shows and business publications

(Billboard, The Hollywood Reporter, Adweek). The privately

held company is active in more than 100 countries, with

headquarters in Haarlem, the Netherlands, and New York, USA.

For more information, please visit, www.nielsen.com

Chart

1:

Click to enlarge

Chart 2:

Click to enlarge

NZ Airports Association: Airlines And Airports Back Visa Simplification

NZ Airports Association: Airlines And Airports Back Visa Simplification Netsafe: Statement From Netsafe About Proposed Social Media Ban

Netsafe: Statement From Netsafe About Proposed Social Media Ban The Reserve Bank of New Zealand: 2024 General Insurance Stress Test Results Published Today

The Reserve Bank of New Zealand: 2024 General Insurance Stress Test Results Published Today  Worldline: School Holidays And Long Weekends Change Regional Spending Patterns In April

Worldline: School Holidays And Long Weekends Change Regional Spending Patterns In April Stats NZ: Livestock Numbers Fall Over The Last 10 Years While Area Planted In Fruit Increases

Stats NZ: Livestock Numbers Fall Over The Last 10 Years While Area Planted In Fruit Increases Moths and Butterflies NZ Trust: Tagged Monarchs Found

Moths and Butterflies NZ Trust: Tagged Monarchs Found