KiwiSaver participation grows despite uncertainty

KiwiSaver participation grows despite uncertain market

activity

Mercer releases quarterly KiwiSaver Index

results

Mercer Wealth Solutions has found that despite fluctuating world markets, many New Zealanders have embraced the KiwiSaver scheme, with participation in workplace savings programs increasing significantly since the introduction of the program.

These latest findings are from the Mercer KiwiSaver Index, which monitors current attitudes and behaviours toward the scheme among working New Zealanders aged 18 to 64 years.

Mercer’s latest findings revealed:

- The proportion of Kiwis who have joined KiwiSaver has grown significantly since October 2007 – from 14% to 25%.

- The growth in KiwiSaver membership has coincided with increased consideration being given to retirement, with two in five (39%) giving at least some thought to retirement (up from 33% in October 2007). This consideration may be a function of concern, with a corresponding rise in the proportion believing they will be less comfortable in retirement than now.

- Coinciding with an intense communications campaign, nearly one in three (32%) claim to have at least a reasonable level of knowledge about KiwiSaver. However, there continues to be room for improvement, with one in four (28%) having only limited understanding of the scheme.

Head of Mercer New Zealand, Mr Bernie O’Brien said increased scheme participation and awareness of retirement planning stemmed from KiwiSaver’s growing media profile and the number of providers publishing information.

“The arrival of KiwiSaver prompted Kiwis to assess their retirement readiness. Mercer’s KiwiSaver Index found scheme participation rates jumped 11% in just three months, suggesting many were motivated to take the next step and join. In the process, Kiwis may have experienced a bit of a reality check, and realised they may need more money in retirement than first thought.

“It’s great to see such strong participation figures and it’s very promising to see early signs that Kiwis are taking control of their financial future,” he said.

Mr O’Brien stated. “Mercer firmly believes more can be done to improve the collective financial literacy of the nation by making unbiased, independent and high quality financial education readily available. This will ensure consumers are making informed and considered decisions about KiwiSaver.”

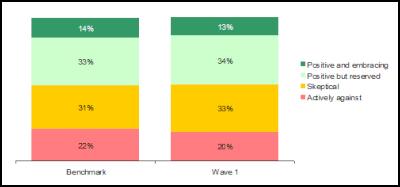

To provide an ongoing evaluation of how well Kiwis understand, accept and are engaged with the KiwiSaver scheme, Mercer has developed a KiwiSaver Index, based on a quarterly survey of a random sample of 300 working New Zealanders. Working New Zealanders can be classified into one of four different ‘levels’ of affinity to the scheme:

- Embracing (13%): These people consider KiwiSaver to be beneficial in helping fund retirement, rate it positively and intend to join in the near future if they haven’t already. Many are aged 55+.

- Reserved (34%): Ambiguous in their support of the scheme. This group (largely aged 45 to 54) see the value in saving for retirement. However, they are somewhat reluctant to join with a concern that it may be too late for them to benefit and have seen similar schemes fail in the past.

- Sceptical (33%): While not ‘anti’ KiwiSaver, this group claim they are not willing to open a KiwiSaver account anytime soon. They tend to be young families, and feel the day-to-day costs of living prevent them from actively participating in the scheme.

- Against (20%): This group is adamant in its opposition to KiwiSaver. They don’t see the scheme as beneficial, and do not intend to open an account in the near future. These people tend to be younger (age 25 to 44), in relationships but have no children.

Click to enlarge

“While there is evidence of some attitudinal change regarding retirement planning, when combined the index results did not reveal any major movements in overall behaviour and intent towards KiwiSaver. This suggests that the job of promoting KiwiSaver and its link with improving retirement standards is far from over if we are to ensure that preparing for retirement remains an ongoing focus for working New Zealanders,” Mr O’Brien added.

Other key findings through subgroup analysis on current participation rates of KiwiSaver revealed higher participation among those who

- have started making

preparations for retirement (47% of those prepared

participating in KiwiSaver, compared to only 22% who have

not commenced preparations),

- have knowledge about the

scheme (33% of those knowledgeable about the scheme

participate, versus 4% among those less knowledgeable), and

- are aged over 50 years (42%).

“The results indicate that younger people are less likely to value participation in retirement schemes. While two in five (42%) of those aged over 50 are participating in some kind of workplace savings scheme, participation rates among those aged 18 – 39 are far lower – with only one in four (24%) participating. We need to put further emphasis on educating younger people about the benefits of joining earlier in life,” said Mr O’Brien.

ENDS

Bill Bennett: Download Weekly - Review Of 2024

Bill Bennett: Download Weekly - Review Of 2024 Bill Bennett: One NZ scores worldwide first as Starlink direct-to-mobile launches

Bill Bennett: One NZ scores worldwide first as Starlink direct-to-mobile launches Hugh Grant: How To Reduce Network Bottlenecks

Hugh Grant: How To Reduce Network Bottlenecks Dominion Road Business Association: Auckland Transport's 'Bus To The Mall' Campaign: A Misuse Of Public Funds And A Blow To Local Businesses

Dominion Road Business Association: Auckland Transport's 'Bus To The Mall' Campaign: A Misuse Of Public Funds And A Blow To Local Businesses Parrot Analytics: A Very Parrot Analytics Christmas, 2024 Edition

Parrot Analytics: A Very Parrot Analytics Christmas, 2024 Edition Financial Markets Authority: Individual Pleads Guilty To Insider Trading Charges

Financial Markets Authority: Individual Pleads Guilty To Insider Trading Charges