Land Costs Major Driver in Housing Affordability

News Release 5 February 2008

Land Costs the Major

Driver in reducing Housing Affordability – BRANZ

Group

Increasing section prices have been the major

factor in reducing housing affordability over the past

decade, according to a recently released report from the

BRANZ Group.

The Changing Housing Need study undertaken by Ian Page, economics manager with BRANZ Limited and funded by Building Research included an analysis of the impact of the key drivers of housing affordability. The report concludes that the major factor impacting housing affordability has been section prices, which were ahead of both interest rates and the cost of new house construction

Ian Page says, “Housing affordability has fallen markedly since 2001 due to a number of factors. The fact that average wages have only increased by an average of 2.2 percent per year over the past decade has exacerbated this trend. The rising cost of land, with sections increasing by an average of over 14 percent per year over the past five years has been the major contributor to the decline in housing affordability.”

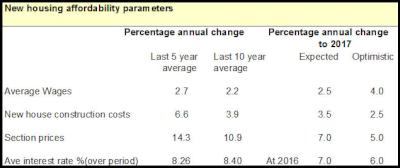

The following table shows the relative impact of each factor on housing affordability.

Click to enlarge

Note: These figures show the average increase per annum and have compounded over these periods

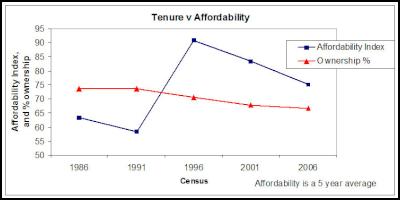

“Given that home ownership has also fallen over the last 10 years, we believe it is reasonable to assume that there is a relationship between housing affordability and home ownership.”

Home ownership has been declining and was down to 66.9 percent in the 2006 census. Tenure and new housing affordability are shown in the graph below which indicates downward trends from 1996 onwards:

Click to enlarge

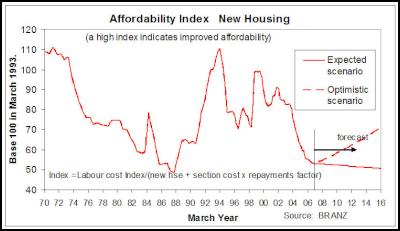

The study also tracks new housing affordability in an index since 1970, see graph below:

Click to enlarge

Note: The above graph is for new housing affordability, but the author notes that the affordability of existing housing has followed a very similar pattern since 1993. See Figure 31, page 53

Between

1993 and 1998 wages rose around 9 percent but construction

costs rose 30 percent and interest rates increased by around

1 percent. This caused affordability to fall over this

period. In 1998 the increase in affordability was mainly due

to a fall in mortgage rates from around 11 percent to

7

percent.

Since, 1999 affordability has declined markedly due to increasing section prices, construction costs and home lending interest rates.

The report provides two sets of forecasts which depend on the assumptions made for growth in incomes, new housing construction cost changes, land prices and interest rates.

The ‘expected’ scenario indicates a flattening out of affordability and is based on modest wage growth, lower rates of increase for construction and land costs, and a slight reduction in interest costs. With the ‘optimistic’ scenario, wage growth is quite high while house and land price escalation is relatively low, and the interest rate for home lending (6.0 percent in 2016) is 3.0 percent below current rates.

“Should these factors come into play, housing affordability could improve. However, when we look at what factors have contributed to housing becoming less affordable over the last decade and particularly the last five years, we can conclude that relatively low wage increases and escalating land prices are the two most important factors. These are followed by the cost of funding and then the cost of new house construction,” Mr Page said.

ENDS

A copy of the

report, Changing Housing Need can be downloaded from the

BRANZ website,

see:

http://www.branz.co.nz/branzltd/bookshop/info.php?ask=free&idnum=1666

NIWA: Students Representing New Zealand At The ‘Olympics Of Science Fairs’ Forging Pathway For International Recognition

NIWA: Students Representing New Zealand At The ‘Olympics Of Science Fairs’ Forging Pathway For International Recognition Coalition to End Big Dairy: Activists Protest NZ National Dairy Industry Awards Again

Coalition to End Big Dairy: Activists Protest NZ National Dairy Industry Awards Again Infoblox: Dancing With Scammers - The Telegram Tango Investigation

Infoblox: Dancing With Scammers - The Telegram Tango Investigation Consumer NZ: This Mother’s Day, Give The Gift Of Scam Protection And Digital Confidence

Consumer NZ: This Mother’s Day, Give The Gift Of Scam Protection And Digital Confidence NZ Airports Association: Airlines And Airports Back Visa Simplification

NZ Airports Association: Airlines And Airports Back Visa Simplification Netsafe: Statement From Netsafe About Proposed Social Media Ban

Netsafe: Statement From Netsafe About Proposed Social Media Ban