Farmer confidence down for first time in 12 months

Farmer confidence down for first time in 12 months

Results at a Glance

- Rural confidence has declined for the first

time in the past five surveys.

- However confidence

remains significantly higher than a year ago.

- Biggest

falls among sheep and beef farmers.

- Dairy farmer

confidence also moderating.

- Farm income expectations

vary by enterprise.

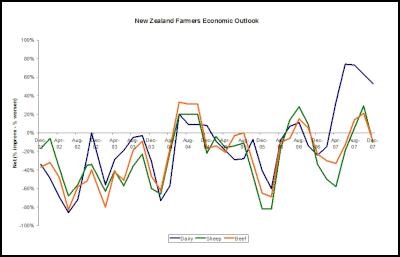

The country’s farmers have experienced their first decline in confidence in 12 months, according to the latest Rabobank/Nielsen Rural Confidence Survey.

The survey – taken across New Zealand last month – showed the number of farmers expecting the rural economy to improve had dropped to 34 per cent, down from 49 per cent in the previous survey (taken in October). The number expecting conditions to worsen had increased to 22 per cent, from 10 per cent previously.

Rabobank New Zealand senior analyst Hayley Moynihan said that while this was the first decline in confidence witnessed in the past five bi-monthly Rabobank/Nielsen Rural Confidence Surveys, farmer confidence remained well above the levels recorded 12 months ago.

“The weakening in farmer sentiment is likely to be a reflection of the combined pressures of a persistently high New Zealand dollar which has been dampening returns from exports, the ongoing increase in key input costs and the prospect of a long, hot summer reducing feed availability for many regions,” she said.

The largest falls in confidence were recorded among sheep and beef farmers, with 32 per cent of sheep farmers and 29 per cent of beef producers expecting economic conditions to deteriorate, compared to just 11 per cent and 16 per cent respectively in the previous survey.

Ms Moynihan said reduced confidence in these sectors was attributable, in large part, to lower beef and sheep prices.

“Farm gate sheep and beef prices had been entering a period of seasonal summer decline and have generally tracked lower than the previous year,” she said.

“Farm gate lamb prices were on average around 12 per cent (or NZ 50 cents a kilogram) lower during the second half of 2007, compared to the same period in 2006. Bull beef prices were down by around 11 per cent (or NZ 39 cents a kilogram) over the same period.”

Dairy farmers’ confidence had also moderated. Although the survey showed 59 per cent of the country’s dairy producers still expected economic conditions to improve, this was down from 67 per cent with that view in the previous survey and 78 per cent at the peak of dairy farmer confidence in June 2007.

“Confidence among dairy farmers should remain buoyed by the payout increase of NZ50 cents per kilogram of milk solids announced by Fonterra in mid December,” Ms Moynihan said.

“However, while the forecast dairy payout for the 2007/08 season continues to break new records, the rate of increase has slowed as international dairy commodity prices appear to have peaked and the strong New Zealand dollar is tempering expectations for the 2008/09 season.”

Ms Moynihan said the survey showed that, in line with headline confidence, farmers’ income expectations were also down, although they were shown to vary considerably depending on the farm enterprise.

In total, 44 per cent of farmers expected higher gross farm incomes over the coming 12 months, down from 56 per cent in the previous survey, while 27 per cent expected lower incomes (compared to just 15 per cent with that expectation previously).

Dairy and cropping farmers were generally optimistic about their incomes, with 83 per cent of dairy producers and 66 per cent of cropping farmers expecting improved incomes.

More pessimistic though were those in sheep and beef enterprises, with 41 per cent of sheep and 36 per cent of beef farmers anticipating lower incomes.

Ms Moynihan said this mixed finding reflected the buoyant international markets that dairy and cropping farmers were enjoying for their products.

“While on the other hand, the sheep and beef sectors are finding that the higher costs of meat production globally are not yet being translated into increased meat prices. This is because several key international competitors recorded higher slaughter rates and production during 2007 which has increased the availability of some meat products,” she said.

Overall, farmers’ investment intentions were also down slightly, with 16 per cent of producers expecting to reduce their total farm investment, compared to 10 per cent last survey. Only 29 per cent expected to increase investment.

Ms Moynihan said investment intentions were most markedly lower among sheep and beef farmers, with 23 and 22 per cent respectively intending to reduce their farm investment.

Regional differences were also evident, she said. “More than one fifth of farmers in the Bay of Plenty/Hawkes Bay /East Coast region (21 per cent) and Otago/Southland (22 per cent) intend to reduce investment. This is likely to reflect the ongoing dry conditions on the East Coast and the de-stocking that occurred, as well as the changing land use that is underway in the southern South Island as producers move away from sheep and beef.”

Investment intentions were strongest in the northern North Island with more than a third of farmers north of Waikato/King Country expecting to increase their total farm business spend.

Ms Moynihan said the latest survey registered little change in farmers’ level of concern about input costs and interest rates. A total of 90 per cent believe input costs will increase over the coming 12 months. Most farmers (62 per cent) expect interest rates to remain unchanged, while 33 per cent are anticipating a further increase in borrowing costs.

Click to enlarge

The bi-monthly Rabobank/Nielsen Rural Confidence Survey is the only study of its type in New Zealand. A panel of 784 farmers across New Zealand was surveyed in the last survey period.

Rabobank New Zealand is a part of the international Rabobank Group, the world's leading specialist in food and agribusiness banking. Rabobank has more than 100 years' experience providing customised banking and finance solutions to businesses involved in all aspects of food and agribusiness. Rabobank has a AAA credit rating and is ranked one of the world’s safest banks by Global Finance magazine. Rabobank operates in 42 countries, servicing the needs of more than nine million clients worldwide through a network of more than 1500 offices and branches. Rabobank New Zealand is one of the leading rural lenders and a significant provider of business and corporate banking and financial services to the New Zealand food and agribusiness sector. The bank has 29 branches throughout New Zealand.

ENDS

Hugh Grant: How To Build Confidence In The Data You Collect

Hugh Grant: How To Build Confidence In The Data You Collect Tourism Industry Aotearoa: TRENZ 2026 Set To Rediscover Auckland As It Farewells Rotorua - The Birthplace Of Tourism

Tourism Industry Aotearoa: TRENZ 2026 Set To Rediscover Auckland As It Farewells Rotorua - The Birthplace Of Tourism NIWA: Students Representing New Zealand At The ‘Olympics Of Science Fairs’ Forging Pathway For International Recognition

NIWA: Students Representing New Zealand At The ‘Olympics Of Science Fairs’ Forging Pathway For International Recognition Coalition to End Big Dairy: Activists Protest NZ National Dairy Industry Awards Again

Coalition to End Big Dairy: Activists Protest NZ National Dairy Industry Awards Again Infoblox: Dancing With Scammers - The Telegram Tango Investigation

Infoblox: Dancing With Scammers - The Telegram Tango Investigation Consumer NZ: This Mother’s Day, Give The Gift Of Scam Protection And Digital Confidence

Consumer NZ: This Mother’s Day, Give The Gift Of Scam Protection And Digital Confidence