Retail sales volumes reflect higher interest rates

Retail sales volumes for the September quarter reflect the impact of higher interest rates

(See also… http://img.scoop.co.nz/media/pdfs/0711/NZ_retailsales_15nov07.pdf)

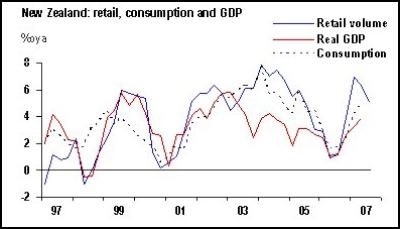

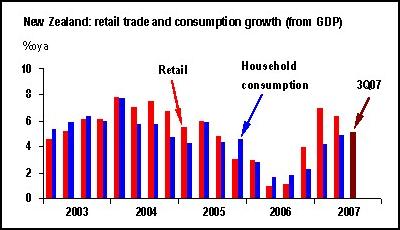

The total volume of retail sales rose 0.2%q/q in 3Q (JPMorgan and consensus 0.2%) after a downwardly revised 0.7% contraction in the second quarter (previously -0.6%). Retail sales volumes have slowed dramatically over the past two quarters, falling 0.5%; this contraction follows a 5.6% surge in the two quarters prior. The sharp slowdown in consumption spending is reflective of the RBNZ's resolve to bring a heated housing market and domestic demand into line. The RBNZ has tightened monetary policy four times this year, taking the official cash rate to a record high 8.25% - in what has been a prolonged tightening cycle that began in 2004, and which has consisted of 13 rate rises. The RBNZ's job is seemingly done, with both the housing market and consumption growth showing signs of cooling. JPMorgan forecasts the RBNZ will keep rates on hold for the foreseeable future.

The retail sales report showed a significant pullback on the more discretionary areas of retailing. Sales of recreational goods, clothing and softgoods, and footwear declined. In volume terms, 12 of the 24 industries recorded sales increases, while the other 12 recorded decreases. The largest sales increases were in supermarket and grocery stores (up 1.6%q/q), and cafes and restaurants (up 3.2%), highlighting the increase in food prices. The largest declines were in recreational goods retailing (down 5.2%q/q), and clothing and softgoods retailing (down 4.4%). Overall, the report showed a significant moderation in sales in 3Q.

The quarterly volumes outcome supports our preliminary 3Q GDP forecast of 0.8%q/q, which also consists of a 0.2% point contribution for production out of the new Tui oil field.

Over the month of September, total retail sales rose a price inflated 1.0%m/m (JPMorgan and consensus 0.5%). The monthly spike was driven by a surge in fuel prices, with half of the dollar value of the monthly increase coming from automotive fuel retailing (up 5.1%).

ENDS

Bill Bennett: Download Weekly - How would NZ telecoms cope with another cyclone

Bill Bennett: Download Weekly - How would NZ telecoms cope with another cyclone NZ On Air: Firm Audience Favourites Lead NZ On Air Non-Fiction Funding

NZ On Air: Firm Audience Favourites Lead NZ On Air Non-Fiction Funding Insurance and Financial Services Ombudsman: Woman Gets $40k More After Disputing Insurer’s Decision

Insurance and Financial Services Ombudsman: Woman Gets $40k More After Disputing Insurer’s Decision BNZ: A Quarter Of Older NZers Fear Going Online Due To Scam Concerns

BNZ: A Quarter Of Older NZers Fear Going Online Due To Scam Concerns University of Auckland: Scientists Develop Tool To Monitor Coastal Erosion In Fine Detail

University of Auckland: Scientists Develop Tool To Monitor Coastal Erosion In Fine Detail Oji Fibre Solutions: OjiFS Proposes To Discontinue Paper Production At Kinleith Mill

Oji Fibre Solutions: OjiFS Proposes To Discontinue Paper Production At Kinleith Mill