Funds returned 3.0% for Sept. Qr, 11.2% Sept Yr

Media Release

Wednesday 31 October 2007

Mercer survey of fund managers shows funds returned 3.0% for September quarter, 11.2% for September year.

Superannuation funds delivered positive returns for the third quarter of 2007, recording a median return of 3.0% for New Zealand investors.

Published today, Mercer’s Quarterly Survey of

New Zealand Wholesale Superannuation Fund Managers showed

the highest performing funds for the quarter were AMP

Capital Investors’ Unit Trust and Arcus Investment

Management. Both recorded a return of 3.7% before tax and

fees while the lowest return was from BT Funds Management at

1.7%. Over the full year Arcus also produced the highest

return (at 14.9%) while BT Funds Management again lagged the

group with a return of 7.2%.

Fund managers with a

higher than average allocation to overseas equities tended

to perform better over the quarter.

“The September quarter was one of the most volatile periods we have seen in both local and offshore markets for quite some time” said David Scobie, Principal of Mercer. A loss of confidence in financial assets of lower credit quality, sparked by troubles in the US sub-prime mortgage sector, initially spread across to other asset classes, including shares. However, by quarter end, domestic and most overseas equity markets had re-couped much of their losses. Government bond markets benefited from a general “flight to quality” over the period at the expense of corporate bonds. Short-term interest rates in New Zealand remained at elevated levels while, in the US, the Federal Reserve moved to lower the official cash rate which served to help restore market confidence and liquidity. The New Zealand dollar was particularly volatile, eventually finishing the period down around 5% in trade-weighted terms. Despite the extreme movements in markets, Balanced Fund returns for the quarter across fund managers surveyed were all positive and in a relatively tight range of 2%. The level of individual Fund exposure to offshore currencies continues to be a notable driver of returns across shorter periods, but ultimately the wide degree of asset exposure diversification has been proving its worth”.

Findings from the survey

include the following:

Global stockmarkets,

for hedged and unhedged New Zealand investors recorded

positive returns over the quarter, with unhedged

investors benefiting from a fall in the NZ dollar. Major

international share markets delivered mixed returns in local

currency terms, with Australia and the US gaining value over

the quarter while the Japanese, UK and European markets

fell.

In US dollar terms the Dow Jones Industrial

Average rose 8.5% over the quarter while the S&P500 and

Nasdaq rose 5.8% and 7.5% respectively. Emerging Markets

ended the quarter up 11.8% while the MSCI Small Cap Index

fell 7.3% (both in local currency terms).

‘Growth’ as an investment style performed

better than 'Value' over the three month

period.

During the September quarter the domestic

sharemarket rose 1.5%. The NZ dollar was down 5.1% on a

trade-weighted basis over the quarter.

AMP

Capital Investors (Unit Trust) and Arcus achieved the

highest return for the quarter of 3.7%, followed by

Tyndall Investment Management who returned 3.2% (returns

before tax and fees). The median return for the quarter was

3.0%.

Returns for the past twelve months ranged

between a gross return of 14.9% from Arcus to a 7.2% return

from BT Funds Management. The median return for the

twelve months was 11.2% before tax and fees.

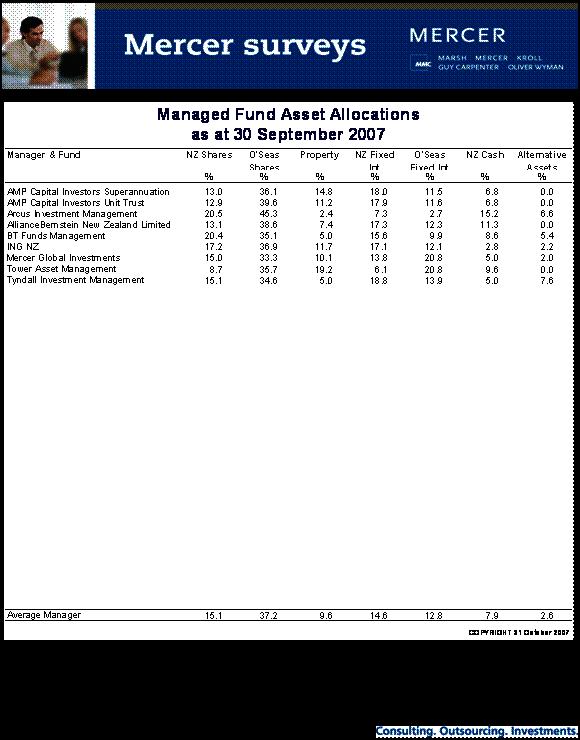

In

terms of the asset allocation of discretionary balanced

funds, the average exposure to growth assets as at 30

September 2007 was 64.5% (including allocations to

alternative assets). The lowest exposure to overseas

equities was 33.3% (Mercer Global Investments) with Arcus

Investment Management holding the highest exposure at 45.3%.

The highest exposure to domestic (or Trans-Tasman) equities

was 20.5% (Arcus).

Comparing the asset allocations of

the current fund managers with their allocations as at 30

September 2004, the average allocation to overseas

equities is slightly higher than that of three years ago

(37.2% compared with 35.3% three years ago). Four managers

have increased their overseas equity exposure over this

time. The average exposure to domestic equities has

decreased from 17.5% at 30 September 2004 to 15.1% at the

end of September 2007. In September 2004 two funds had

exposure to an alternative asset strategy. In September

2007 five funds had allocations to alternative assets,

ranging from 2.0% to 7.6% of the overall fund.

Mercer has also compared the current managers’

three-year results from the September 2004 survey with those

of the current survey. In September 2004, Arcus was the

highest performing manager, with a return of 9.2% per annum.

At the end of September 2007 Arcus was also ranked first

over three years with a return of 9.2% per annum. The

managers with three-year performance at or above median in

both surveys were Arcus Investment Management, Tower Asset

Management and Tyndall Investment Management.

The

median return for the three year period to 30 September 2004

was 5.9% per annum. For the three year period to 30

September 2007 the median return was 14.0% per

annum.

-End-

www.mercer.co.nz

Editors

Please Note:

Attached is a copy of the Mercer Survey. When quoting material from the Survey, we would appreciate acknowledgement of Mercer.

Risk Warning

© 2007,

Mercer

This press release (‘Release’) refers to and

draws from confidential and proprietary information of

Mercer. This Release, and any opinions on or ratings of

investment products, asset classes and asset management

styles it contains, may not be modified, sold, or otherwise

provided, in whole or in part, to any other person or entity

without Mercer's written permission.

Information

contained herein has been obtained from a range of sources.

While this information is believed to be reliable, no

representations or warranties are made as to the accuracy of

the information presented and no responsibility or

liability, including for consequential or incidental

damages, can be accepted for any error, omission or

inaccuracy in this Release.

Opinions on or ratings of

investment products, asset classes and asset management

styles contained herein are not intended to convey any

guarantees as to the future investment performance of these

products, asset classes and asset management styles. Past

performance cannot be relied on as a guide to future

performance. This Release does not contain investment

advice and no investment decision should be made in

connection with the subject matter of this Release without

first obtaining appropriate professional advice.

Source: MSCI. Data provided ‘as is’.

Mercer notes that

some of the fund managers included in this survey are

obtaining, or have obtained, additional returns in their

cash portfolios through strategies aimed at reducing tax

payable. Selection of fund managers should not be based on

a quantitative assessment alone as the mandate represented

in the survey may not be appropriate for your

needs.

Financial Markets Authority: Westpac Admits To Misleading Representations That Resulted In $6.35m In Overcharges

Financial Markets Authority: Westpac Admits To Misleading Representations That Resulted In $6.35m In Overcharges Bill Bennett: Download Weekly - Review Of 2024

Bill Bennett: Download Weekly - Review Of 2024 Bill Bennett: One NZ scores worldwide first as Starlink direct-to-mobile launches

Bill Bennett: One NZ scores worldwide first as Starlink direct-to-mobile launches Hugh Grant: How To Reduce Network Bottlenecks

Hugh Grant: How To Reduce Network Bottlenecks Dominion Road Business Association: Auckland Transport's 'Bus To The Mall' Campaign: A Misuse Of Public Funds And A Blow To Local Businesses

Dominion Road Business Association: Auckland Transport's 'Bus To The Mall' Campaign: A Misuse Of Public Funds And A Blow To Local Businesses Parrot Analytics: A Very Parrot Analytics Christmas, 2024 Edition

Parrot Analytics: A Very Parrot Analytics Christmas, 2024 Edition